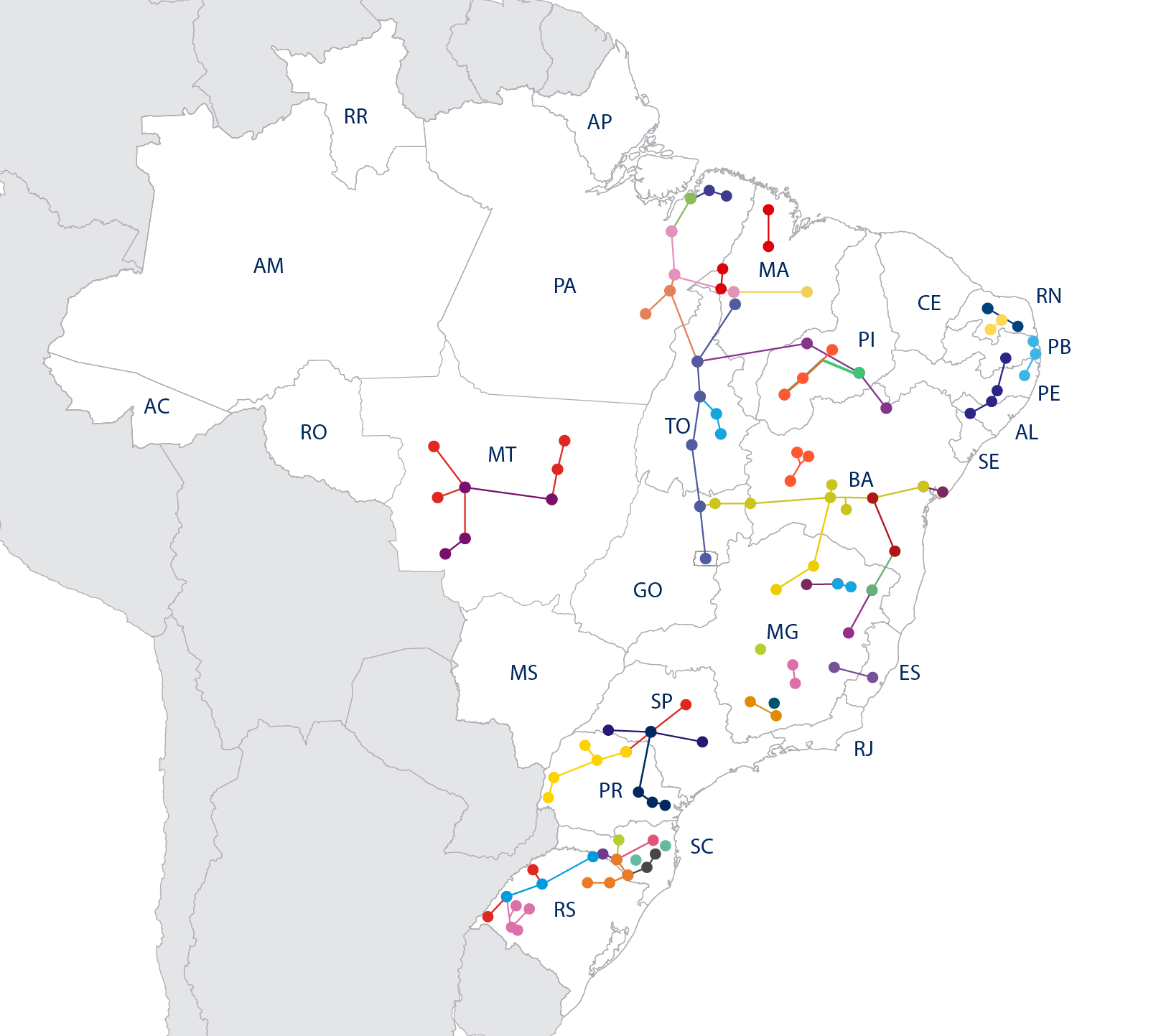

Transmissora Aliança de Energia Elétrica S.A. – TAESA – is one of the largest private electric energy transmission groups in Brazil in terms of Annual Permitted Revenues (also known as RAP). The company is exclusively dedicated to the construction, operation and maintenance of transmission assets, with 14,509 km of lines in operation and 804 km of lines under construction, totaling 15,313 km of extension and 113 substations. In addition, it has assets in operation with voltages between 69kV and 525kV, and is present in all 5 Regions of the country (18 States and the Federal District), as well as an System Operations Center in Rio de Janeiro. Currently, TAESA holds 44 transmission concessions: (i) 14 concessions that comprise the holding company (TSN, Novatrans, ETEO, GTESA, PATESA, Munirah, NTE, STE, ATE, ATE II, ATE III, Miracema, Saíra and Sant’Ana); (ii) 11 full investees (Brasnorte, São Gotardo, Mariana, Janaúba, São João, São Pedro, Lagoa Nova, Ananaí, Pitiguari, Tangará and Juruá); and (iii) shareholding interest in 19 companies (ETAU, AIE Group and TBE Group).

|

|

|

|

|

|

|

|

|

|

EIGPM1 -278.00% (-0.73)

|

TAEE11 -1.66% (43.91)

|

EIPCA1 0.00% (0.33)

|

IEEX -1.74% (131,634.00)

|

IBXX -1.17% (79,775.00)

|

IGCX -1.15% (28,781.00)

|

TAEE11 -1.66% (43.91)

|

| TAESA’s Main Figures |

| 44 concessions: 14 concessions in the holding company, 11 full investees, and shareholding interest in 19 companies |

| Total of 15,313 km of transmission lines and 113 substations (14,509 km of lines in operation and 804 km of lines under construction) |

| Present in 18 States and the Federal District: Alagoas, Bahia, Espírito Santo, Goiás, Maranhão, Mato Grosso, Minas Gerais, Pará, Paraíba, Paraná, Pernambuco, Piauí, Rio Grande do Norte, Rio Grande do Sul, Santa Catarina, São Paulo, Tocantins and Rio de Janeiro. |

| Average concession term: 14 years (as of 12/01/2024) |

| Line availability rate: 99.93% / Variable Portion (PV): R$ 5.8 million (9M25) |

| Total RAP R$ 4.4 billion (2025-2026 cycle): R$ 4.0 billion operational ( and R$ 0.4 billion under construction) |

| Investments done between 2006 and 1Q25 (CAPEX + M&A): R$ 13.3 billion |

| Dividends and Interst on Equity (IoE) declared between 2006 and 1Q25: R$ 14.8 billion |

| Financial Information (9M25 - TAESA Consolidated Regulatory) |

| EBITDA of R$ 1,580.1 million and EBITDA margin of 84.5% |

| Net Income of R$ 811.0 million / Distributed Dividends and JCP (2024) (Interest on Equity) of R$ 986.5 million |

| Gross Debt of R$ 10459.6 million / Cash balance of R$ 1,113.6 million / Net Debt of R$ 11,976.2 millionAverage Nominal Cost of 5.60% and Average Term of 5.2 years |

| Net Debt/EBITDA: 4.1x (it considers jointly controlled and associated companies) |

| Market Cap: R$ 14.6 billion (as of nov/2025) |