Sustainability is one of TAESA’s strategic pillars and is fully integrated into its business decisions, helping to drive sustainable growth with financial discipline and operational efficiency. We are committed to creating shared value with society and increasing quality of life, while having the utmost respect for the environment and considering the needs of future generations.

Since 2019, TAESA has adopted market-leading ESG practices, aiming to become a benchmark in the Brazilian power transmission industry. Thus, the company remains a signatory of the UN Global Compact, supporting the achievement of the Sustainable Development Goals (“SDGs”) outlined in the 2030 Agenda. In addition, we have joined Movimento +Mulher 360 (Women 360 Movement), the UN Women’s Empowerment Principles, the Race is a Priority Movement, and the Transparency 100% Movement—further strengthening its commitment to diversity, inclusion, and corporate ethics.

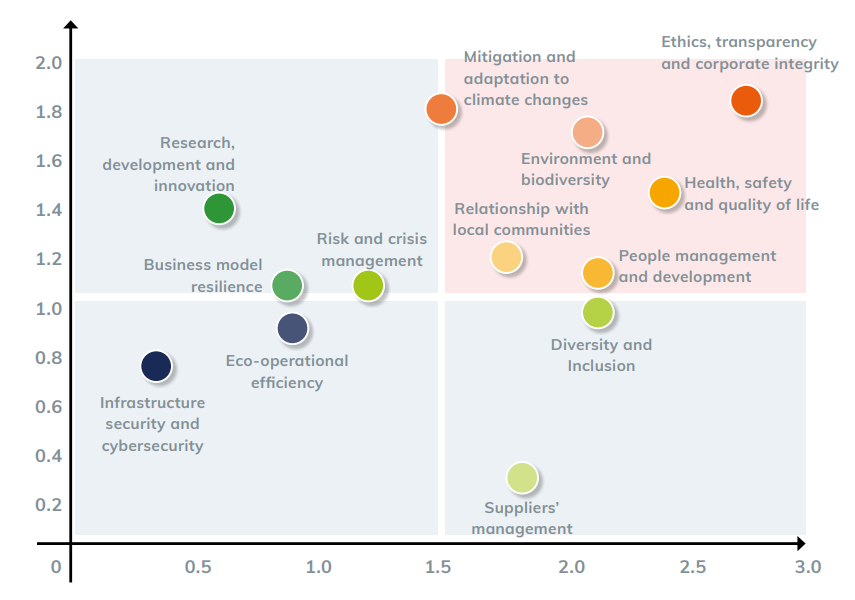

We believe that organizational longevity and success go beyond economic and operational performance. Strong Corporate Governance, Risk Management, Ethical Conduct, and Compliance—with an emphasis on the universal principles of Human Rights (equity, diversity, non-discrimination in any form, freedom, social security, etc.), Labor, Environment, and Anti-Corruption, as prioritized by the UN Global Compact, which includes social issues, public commitments, and Innovation—are key to achieving strong performance and sustainable growth.

TAESA ensures the safety and reliability of its operations, actively helping to improve overall quality of life, and ensuring environmental protection, and sustainable development while anticipating the needs of future generations through the following commitments: