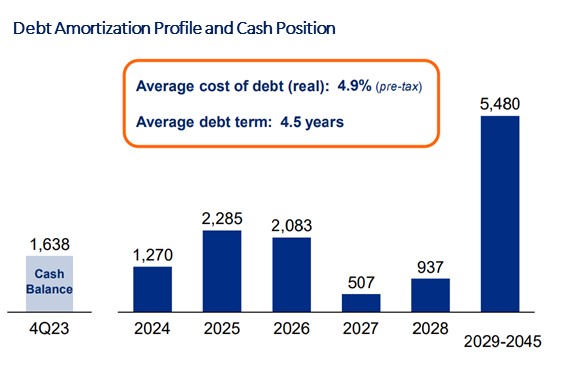

In 4Q23, gross debt totaled R$ 9,835.5 MM and cash totaled R$ 1,317.7 MM, resulting in a net debt of R$ 8,517.9 MM, an increase of 3.8% compared to the previous quarter.

The 1.3% drop in Cash and Investments in the quarter is mainly explained by variation in the CDI, payment of R$ 522 MM in interest and amortization related to the 3rd, 6th, 10th and 12th issuances of Taesa’s debentures, R$ 473 MM in Capex, and R$ 205 MM in dividend payments. These effects were partially offset by the operating cash generation and receipt of dividends from subsidiaries.

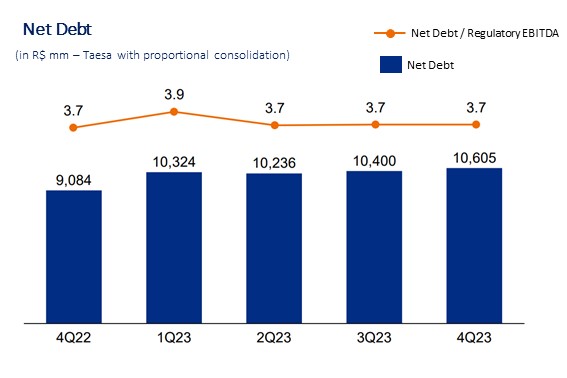

Proportionally consolidating the jointly controlled and associated companies, the total gross debt would be R$ 12,243.2 MM and the cash of R$ 1,638.2 MM, considering the following values: (i) TBE debt in the amount of R$ 1,273.7 MM and cash/investments of R$ 206.9 MM; (ii) ETAU cash/investments of R$ 21.8 MM; and (iii) debt from AIE (Aimorés, Paraguaçu and Ivaí) of R$ 1,134.0 MM and cash/investments of R$ 91.9 MM.

Considering the proportional net debt of jointly controlled and associated companies, the net debt to EBITDA ratio was 3.7x in 4Q23, in line with the value recorded in 3Q23 (3.7x). Disregarding the results of jointly controlled and associated companies, this indicator would be 4.2x in 4Q23 also in line with ratio recorded in 3Q23 (4.2x)