| Concession | Category | Contract Signature | RAP Reduction | Stake | Km* | Substations | RAP 25/26 (R$ mn) ** | End | Inflation Index | Tariff Review |

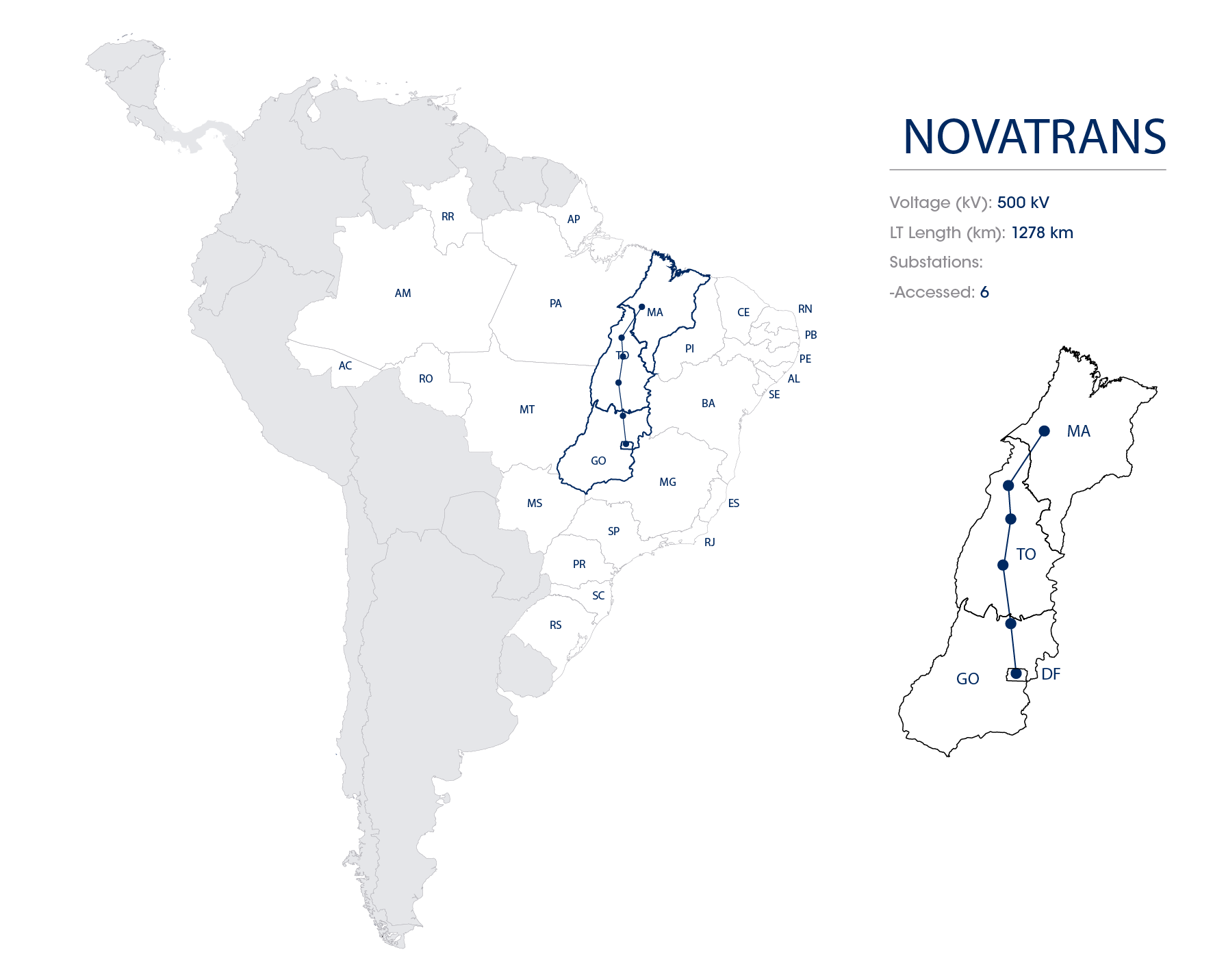

| NOVATRANS | 2 | 2000 | Jun/18 to Apr/19 | 100,00% | 1278 | 6 | 549.72 | Dec/30 | IGP-M | No |

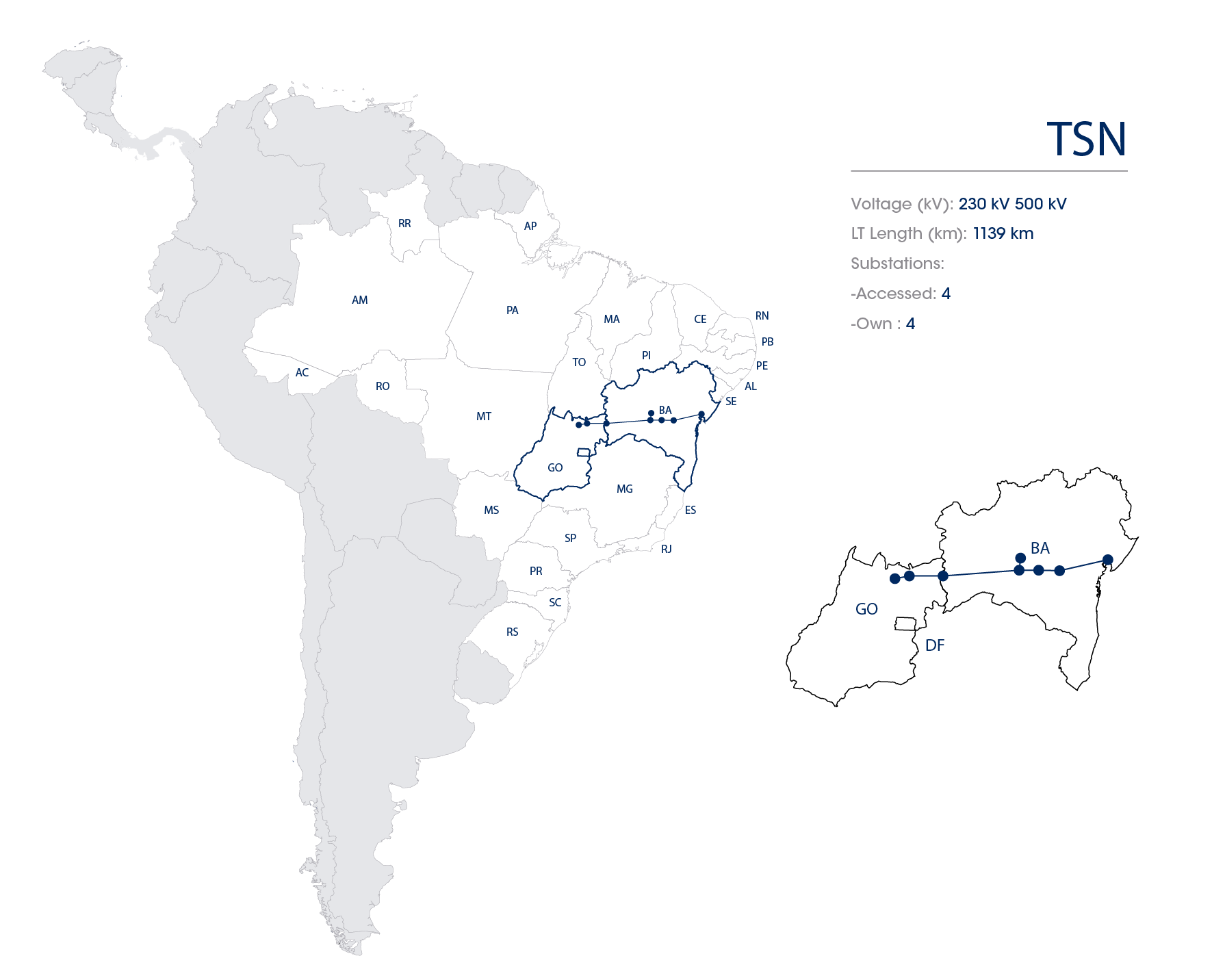

| TSN | 2 | 2000 | Mar/18 to Jun/18 | 100,00% | 1139 | 8 | 521.62 | Dec/30 | IGP-M | No |

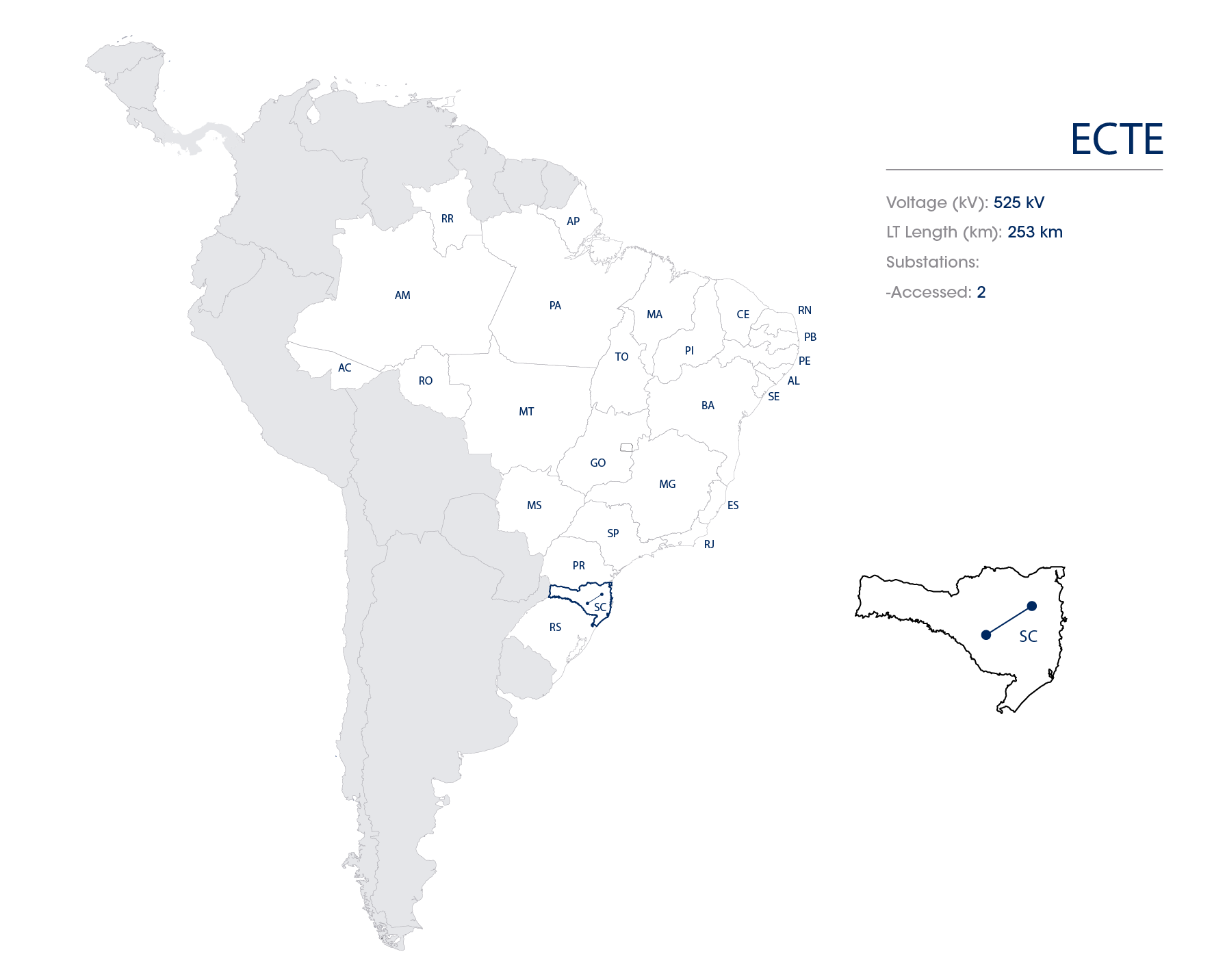

| ECTE | 2 | 2000 | Mar/17 | 19,09% | 253 | 2 | 16.77 | Nov/30 | IGP-M | No |

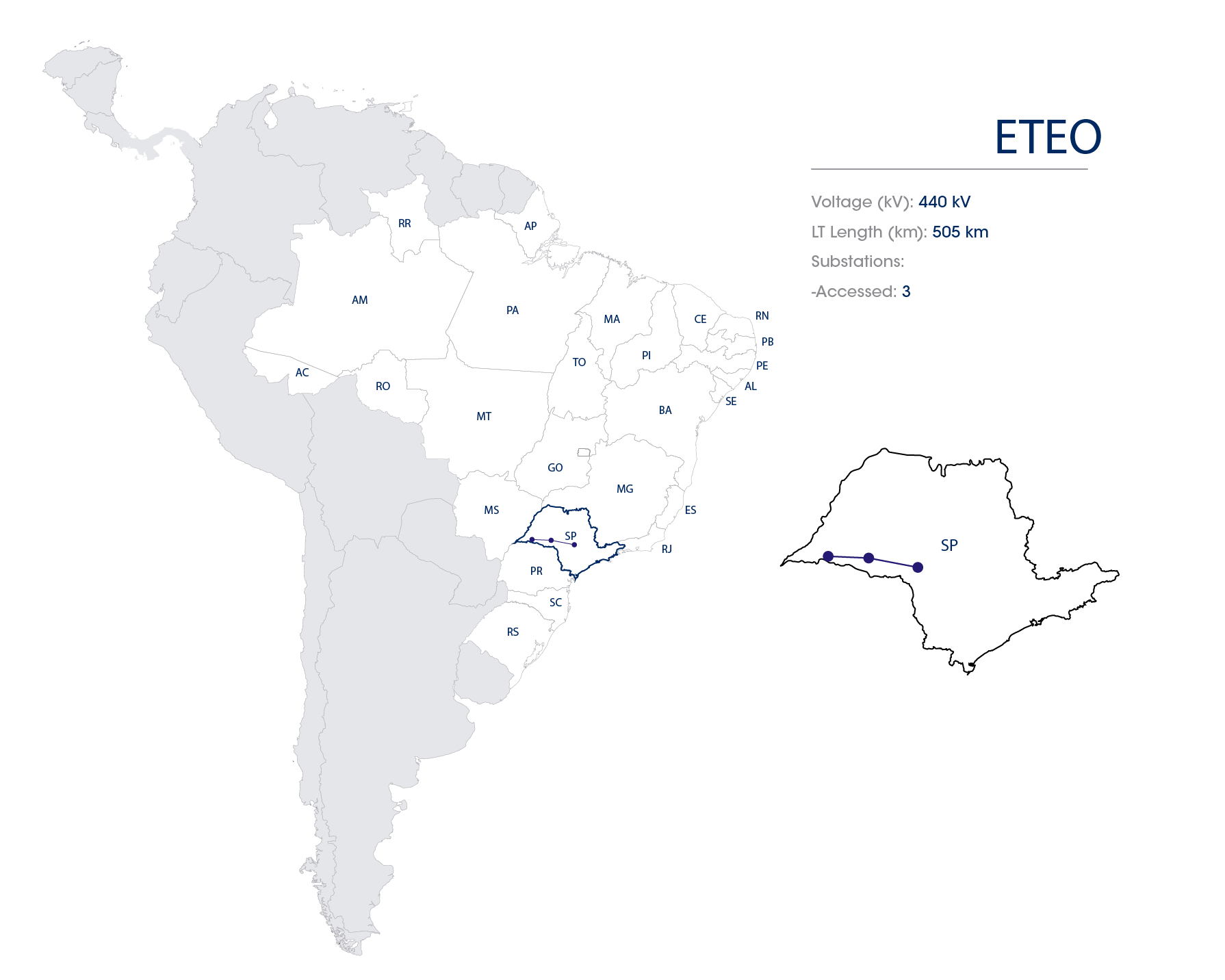

| ETEO | 2 | 2000 | Oct/16 | 100,00% | 505 | 3 | 162.89 | May/30 | IGP-M | No |

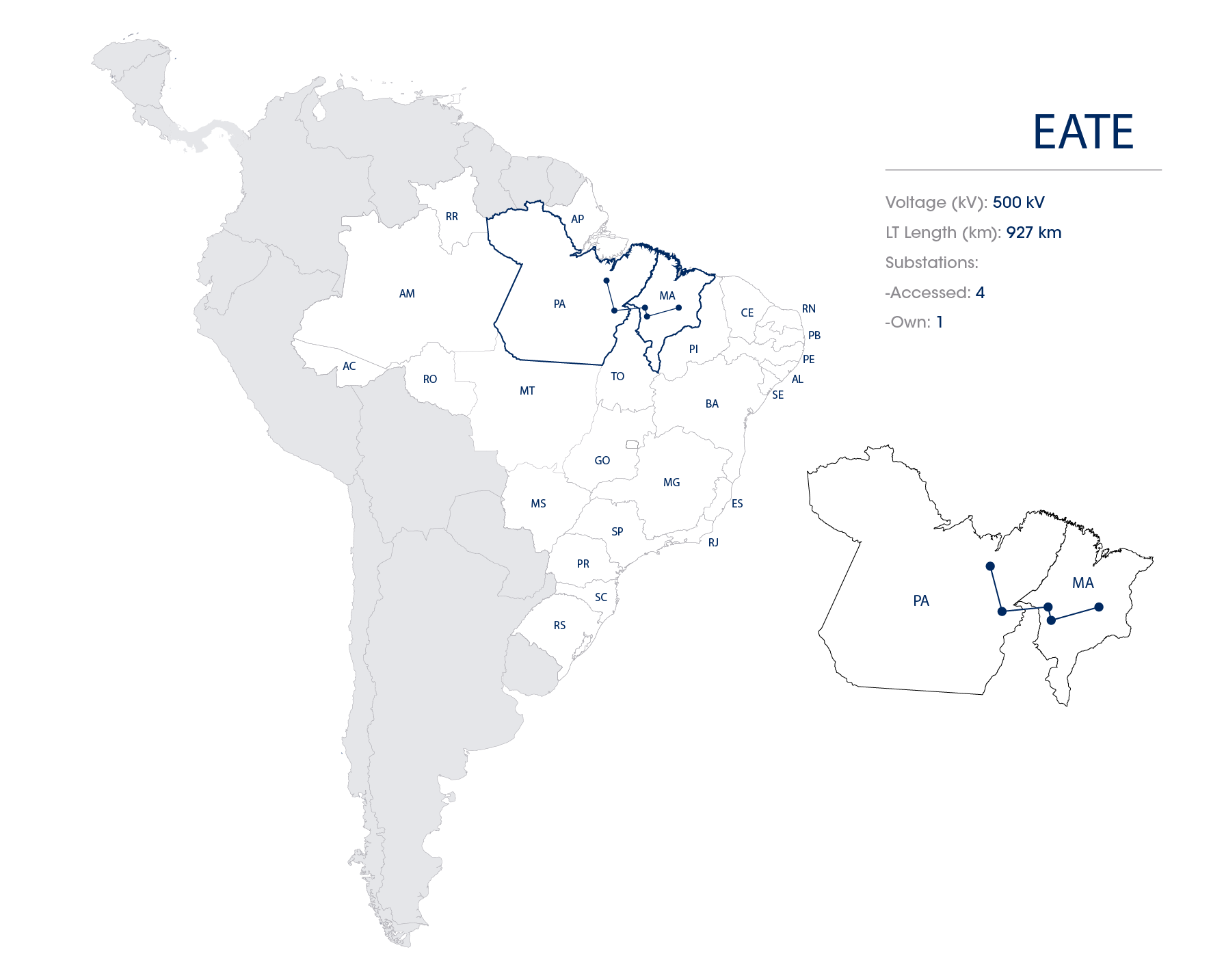

| EATE | 2 | 2001 | Feb/18 to Mar/18 | 49,98% | 931 | 5 | 226.20 | Jun/31 | IGP-M | No |

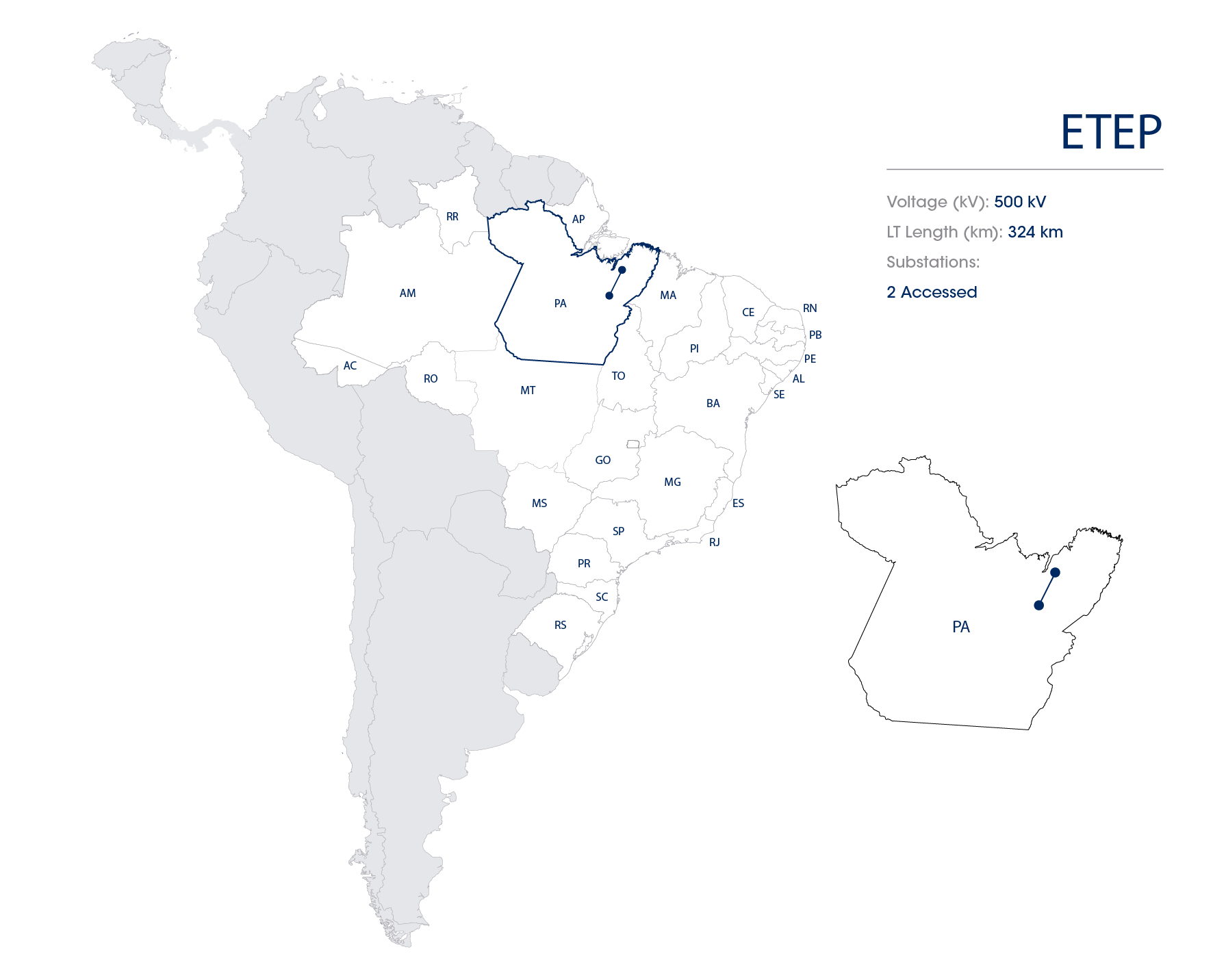

| ETEP | 2 | 2001 | Aug/17 | 49,98% | 329 | 2 | 45.43 | Jun/31 | IGP-M | No |

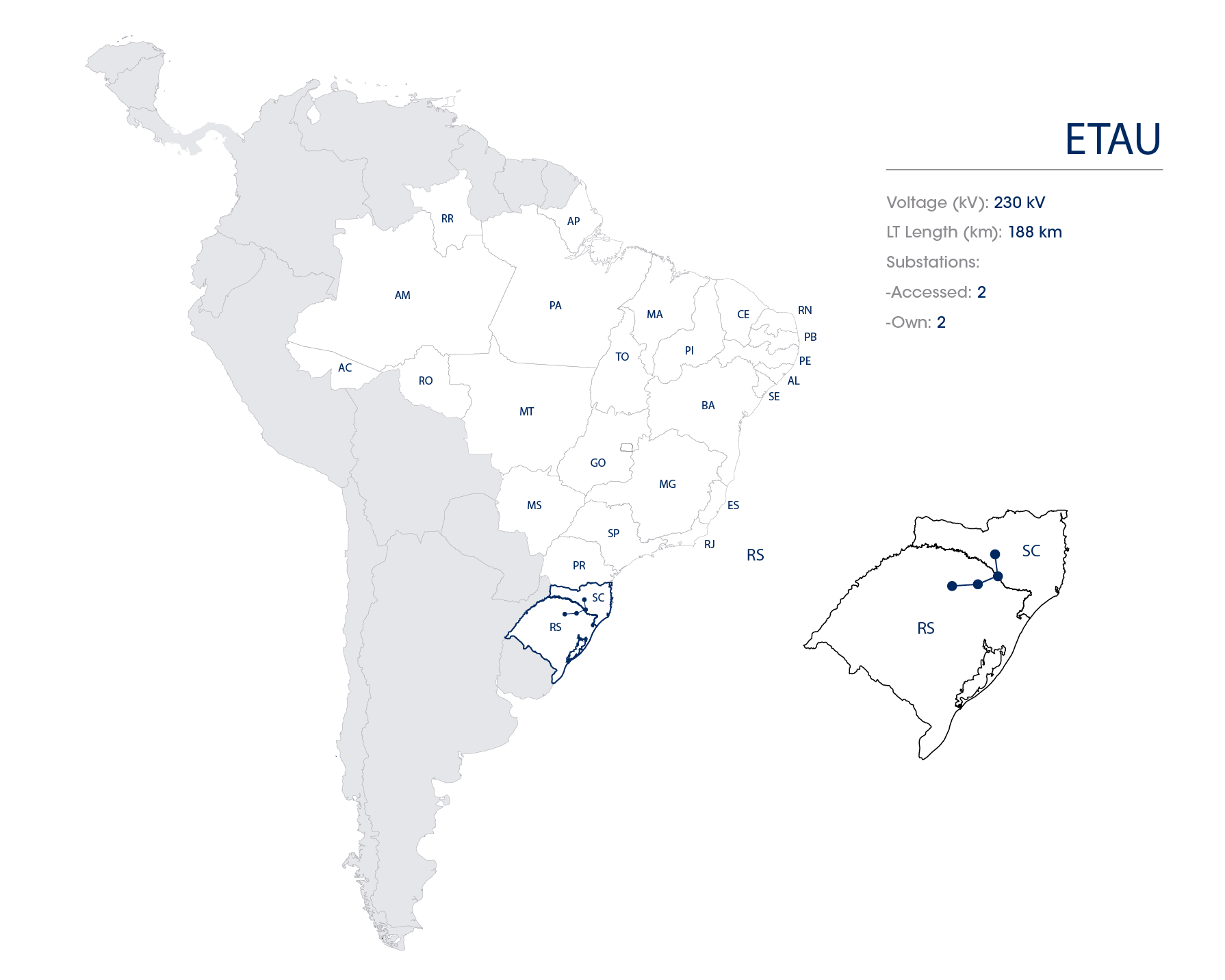

| ETAU | 2 | 2002 | jun/21 | 75,62% | 188 | 4 | 40.45 | Dec/32 | IGP-M | No |

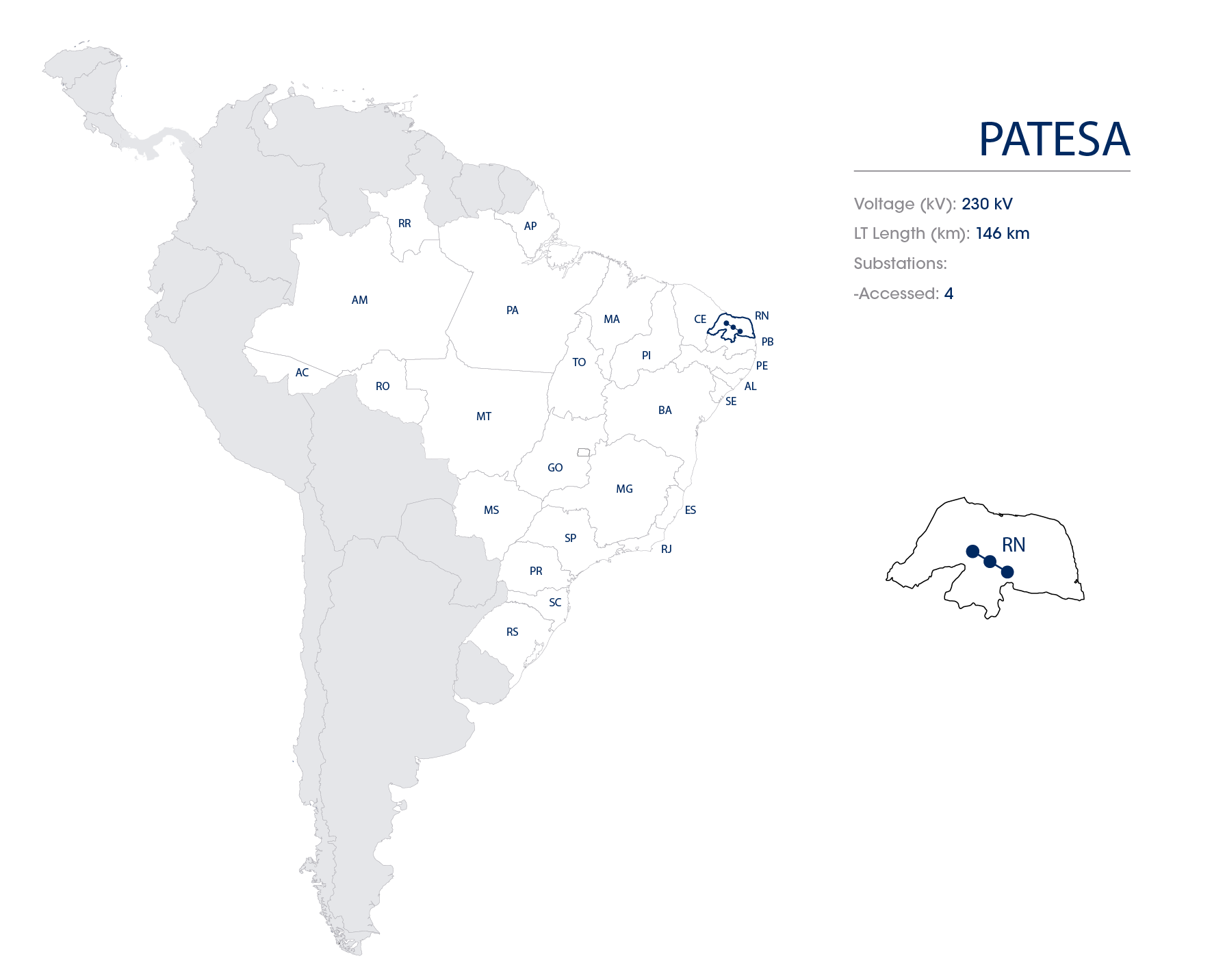

| PATESA | 2 | 2002 | Set/19 | 100,00% | 164 | 4 | 28.52 | Dec/32 | IGP-M | No |

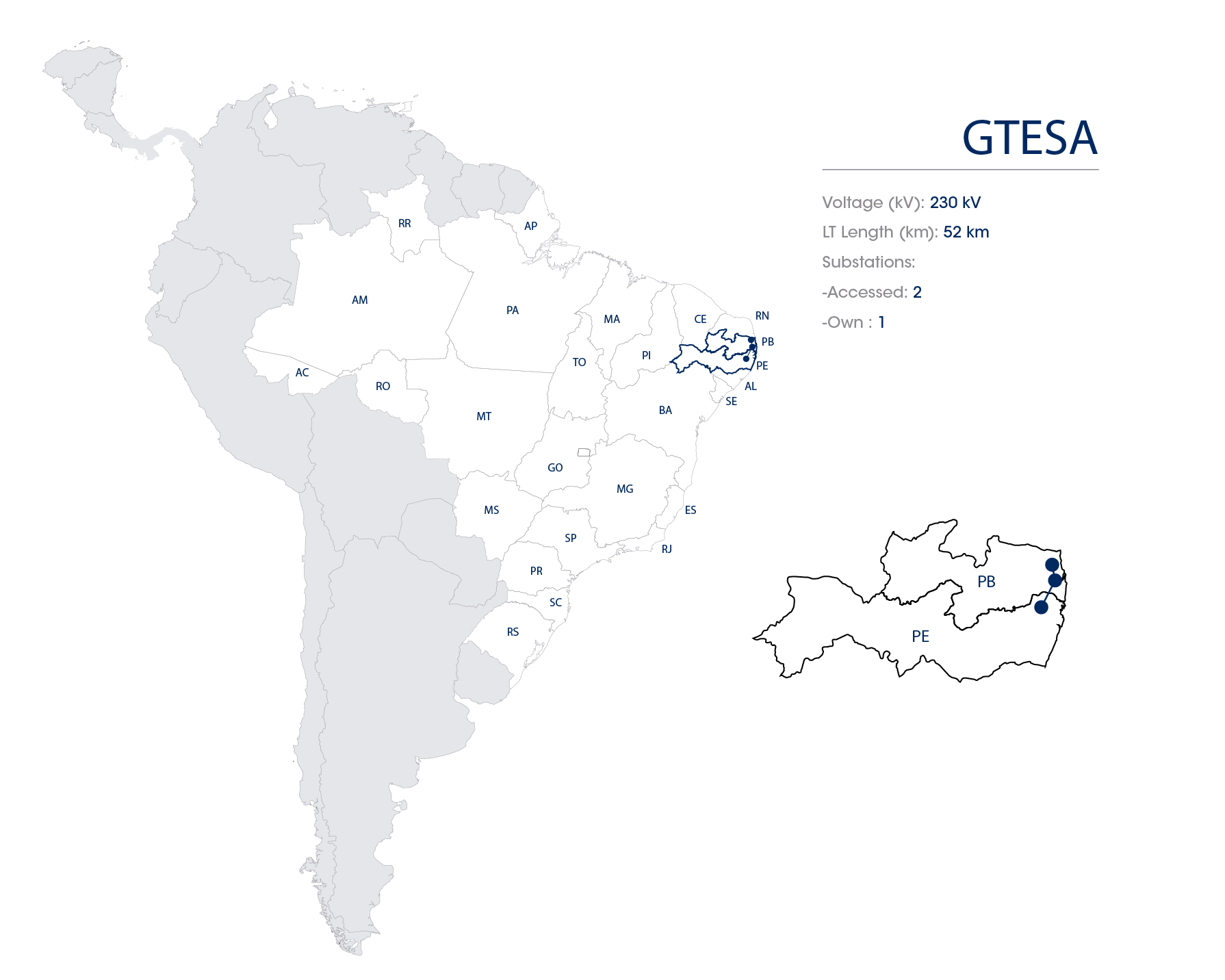

| GTESA | 2 | 2002 | Aug/18 | 100,00% | 52 | 3 | 9.14 | Jan/32 | IGP-M | No |

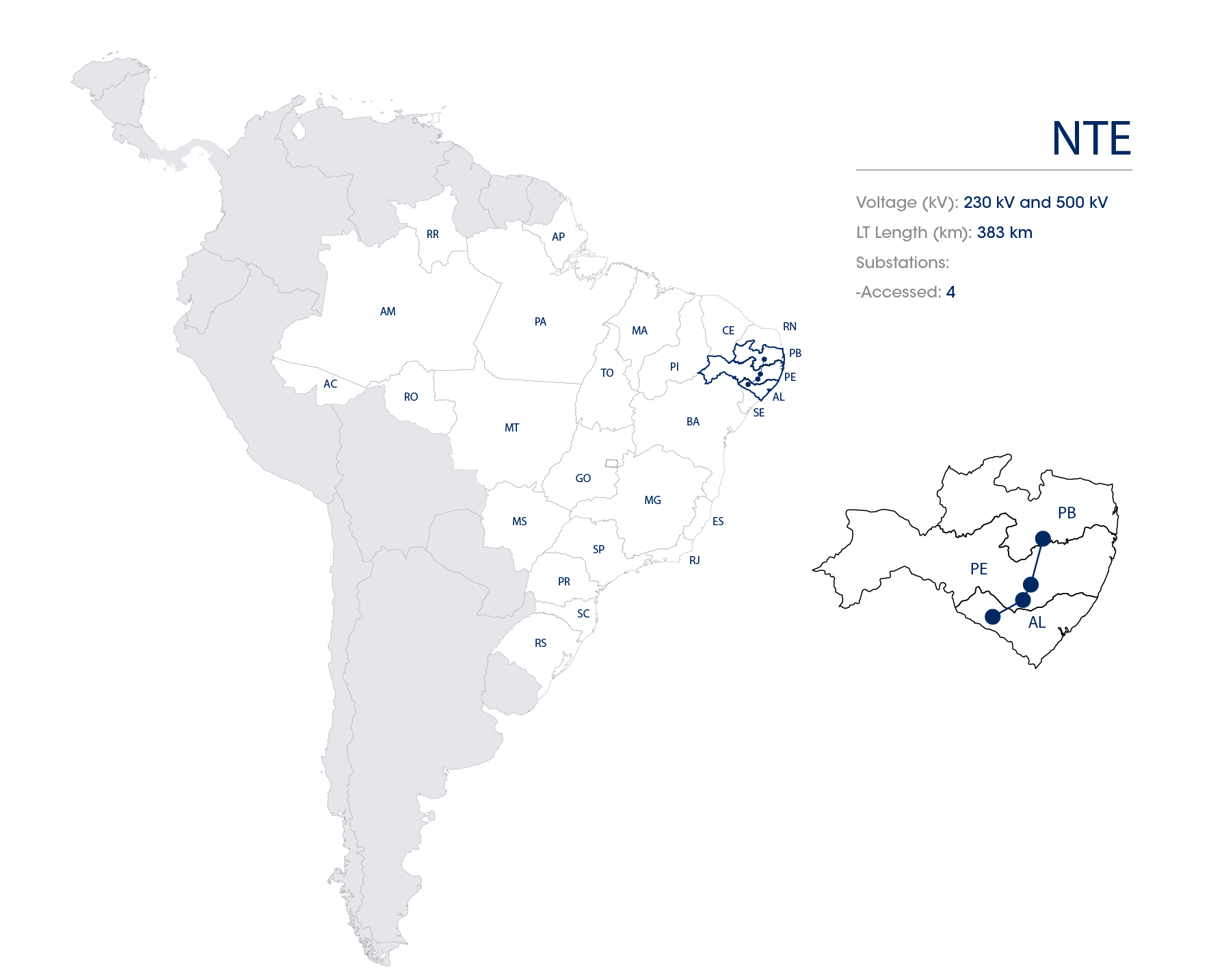

| NTE | 2 | 2002 | Jan/19 | 100,00% | 383 | 4 | 142.31 | Jan/32 | IGP-M | No |

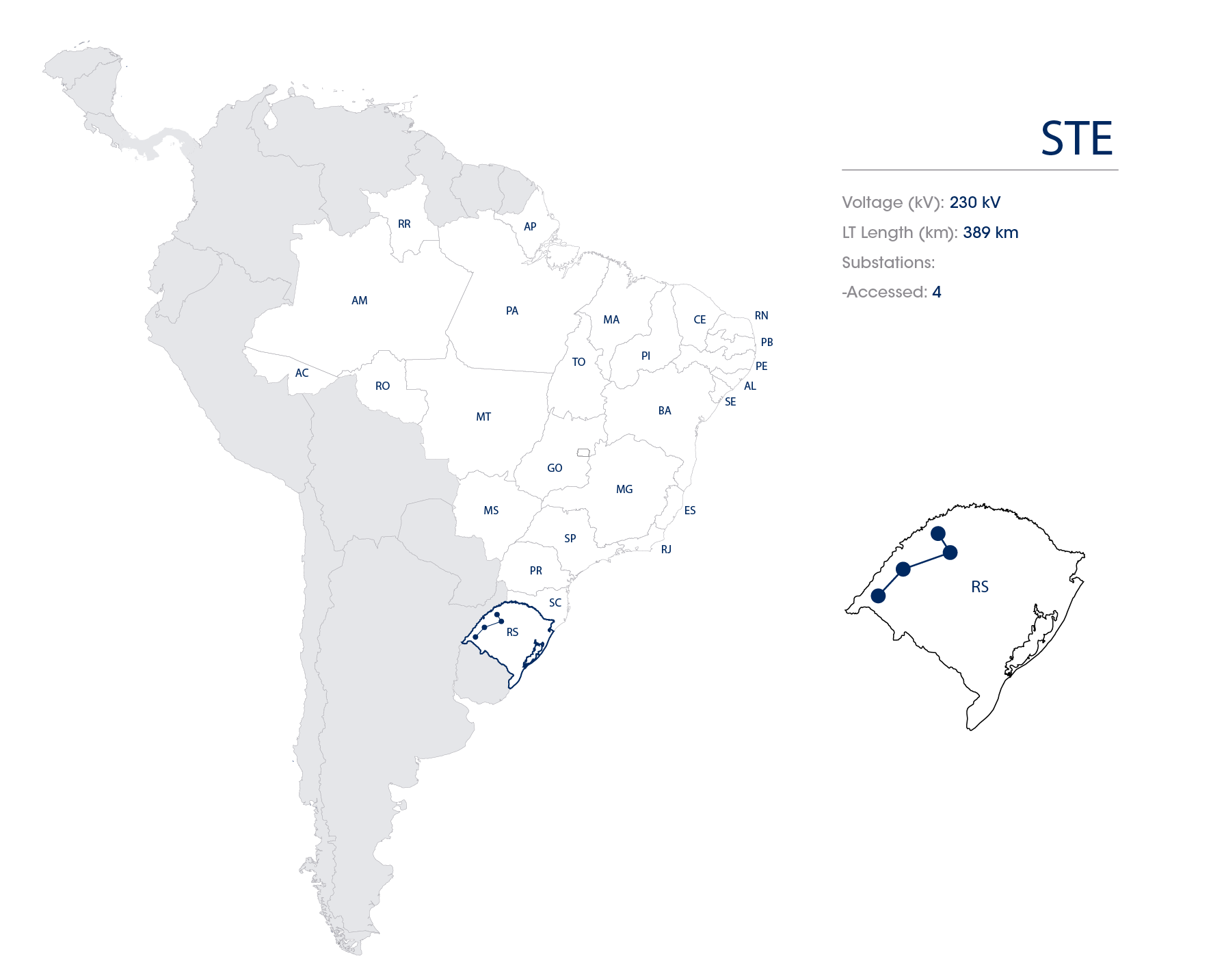

| STE | 2 | 2002 | Jun/19 to Jul/19 | 100,00% | 390 | 5 | 79.25 | Dec/32 | IGP-M | No |

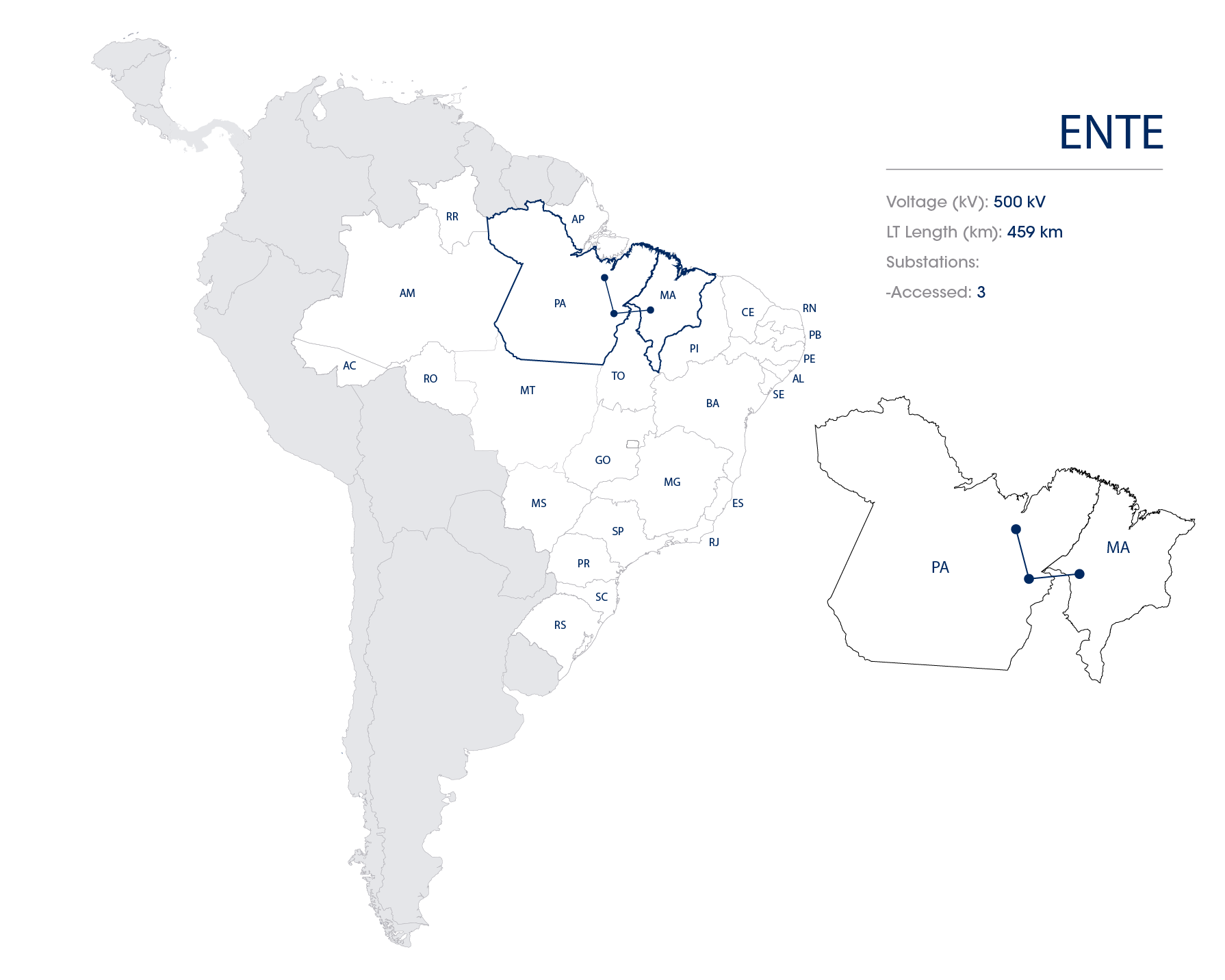

| ENTE | 2 | 2002 | Feb/20 | 49,99% | 459 | 3 | 114.44 | Dec/32 | IGP-M | No |

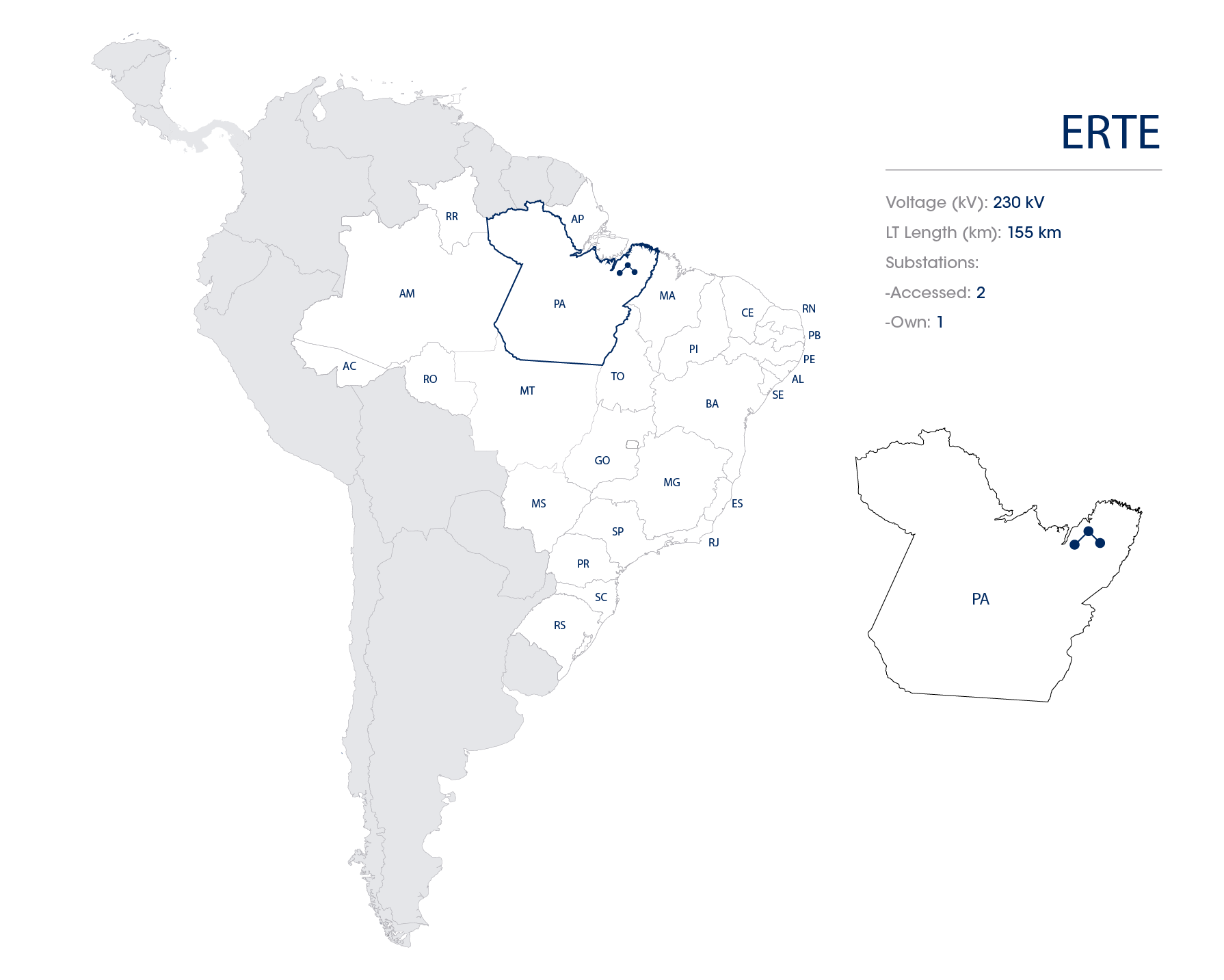

| ERTE | 2 | 2002 | Set/19 | 49,99% | 155 | 3 | 23.80 | Dec/32 | IGP-M | No |

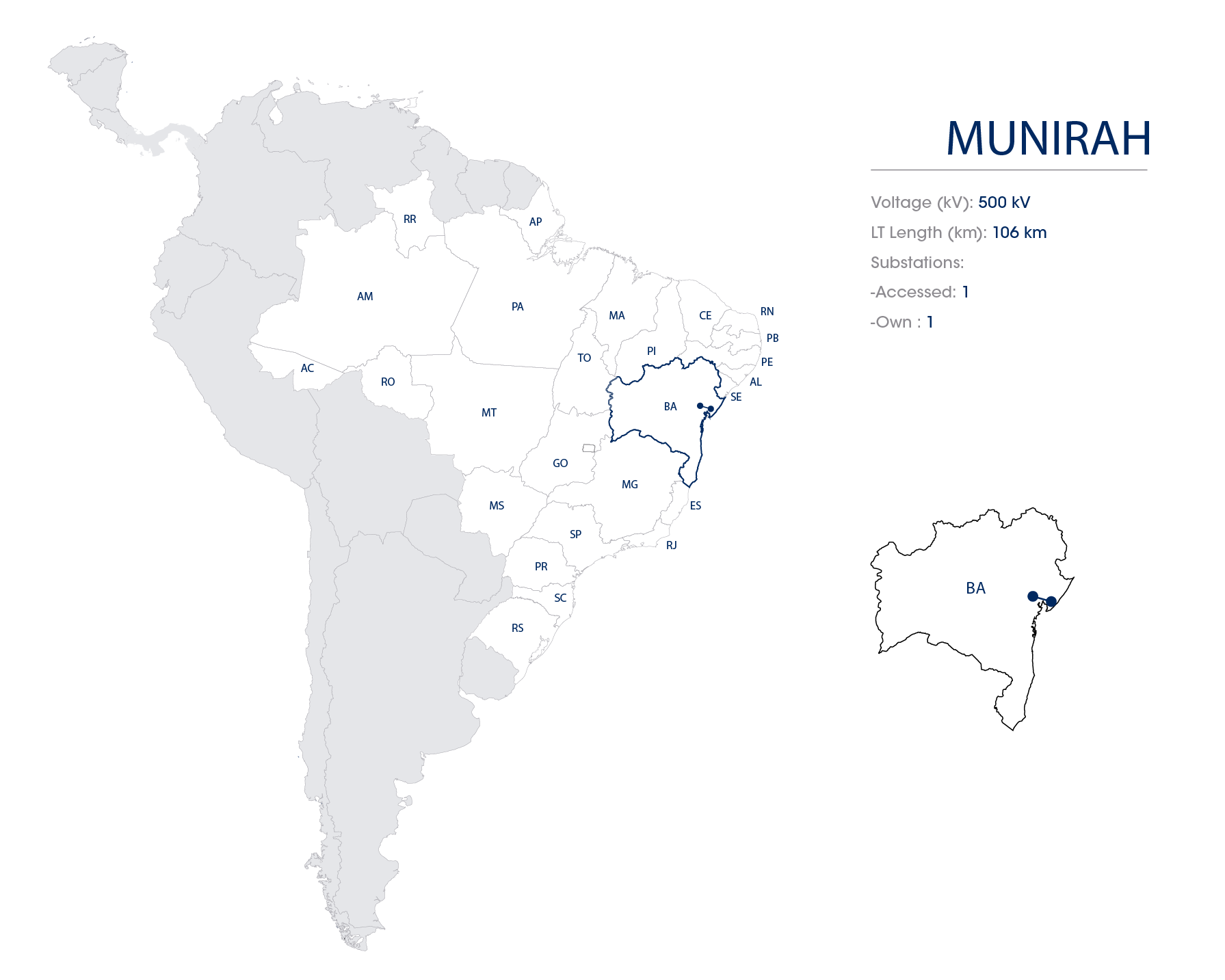

| MUNIRAH | 2 | 2004 | Oct/20 | 100,00% | 106 | 2 | 35.12 | Feb/34 | IGP-M | No |

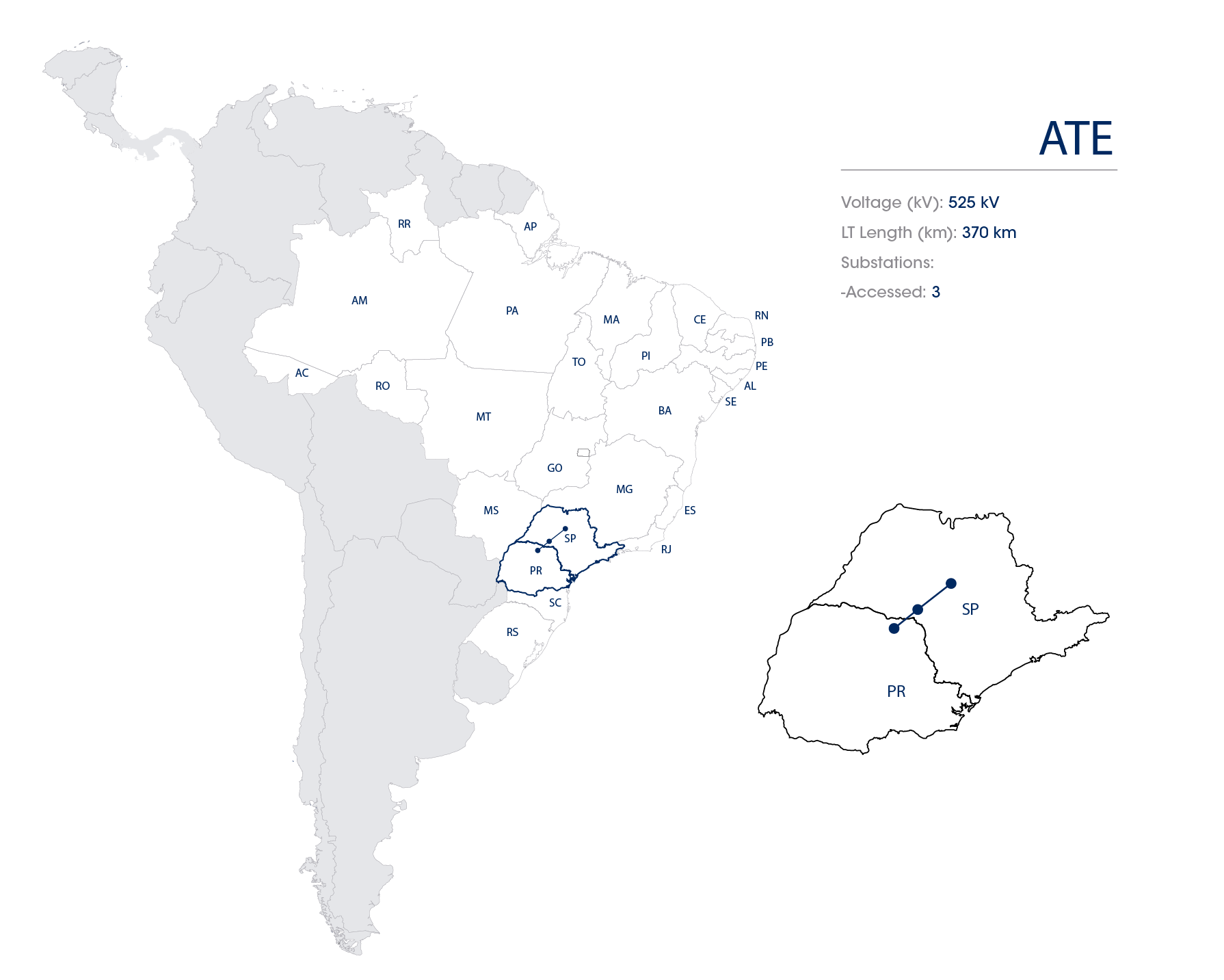

| ATE I | 2 | 2004 | Oct/20 | 100,00% | 370 | 3 | 156.49 | Feb/34 | IGP-M | No |

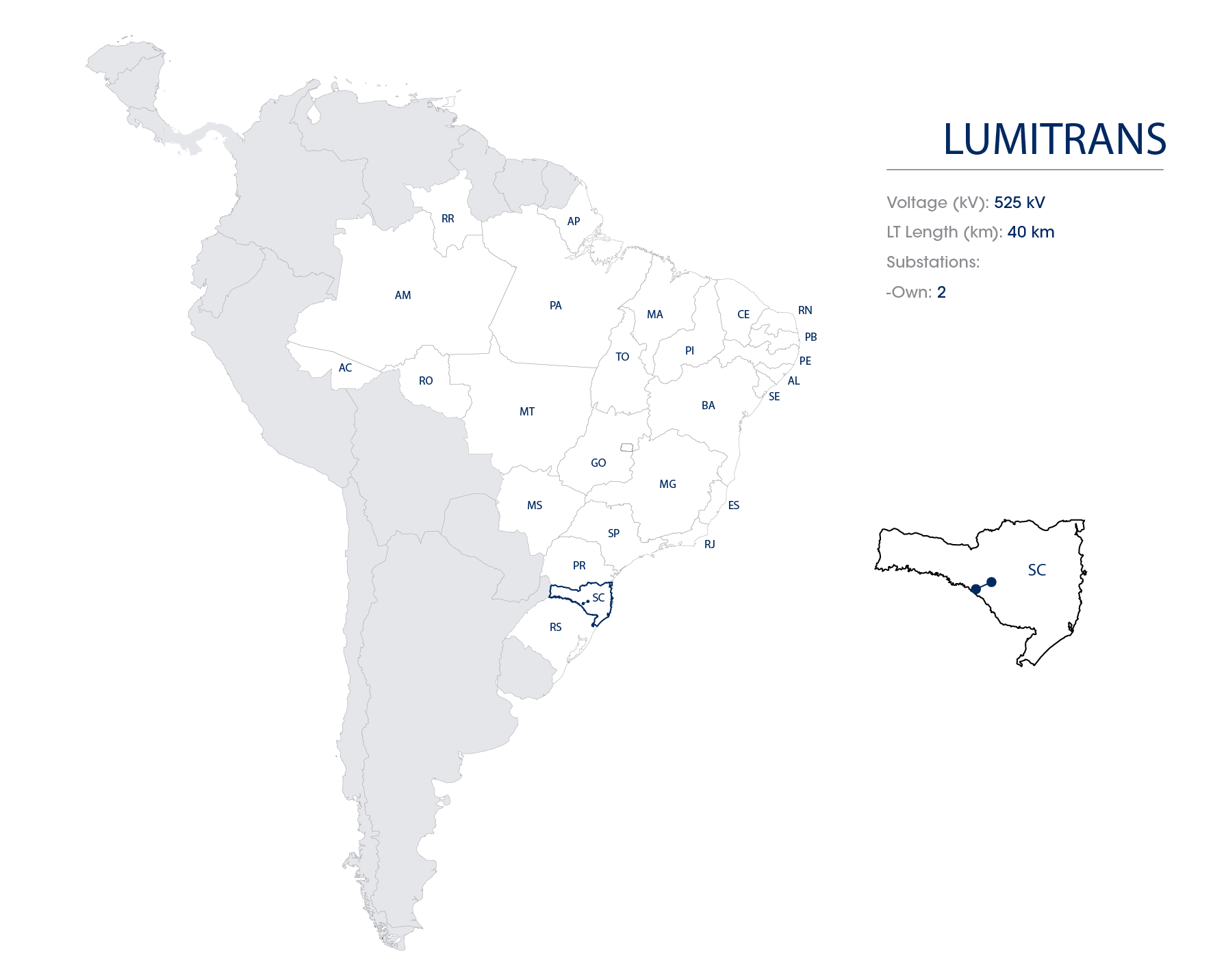

| LUMITRANS | 2 | 2004 | Oct/22 | 39,99% | 40 | 2 | 9.85 | Feb/34 | IGP-M | No |

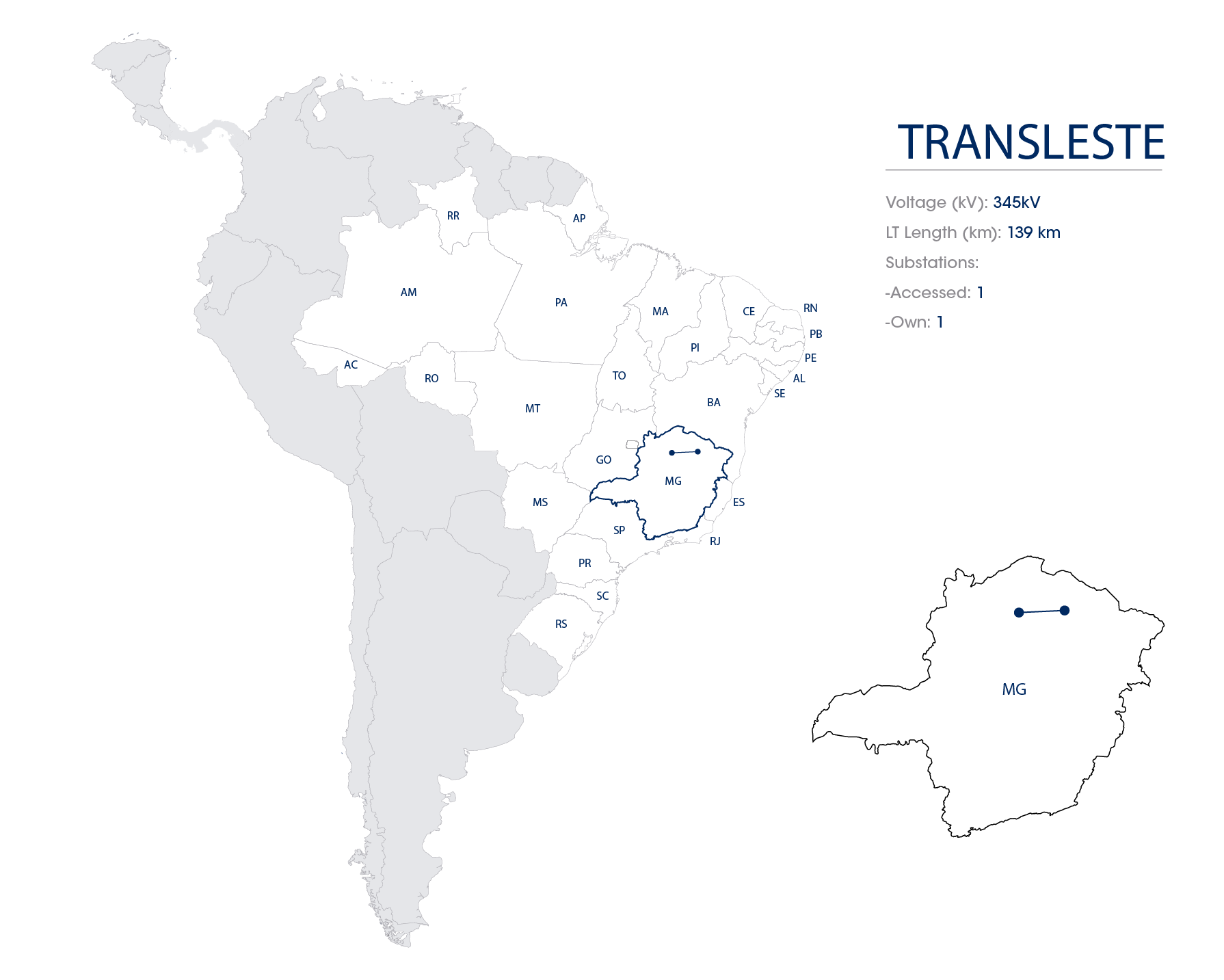

| TRANSLESTE | 2 | 2004 | Dec/20 | 54,00% | 139 | 2 | 20.36 | Feb/34 | IGP-M | No |

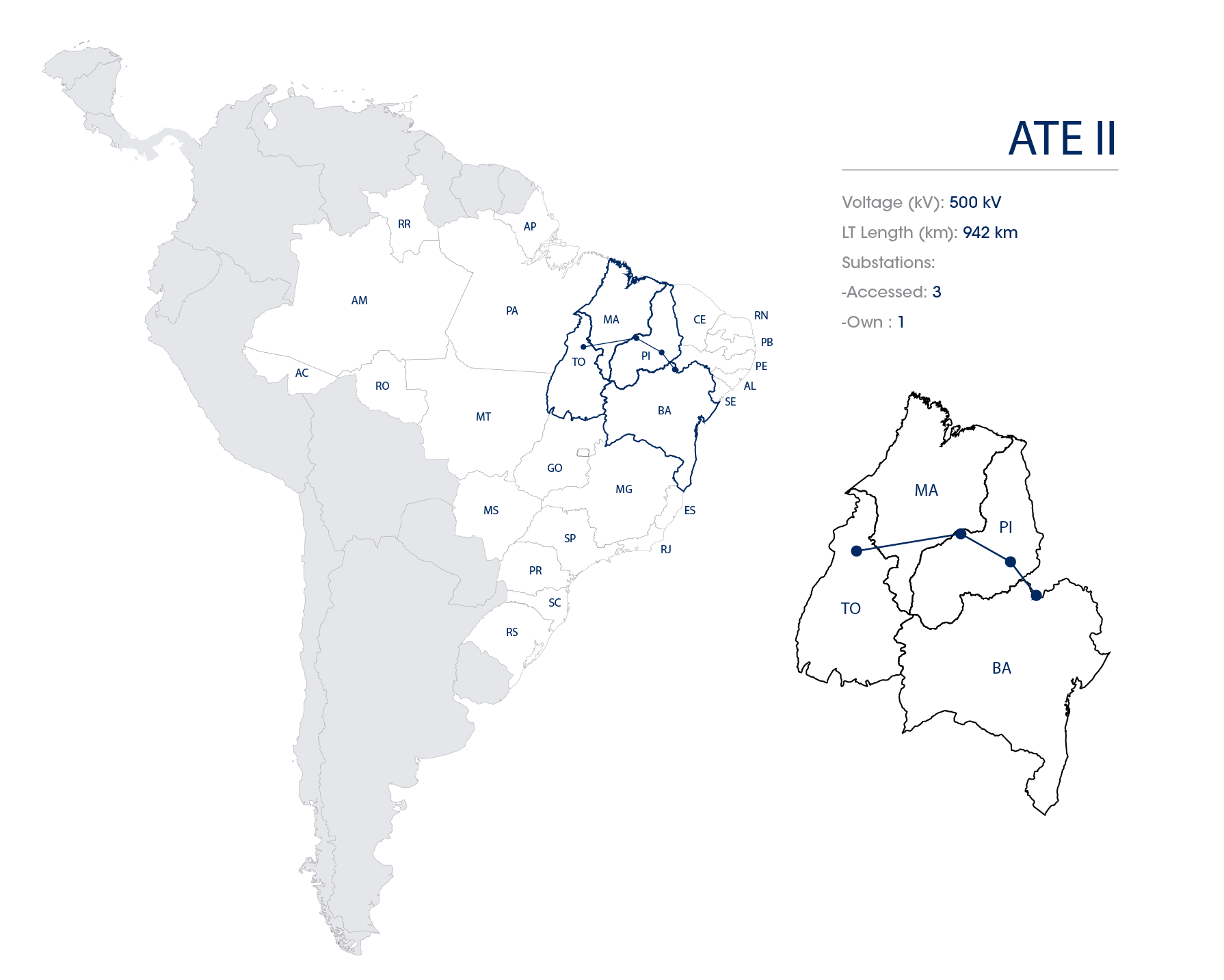

| ATE II | 2 | 2005 | Dec/21 | 100,00% | 942 | 4 | 215.87 | Mar/35 | IGP-M | No |

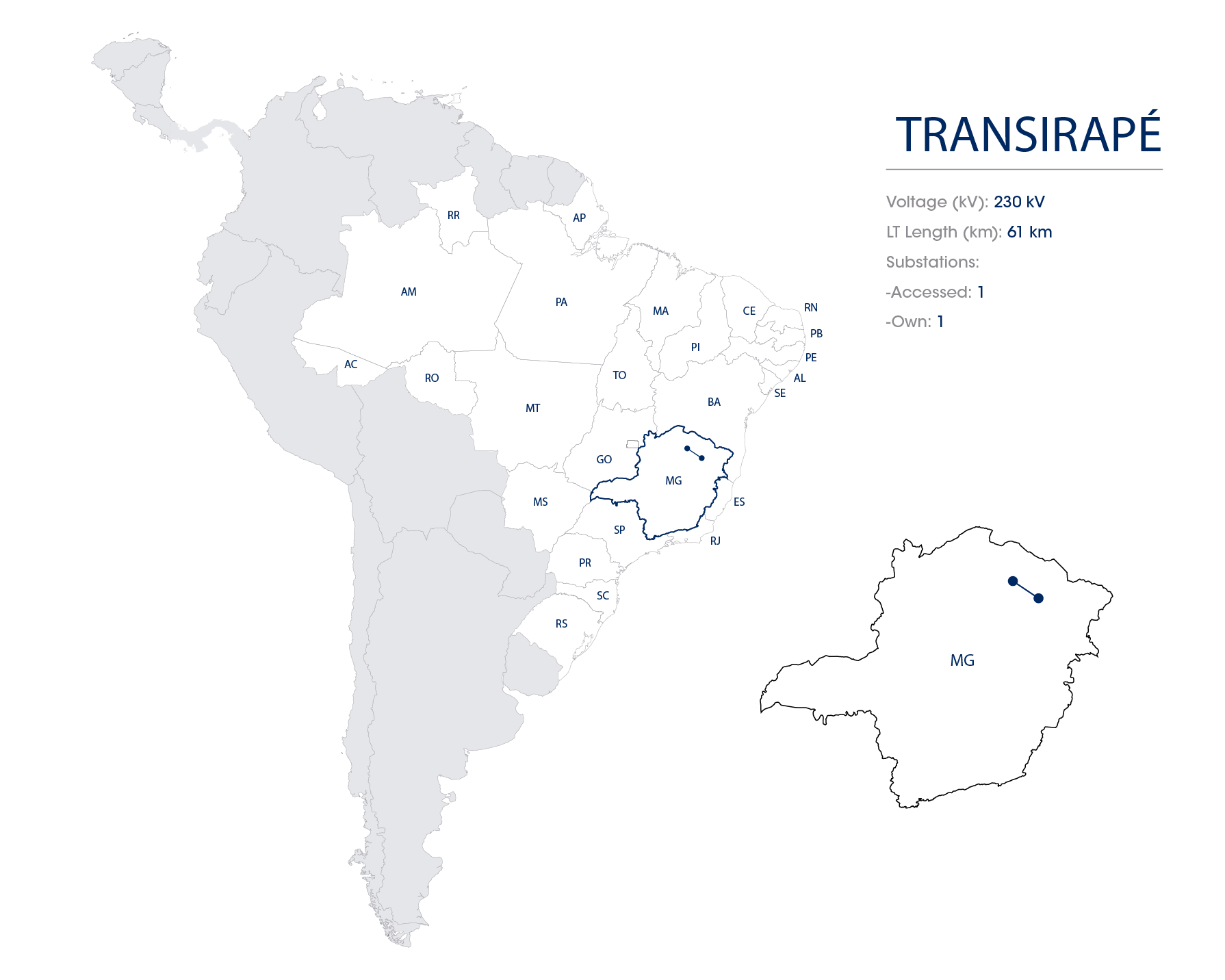

| TRANSIRAPÉ | 2 | 2005 | May/22 | 54,00% | 61 | 2 | 25.03 | Mar/35 | IGP-M | No |

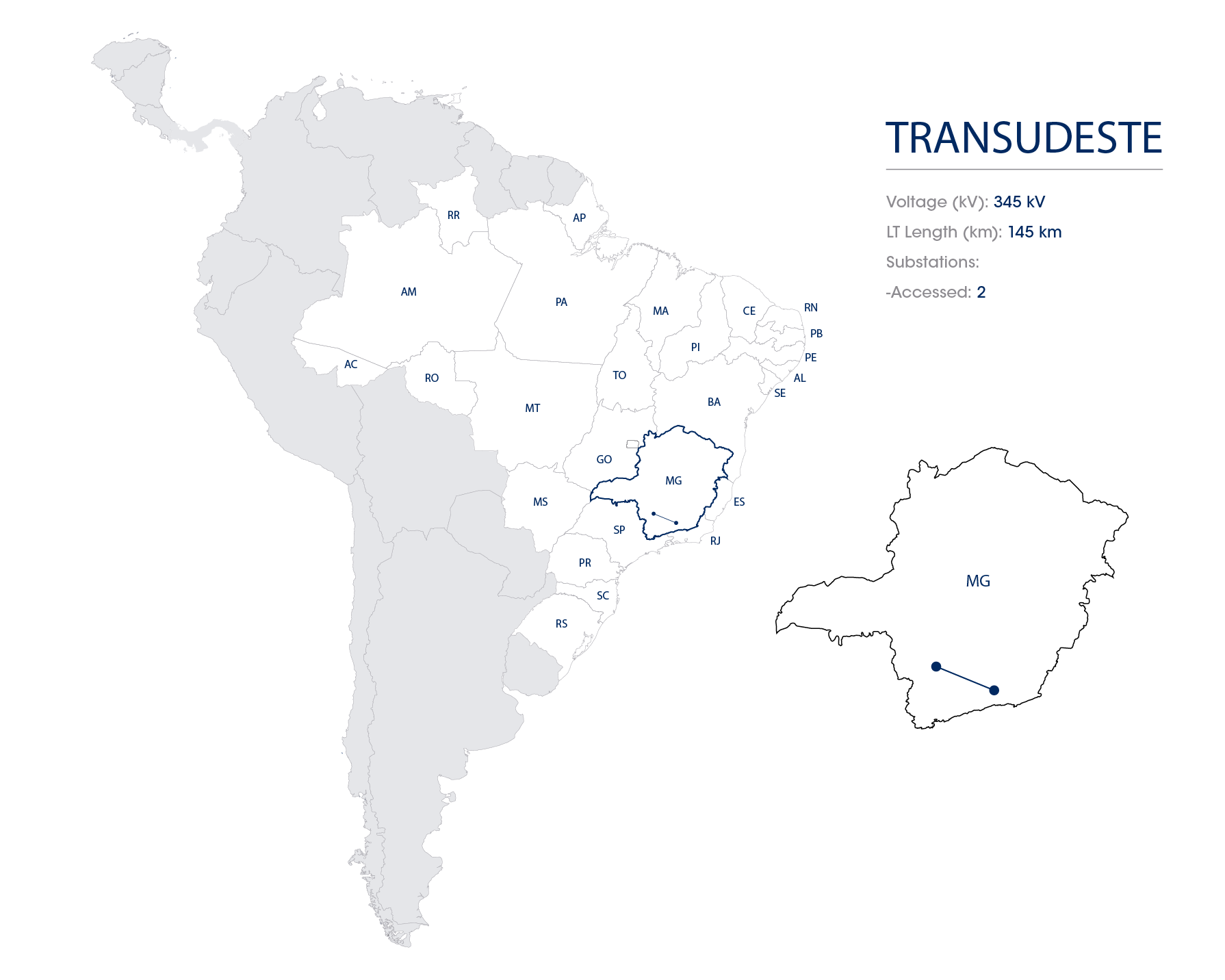

| TRANSUDESTE | 2 | 2005 | Feb/22 | 54,00% | 162 | 3 | 12.62 | Mar/35 | IGP-M | No |

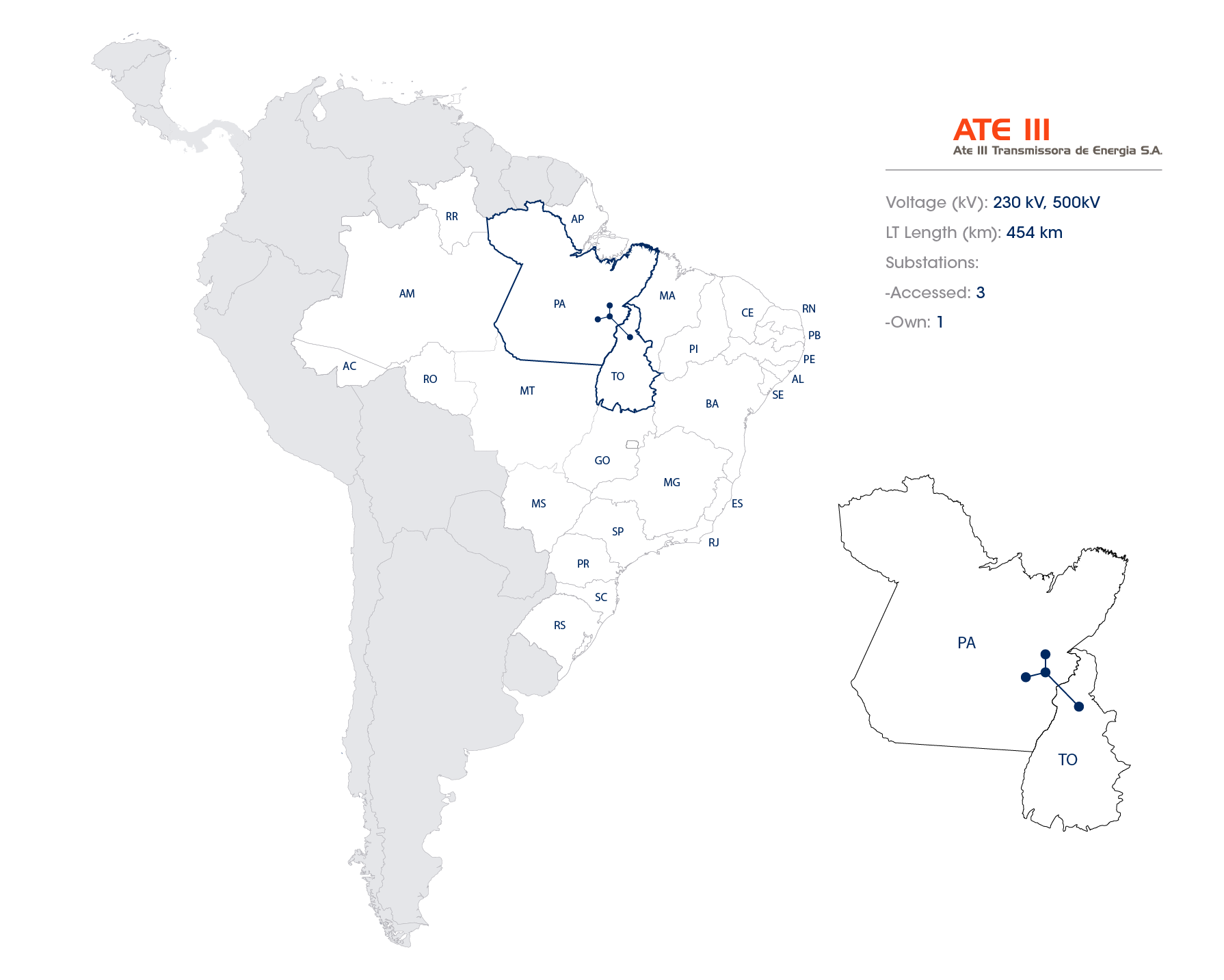

| ATE III | 2 | 2006 | Apr/23 to May/23 | 100,00% | 454 | 4 | 110.49 | Apr/36 | IPCA | No |

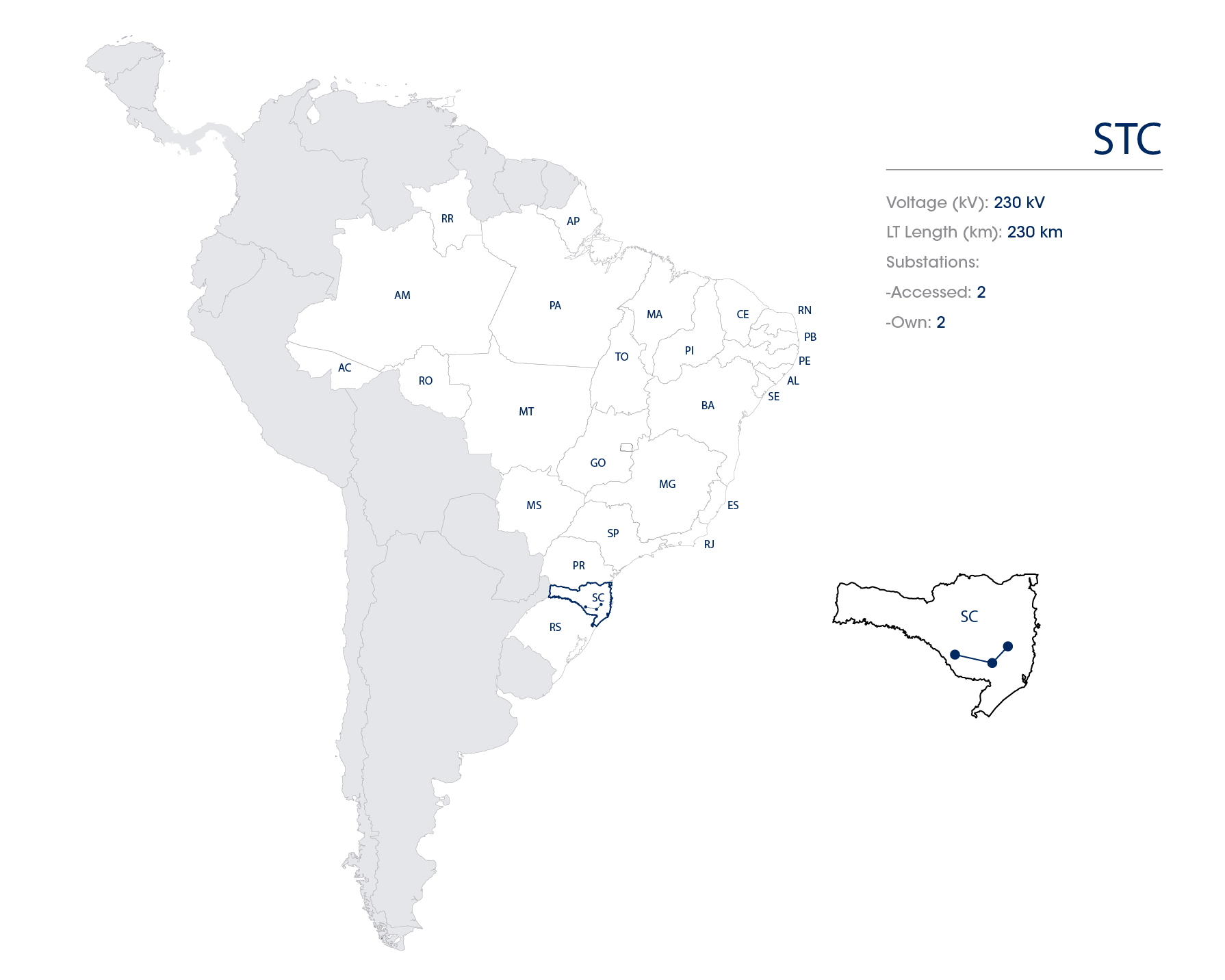

| STC | 2 | 2006 | Nov/22 | 39,99% | 230 | 4 | 16.20 | Apr/36 | IPCA | No |

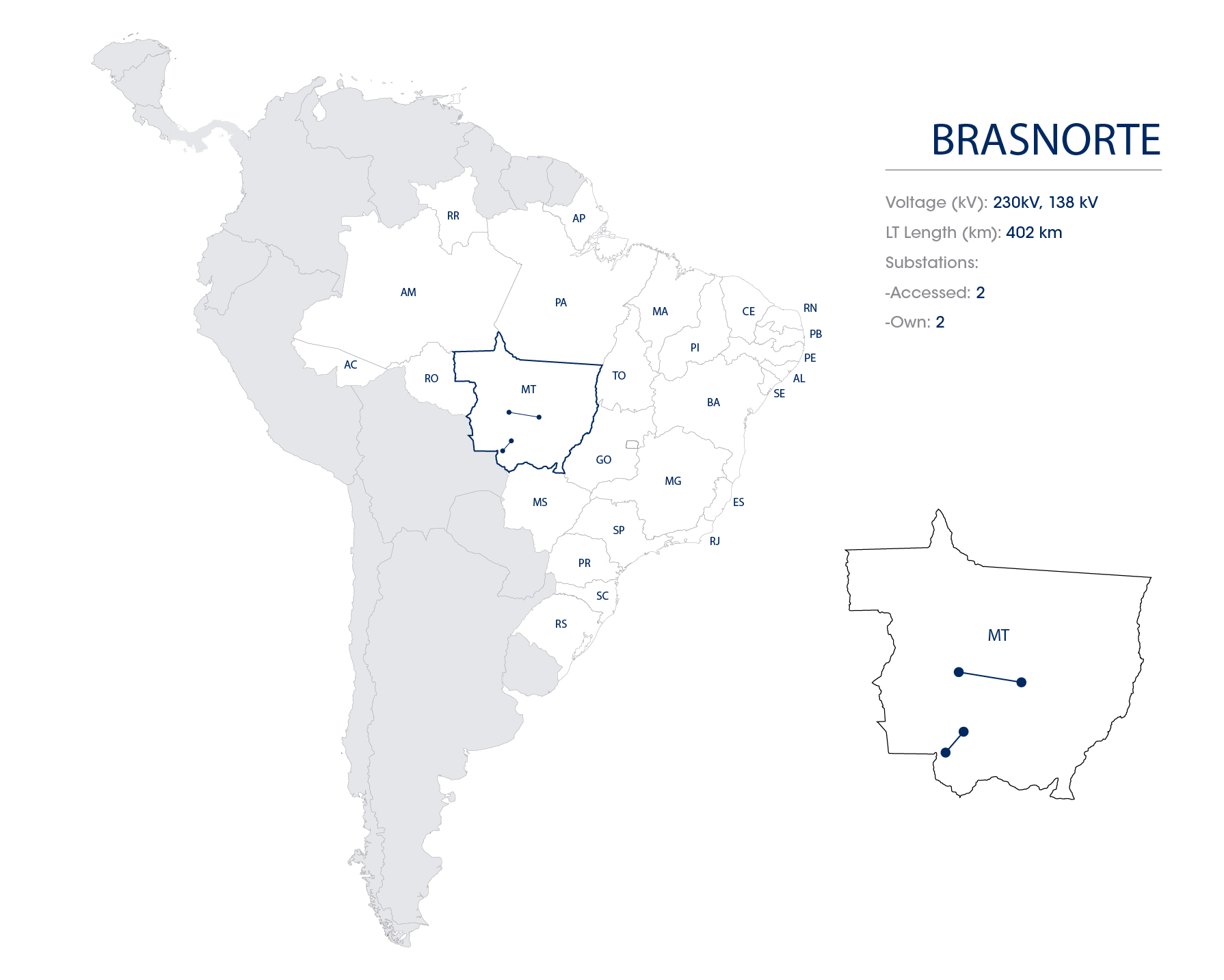

| BRASNORTE | 3 | 2008 | No | 100,00% | 402 | 4 | 42.25 | Mar/38 | IPCA | Yes |

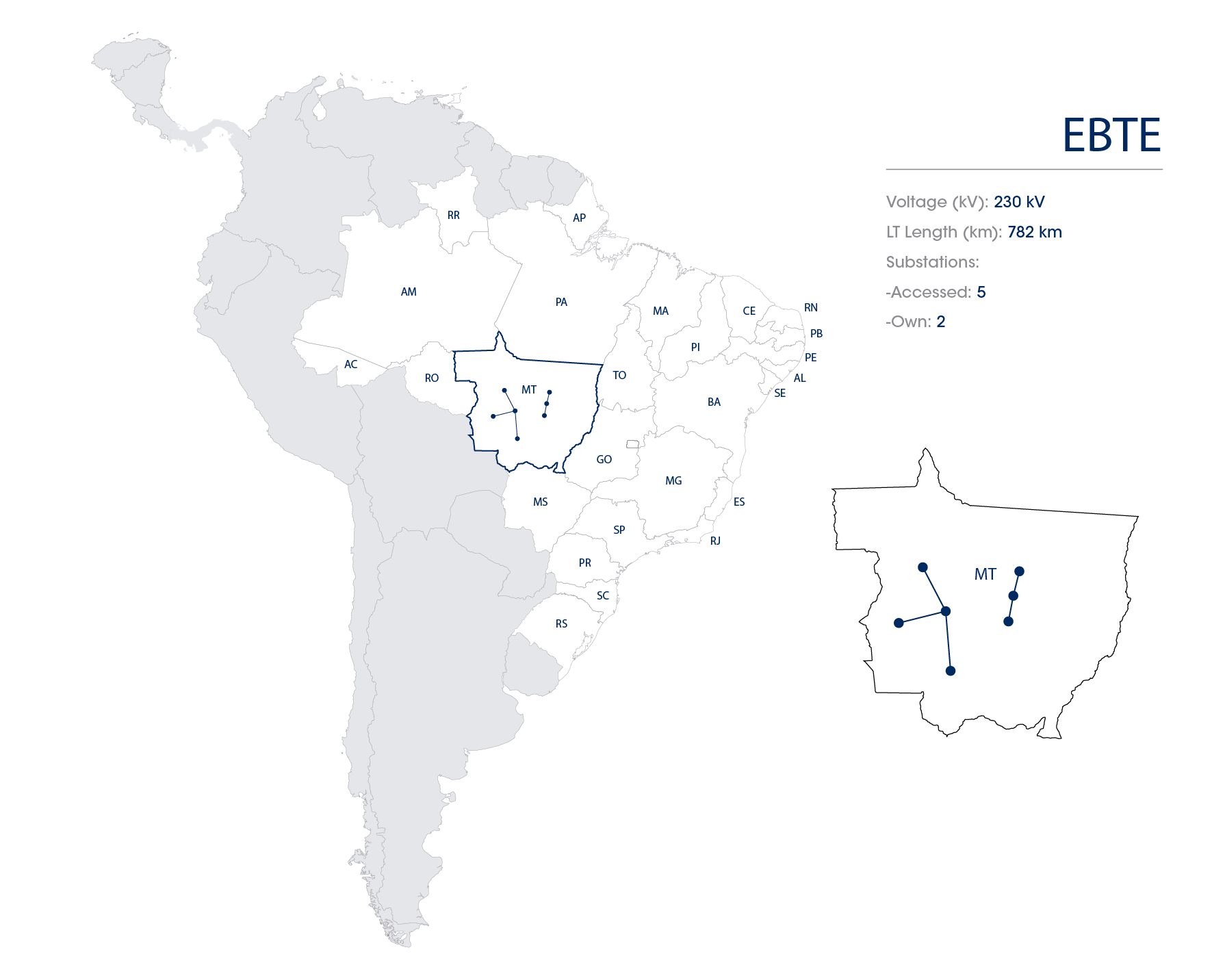

| EBTE | 3 | 2008 | No | 74,49% | 949 | 8 | 63.89 | Oct/38 | IPCA | Yes |

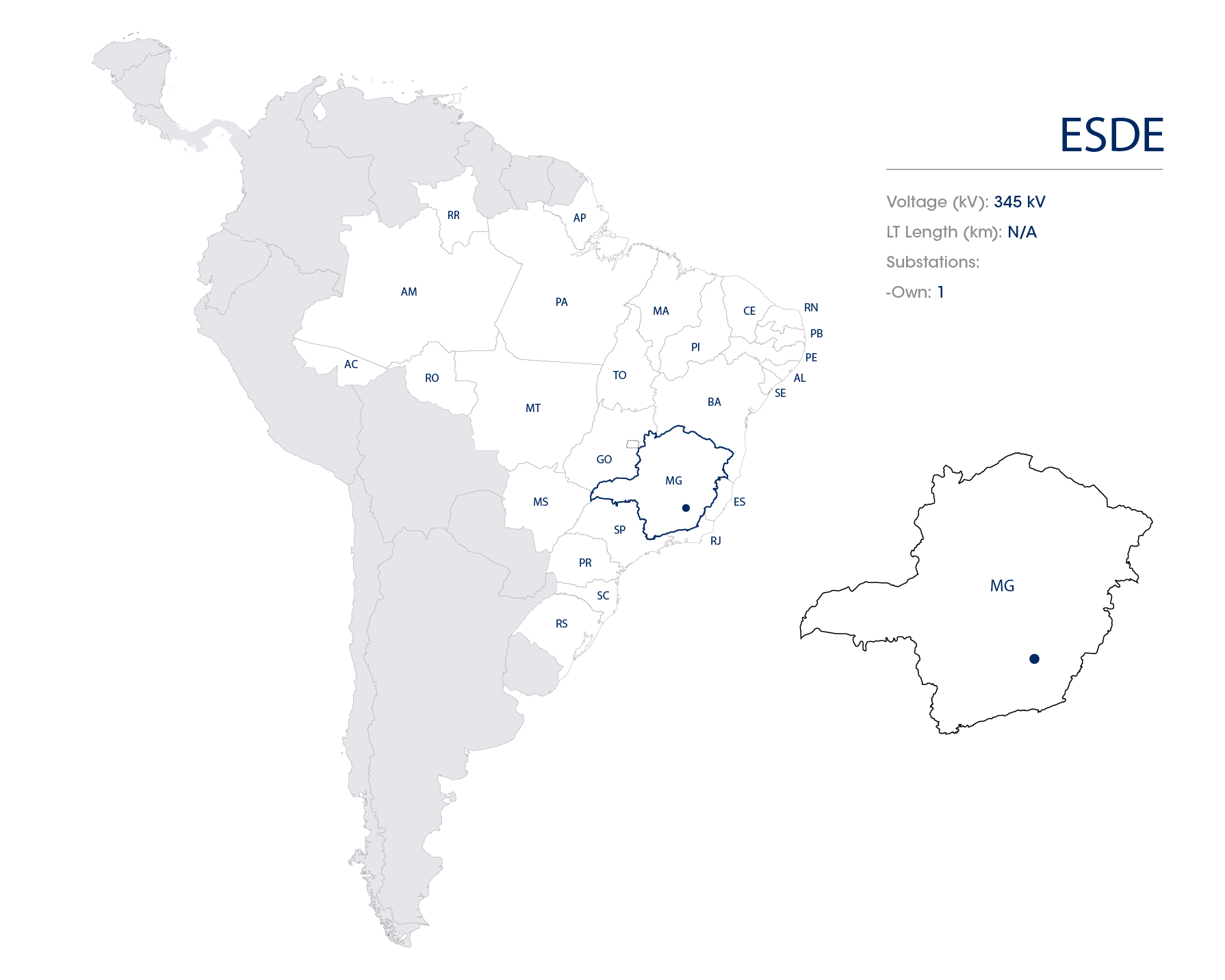

| ESDE | 3 | 2009 | No | 49,98% | - | 1 | 10.00 | Nov/39 | IPCA | Yes |

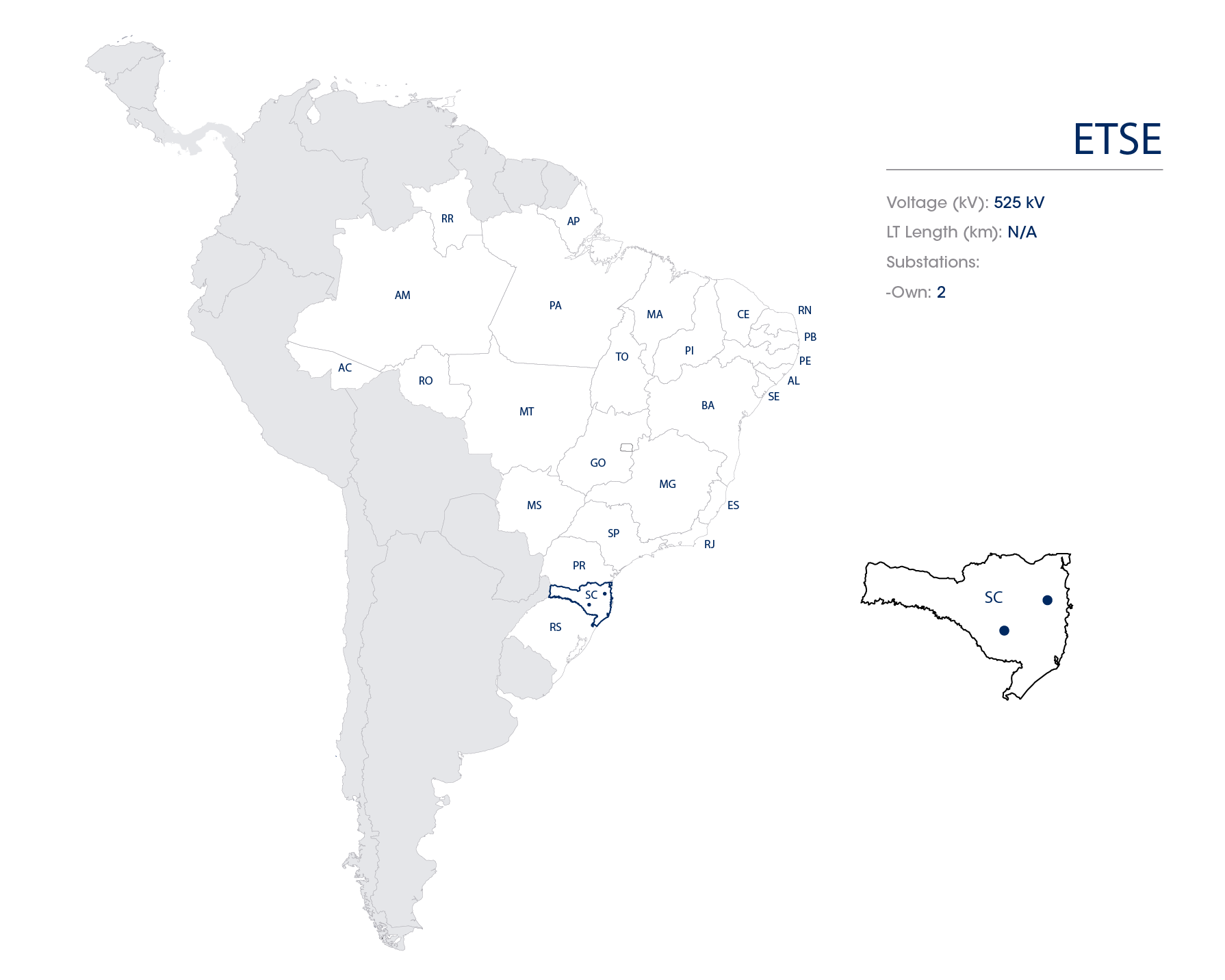

| ETSE | 3 | 2012 | No | 19,09% | - | 2 | 7.49 | May/42 | IPCA | Yes |

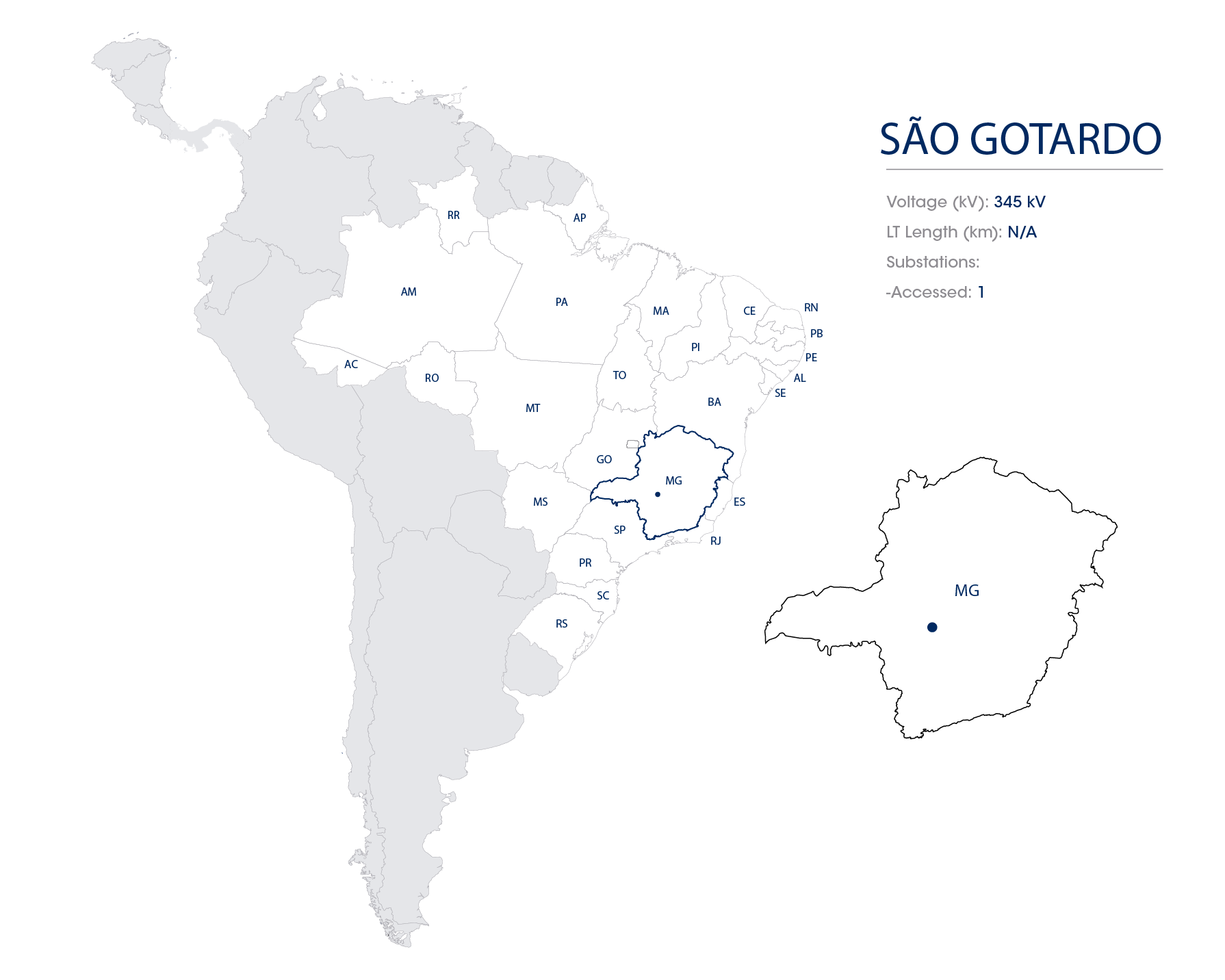

| SÃO GOTARDO | 3 | 2012 | No | 100,00% | - | 1 | 7.90 | Aug/42 | IPCA | Yes |

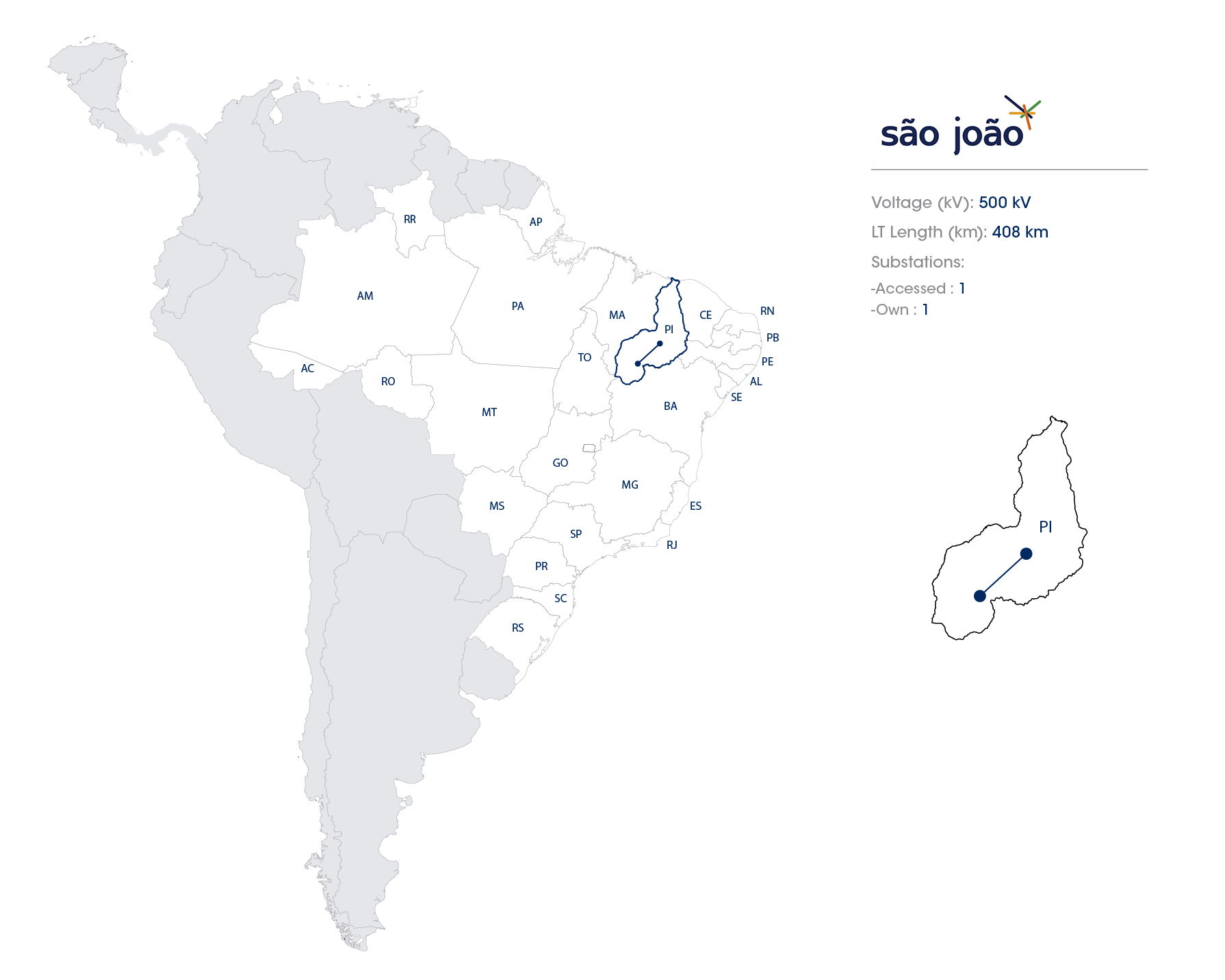

| SÃO JOÃO | 3 | 2013 | No | 100,00% | 413 | 2 | 70.53 | Aug/43 | IPCA | Yes |

| SÃO PEDRO | 3 | 2013 | No | 100,00% | 494 | 6 | 95.68 | Oct/43 | IPCA | Yes |

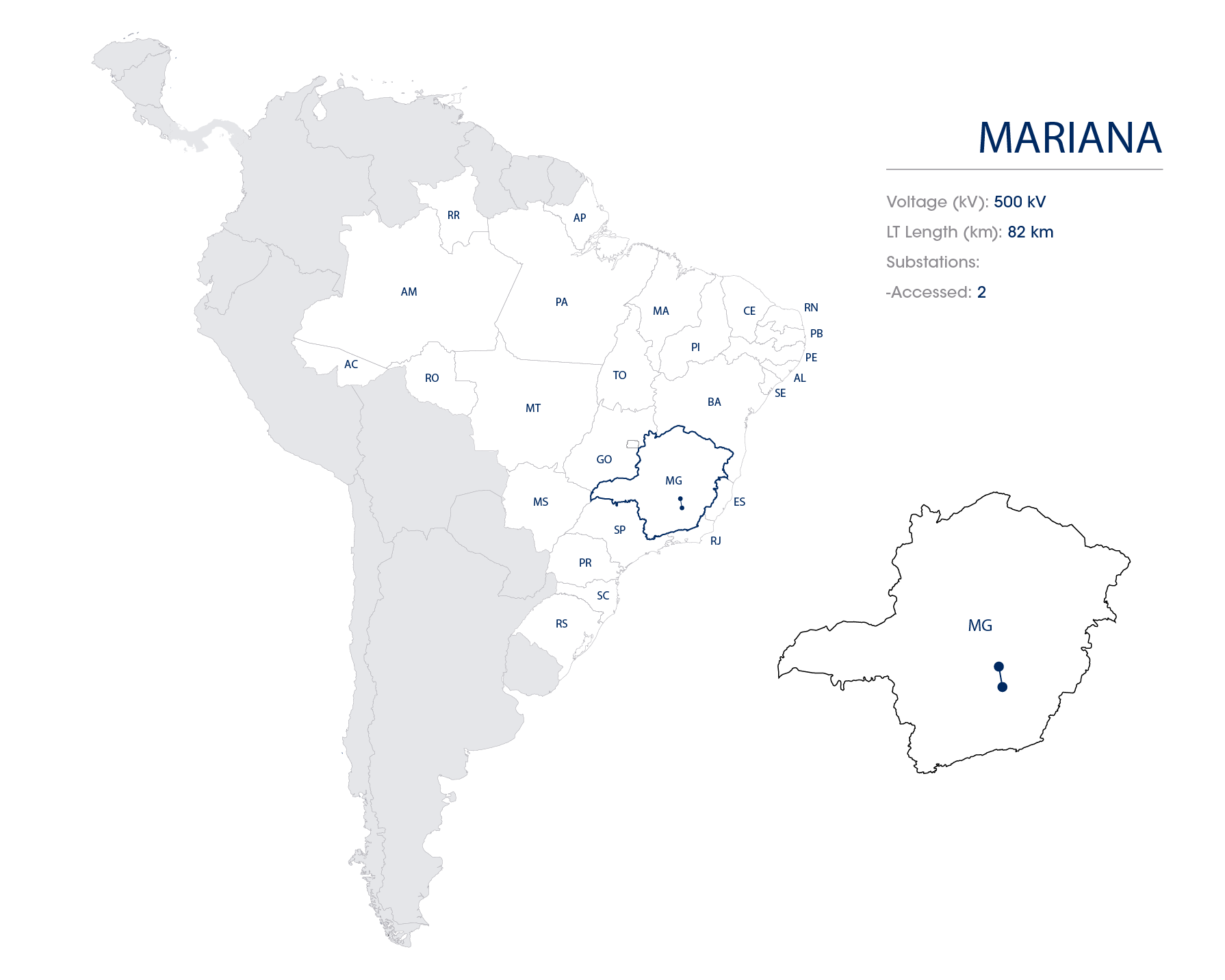

| MARIANA | 3 | 2014 | No | 100,00% | 82 | 2 | 23.93 | Oct/46 | IPCA | Yes |

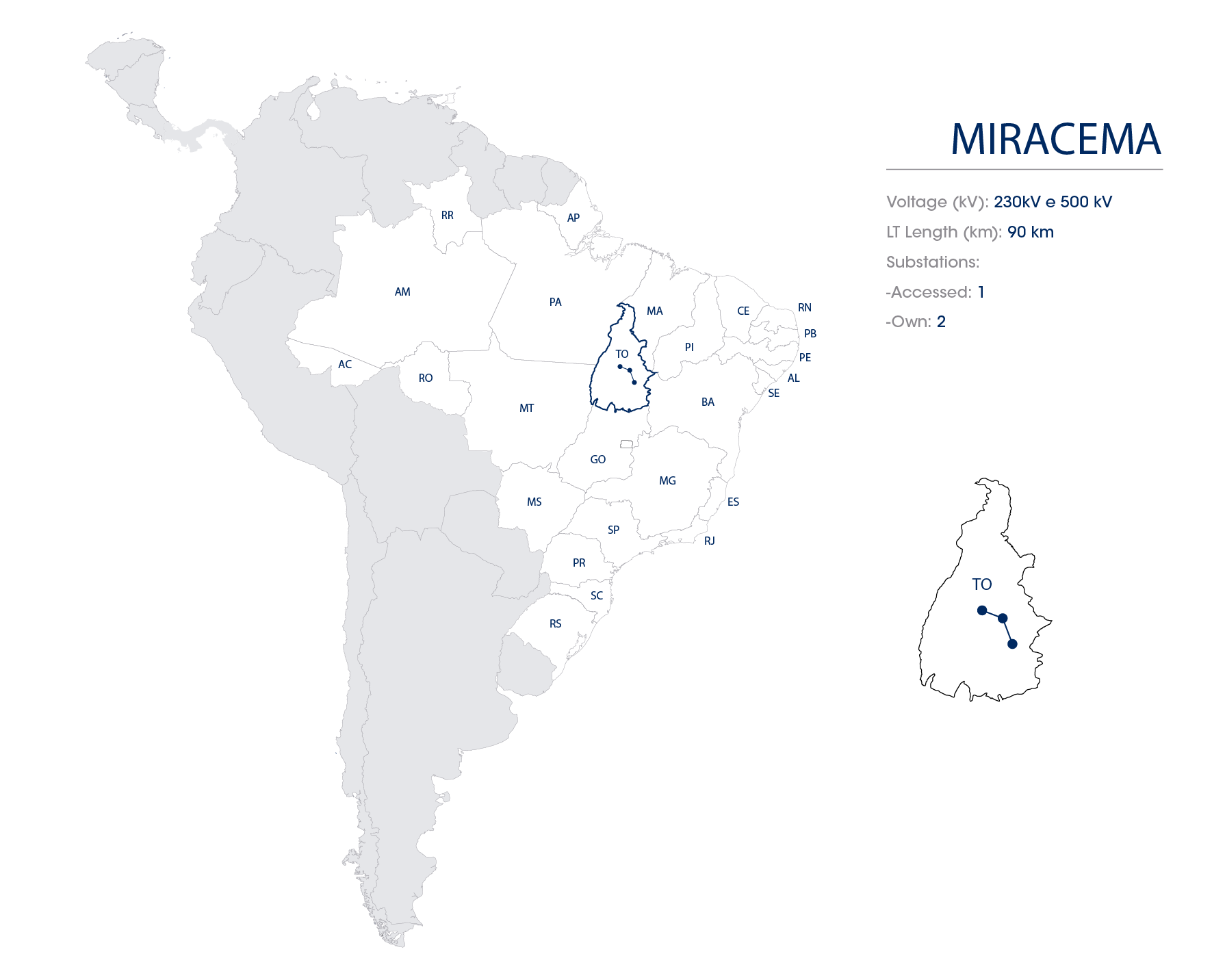

| MIRACEMA | 3 | 2016 | No | 100,00% | 90 | 3 | 104.25 | Jun/46 | IPCA | Yes |

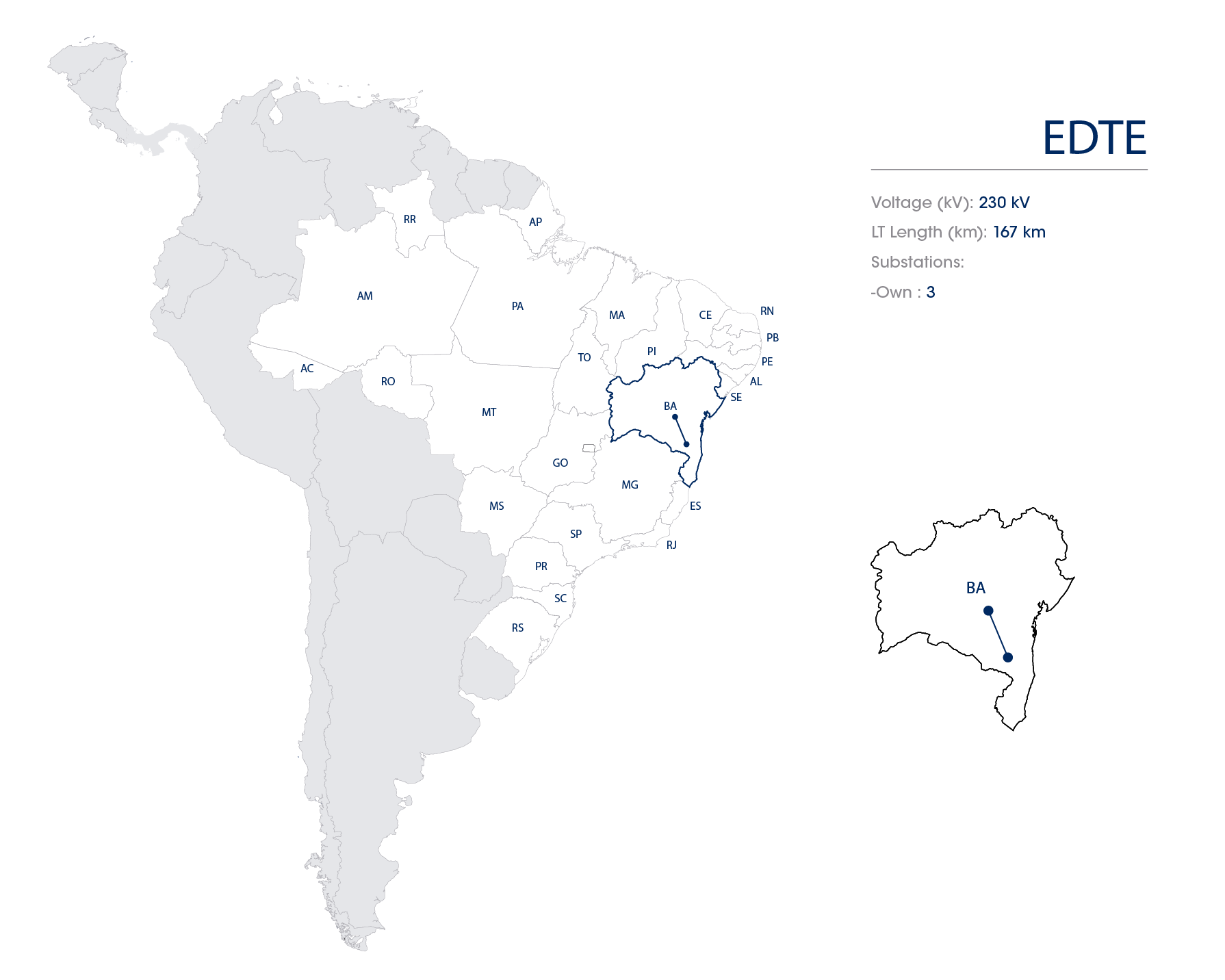

| EDTE | 3 | 2016 | No | 49,99% | 164 | 3 | 52.42 | Dec/46 | IPCA | Yes |

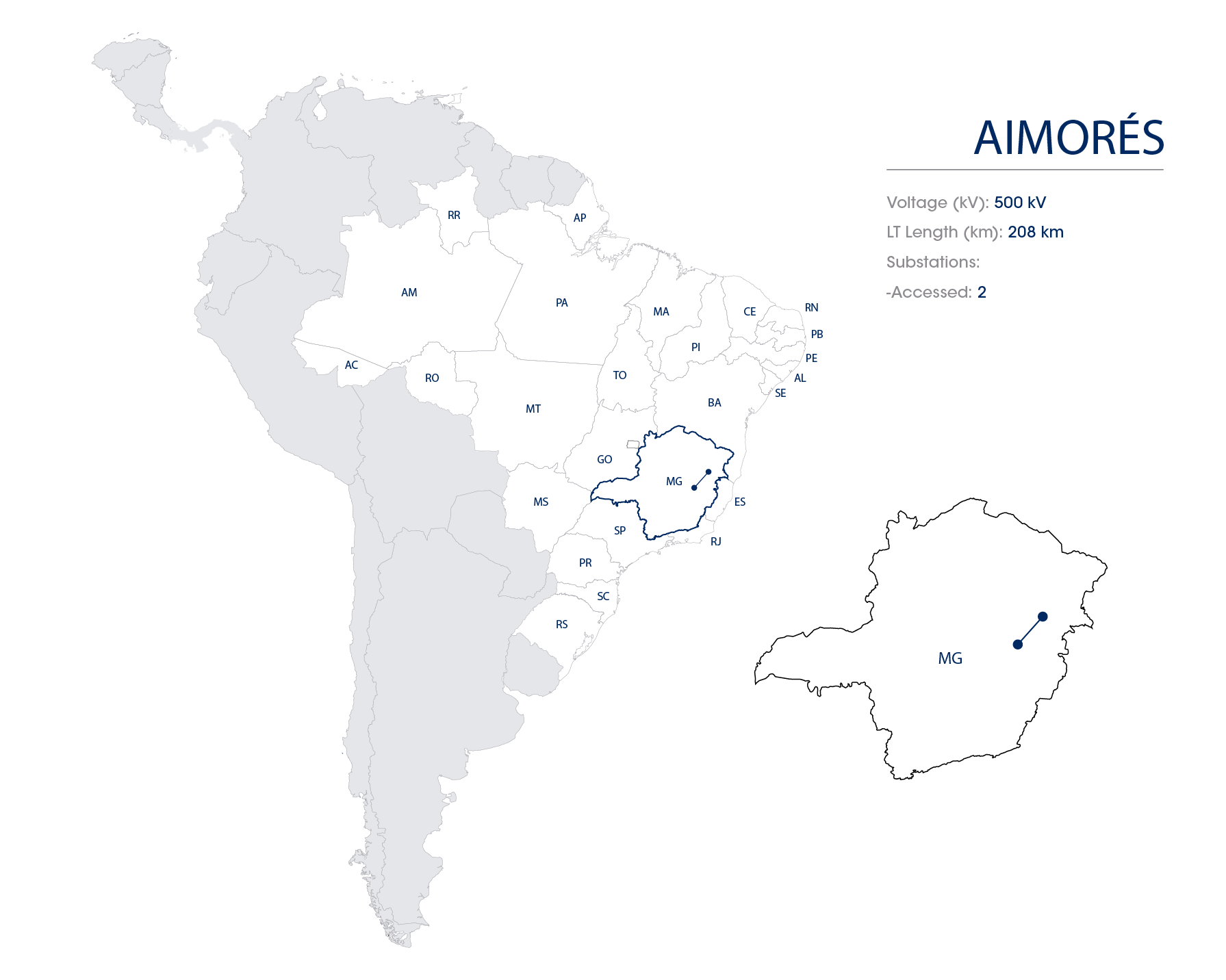

| AIMORÉS | 3 | 2017 | No | 50,00% | 208 | 2 | 59.94 | Feb/47 | IPCA | Yes |

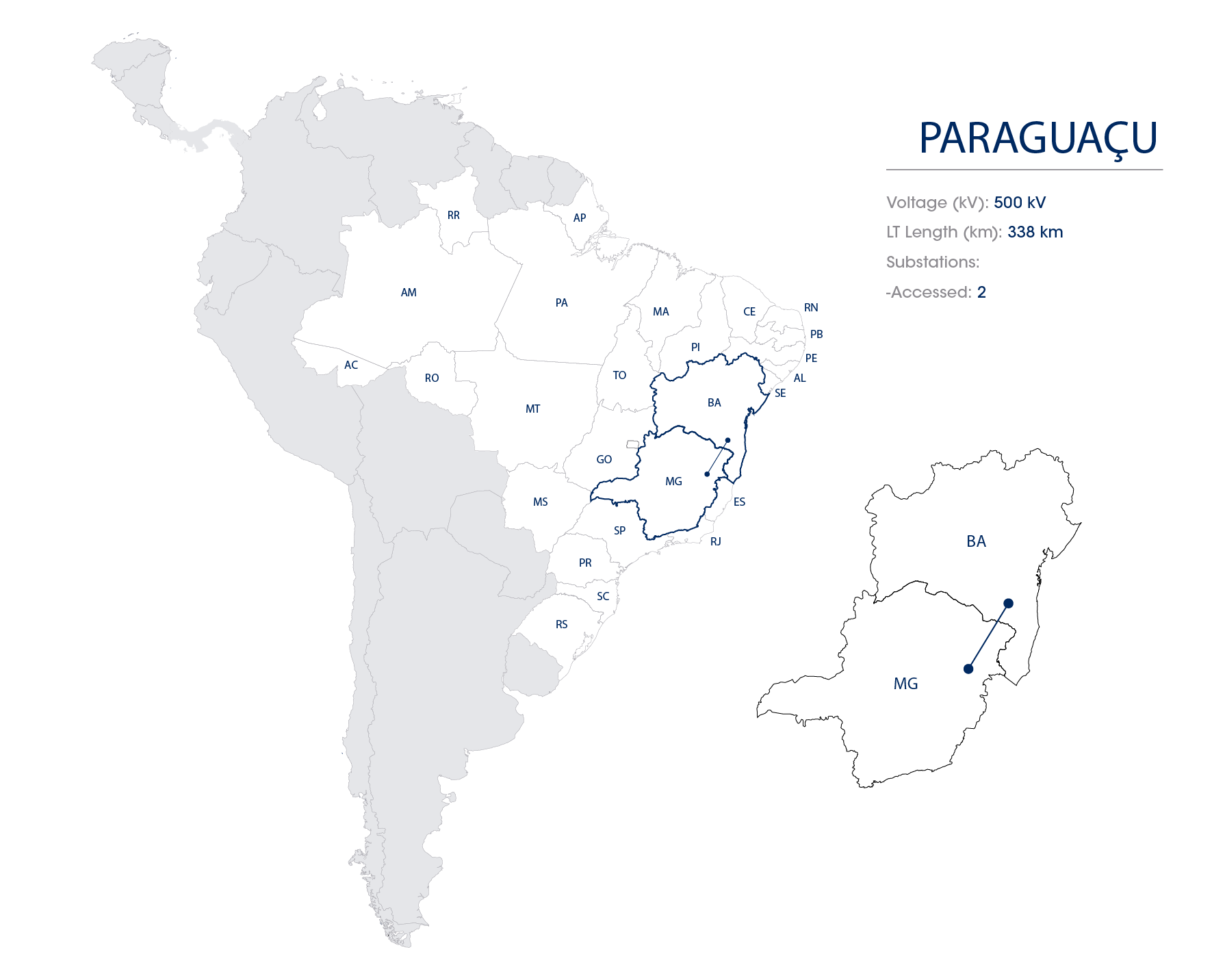

| PARAGUAÇU | 3 | 2017 | No | 50,00% | 338 | 2 | 89.46 | Feb/47 | IPCA | Yes |

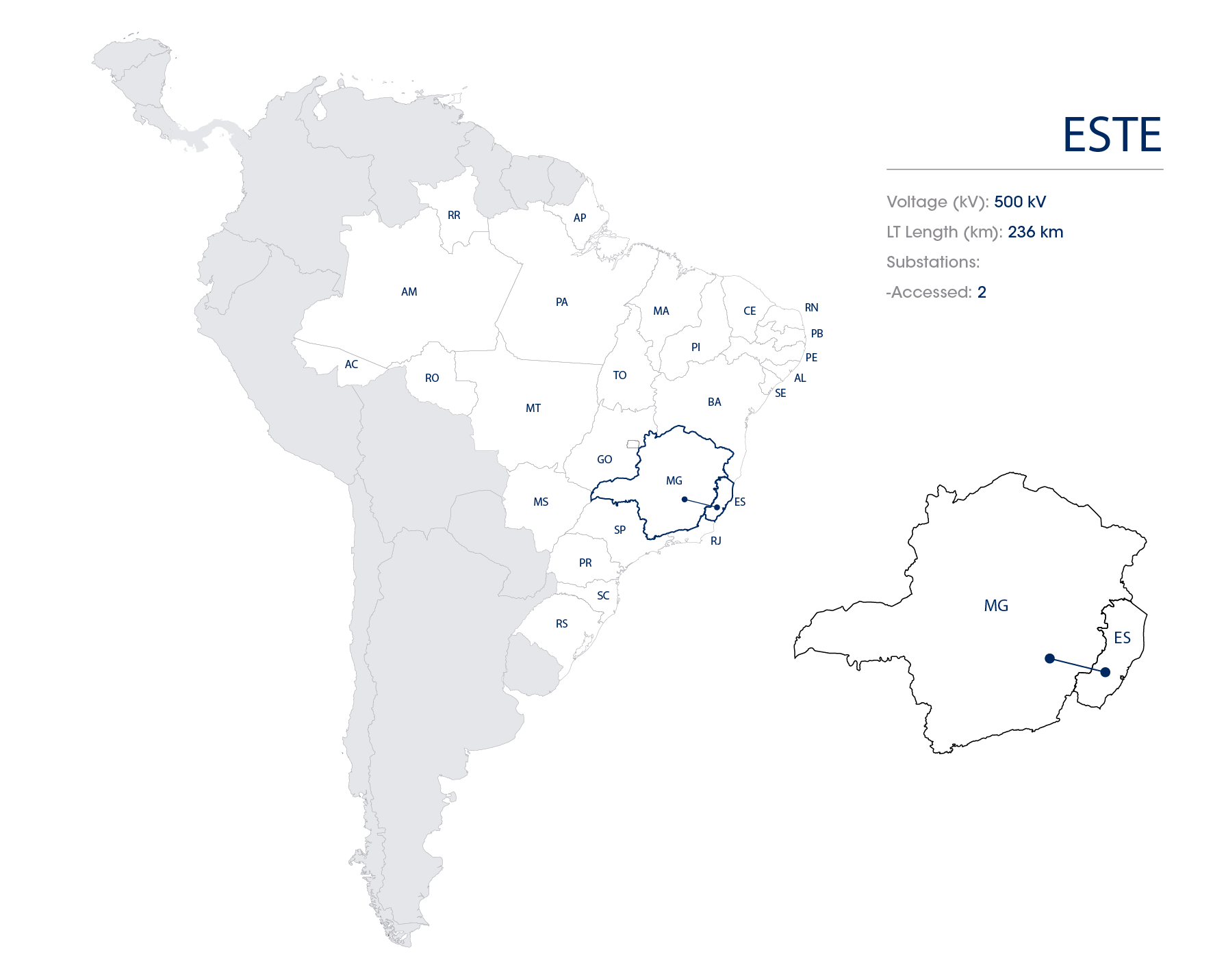

| ESTE | 3 | 2017 | No | 49,98% | 240 | 2 | 84.71 | Feb/47 | IPCA | Yes |

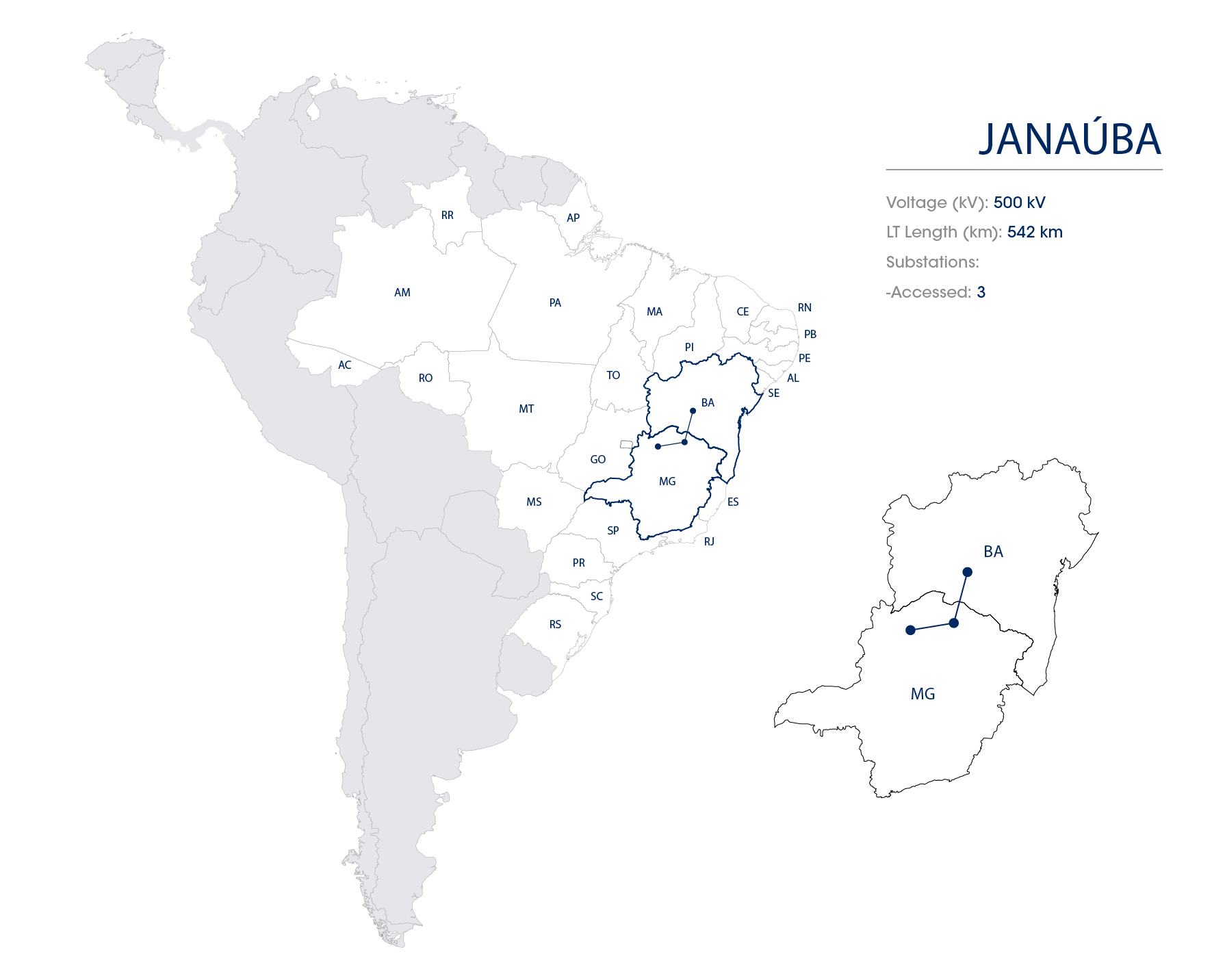

| JANAÚBA | 3 | 2017 | No | 100,00% | 545 | 3 | 293.05 | Feb/47 | IPCA | Yes |

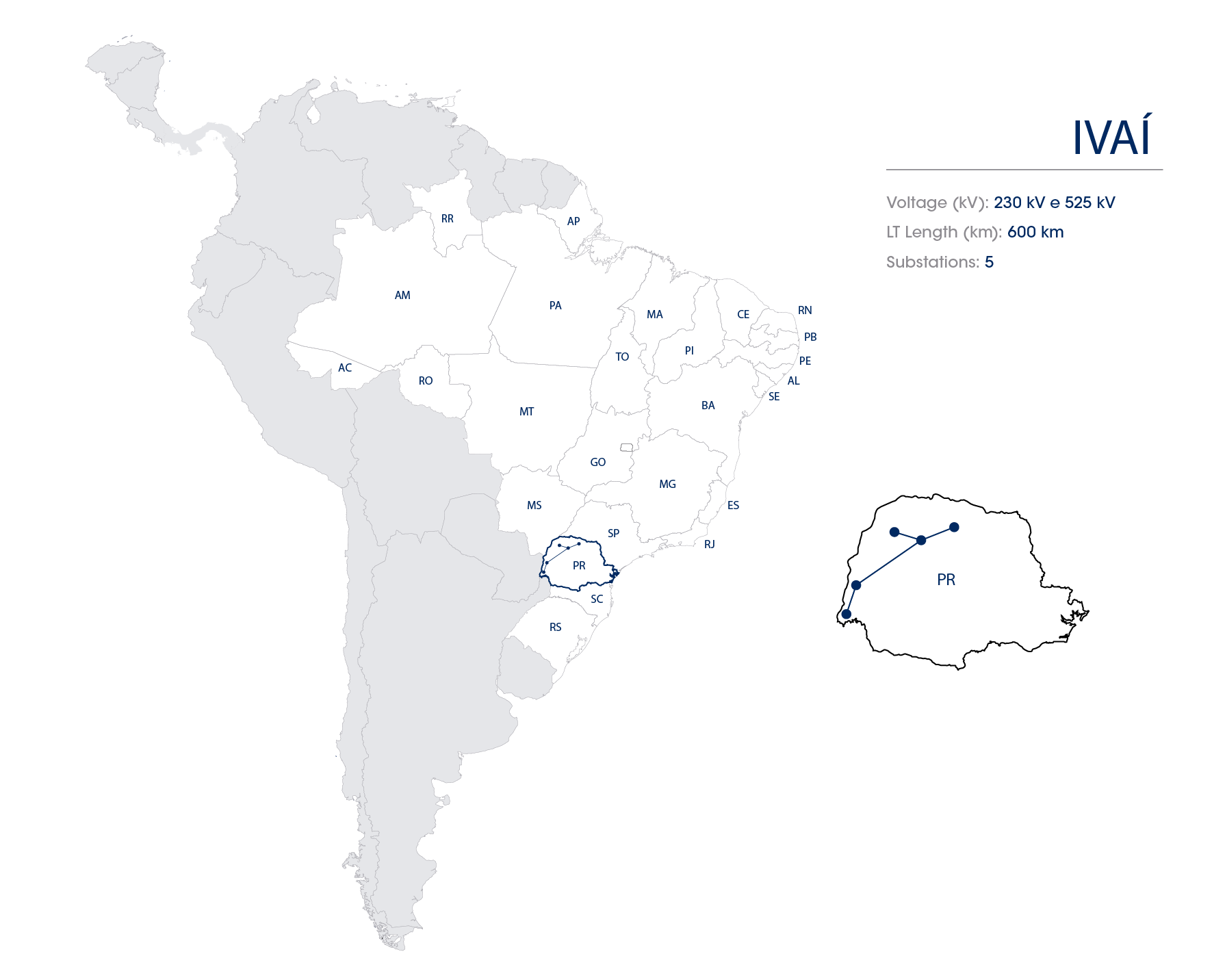

| IVAÍ | 3 | 2017 | No | 50,00% | 593 | 5 | 217.81 | Aug/47 | IPCA | Yes |

| LAGOA NOVA | 3 | 2017 | No | 100,00% | 28 | 2 | 17.71 | Aug/47 | IPCA | Yes |

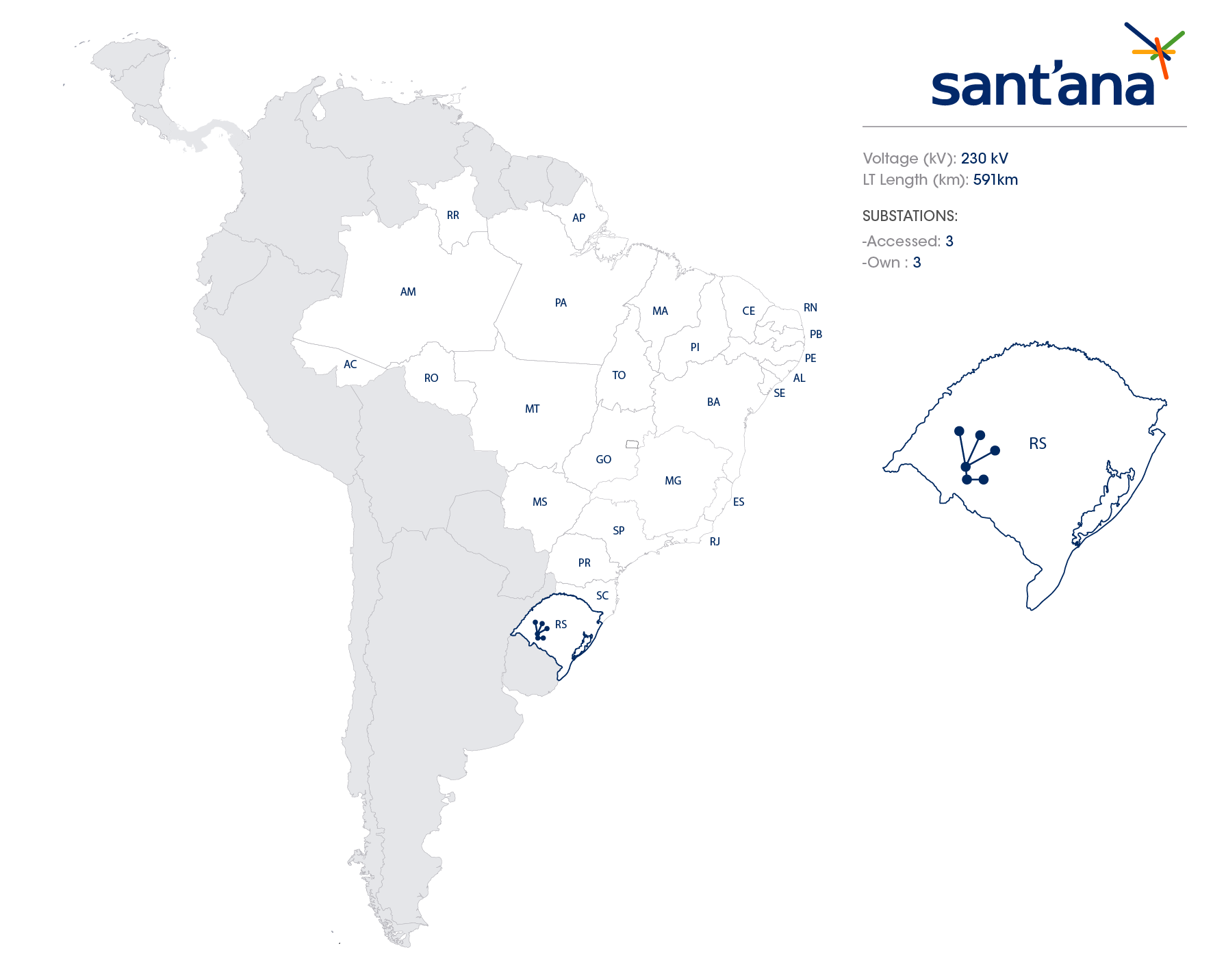

| SANT’ANA | 3 | 2019 | No | 100,00% | 558 | 6 | 93.05 | Mar/49 | IPCA | Yes |

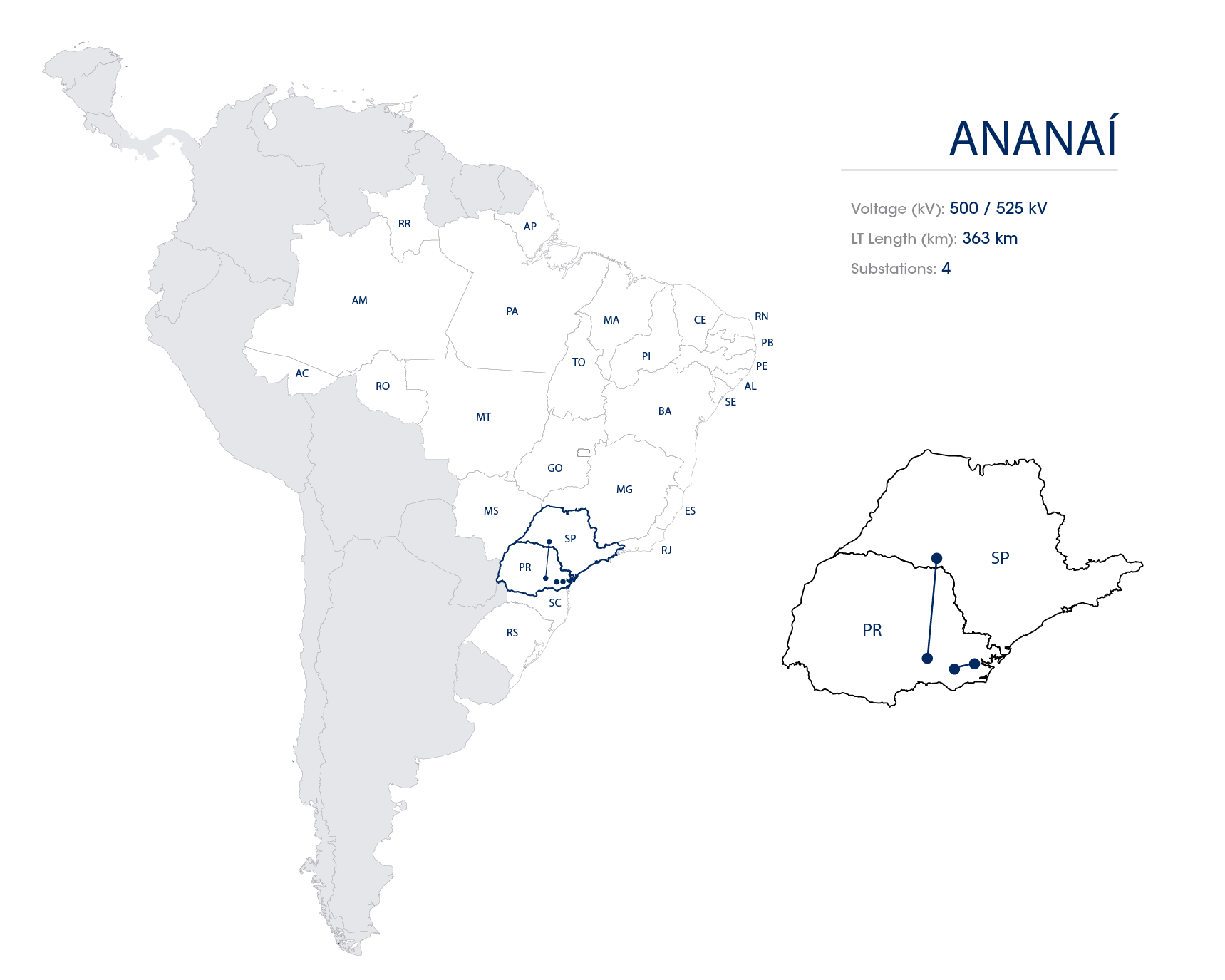

| ANANAÍ | 2 | 2022 | No | 100,00% | 363 | 4 | 171.14 | Mar/52 | IPCA | No |

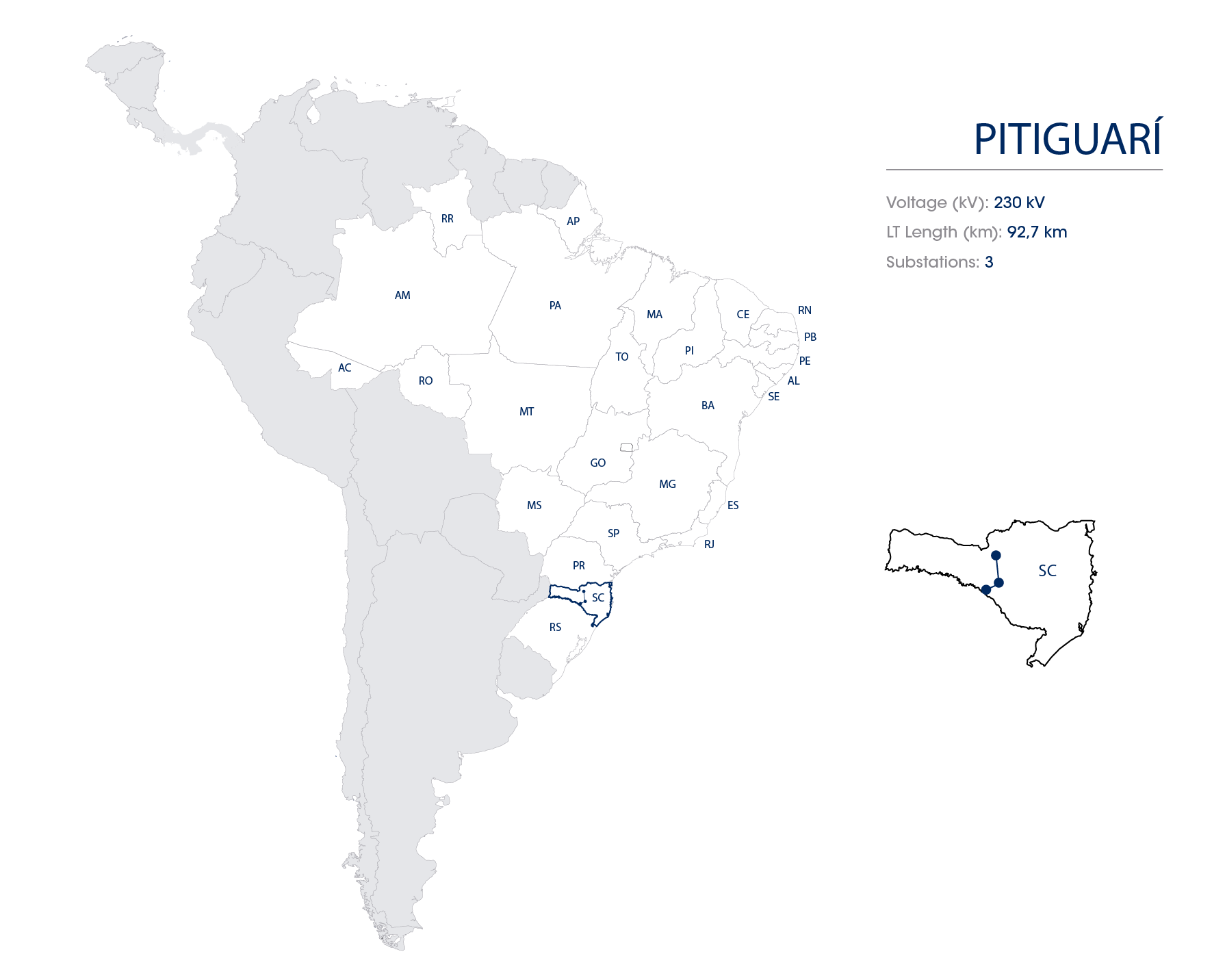

| PITIGUARI | 3 | 2022 | No | 100,00% | 93 | 3 | 23.38 | Sep/52 | IPCA | No |

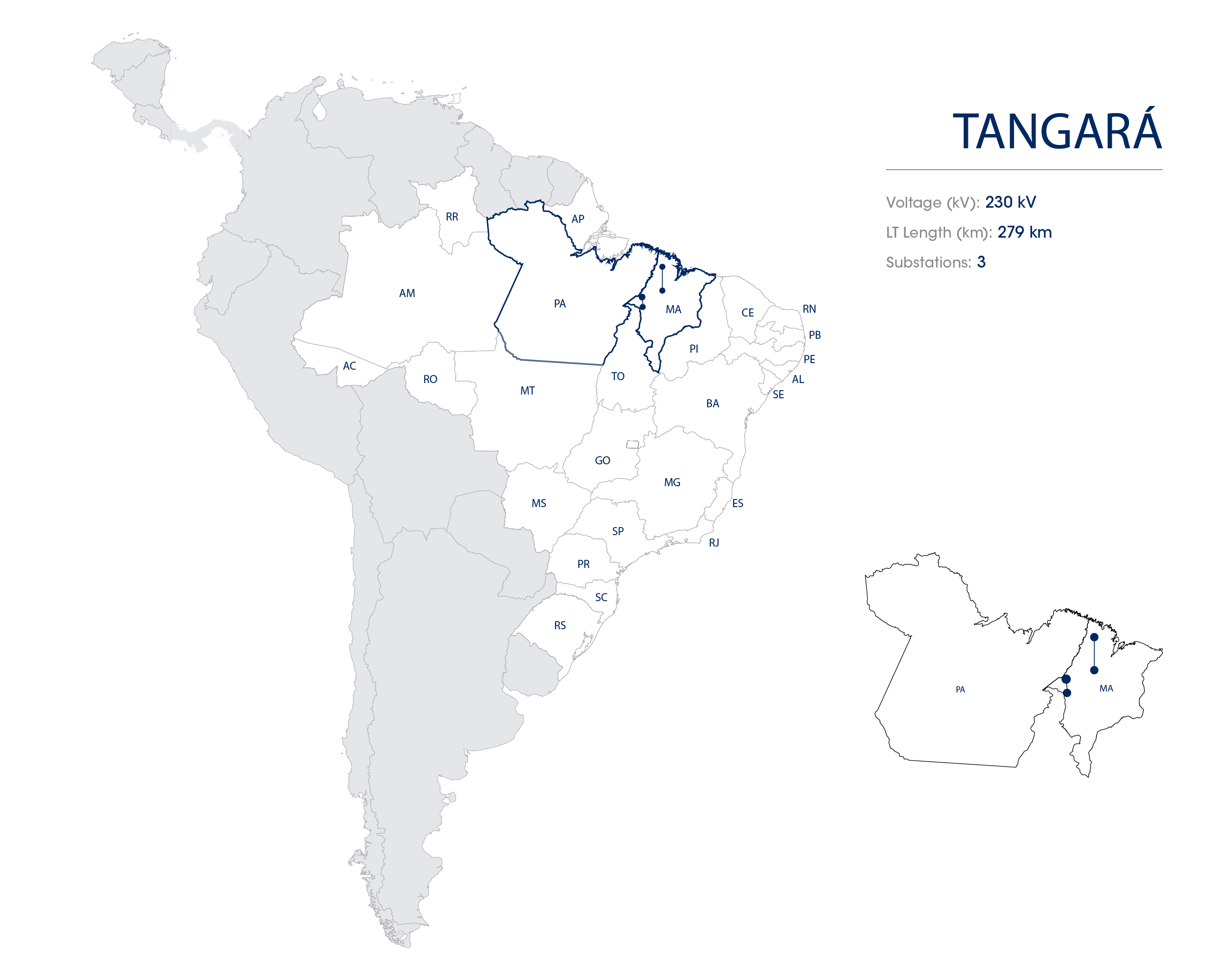

| TANGARÁ | 3 | 2023 | No | 100,00% | 279 | 4 | 108.26 | Mar/53 | IPCA | No |

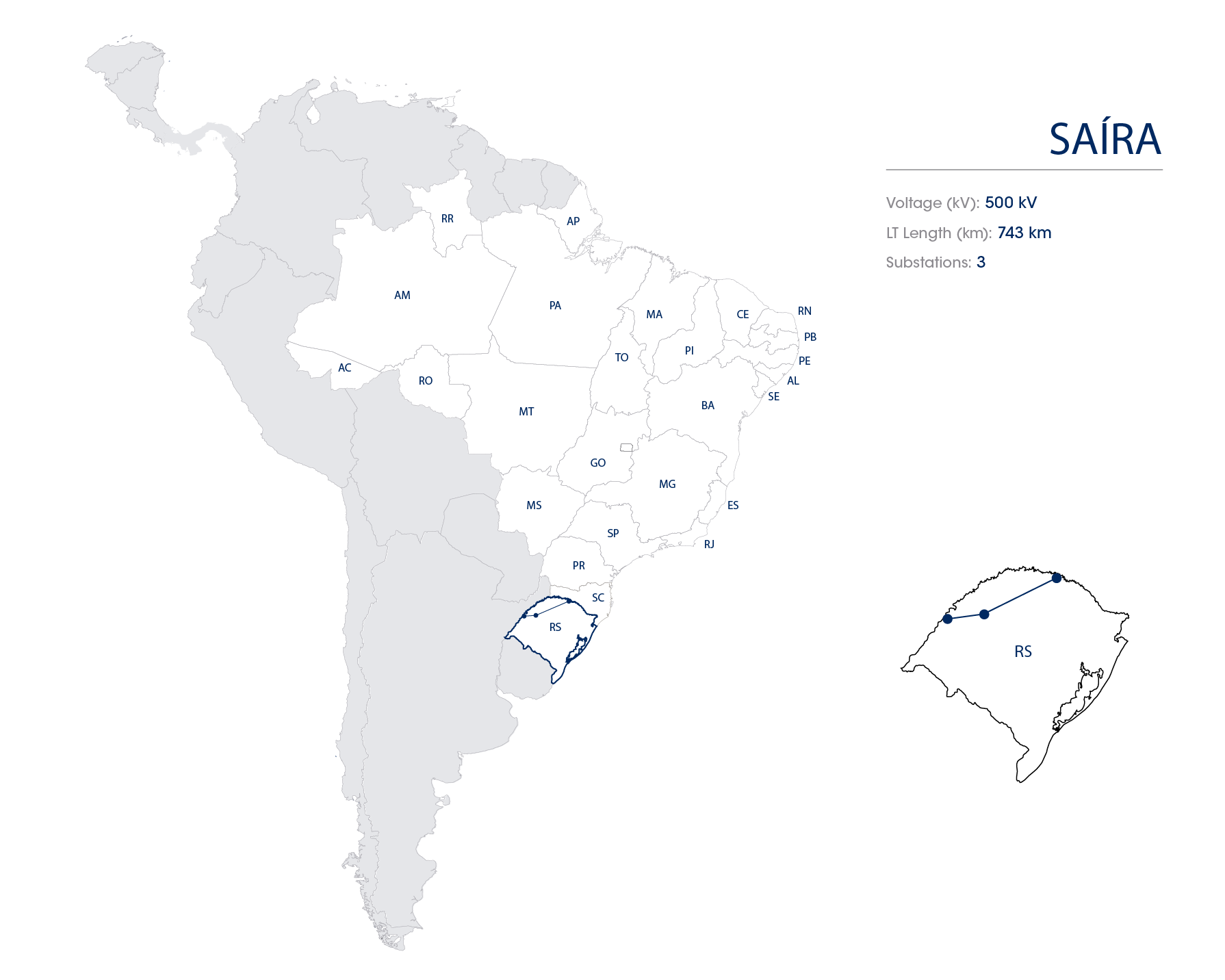

| SAÍRA | 3 | 2023 | No | 100,00% | 743 | 4 | 191.73 | Mar/53 | IPCA | No |

| JURUÁ | 3 | 2024 | No | 100,00% | 0 | 1 | 19.61 | Mar/54 | IPCA | Yes |

| Total | 15,313 | 113*** | 4,410.7 |

* Not weighted by the stake

** Weighted by the stake, including reinforcements and Border Network

*** Some substations are shared by different lines

Aimorés began operating in May 6, 2022 from lot 4 of the ANEEL transmission auction nº013/2015 (part 2), held in October 2016. It is located in the State of Minas Gerais, with approximately 208 km of 500kV transmission lines and 2 substations (all accessed by TAESA).

The contractual purpose of this concession aims to supply of electric energy the State of Minas Gerais, through the transmission line that will connect the substation Padre Paraíso 2 to the substation Governador Valadares 6.

This concession is controlled in partnership by TAESA and ISA Energia and its results will be accounted through equity method in TAESA. Its fiscal regimen is Lucro Real (Real Profit) and it has a fiscal benefit SUDENE on 80% of its area. The related PIS and COFINS are 1.65% and 7.60% (RAP must be grossed up of PIS / COFINS).

Ananaí is a project under construction and refers to lot 1 of the Transmission Auction No. 02/2021 of December 2021. It is located in the State of São Paulo and Paraná with an extension of 363 km of transmission lines of 500 kV and 525 kV and 4 substations (all accessed by TAESA). The term stipulated by ANEEL for energizing Ananaí is March 2027 while the concession term is expected to end in March 2052.

The purpose of this concession is to carry out structural work for the power system that supplies the metropolitan area of Curitiba. The transmission lines also increase the South – Southeast interconnection capacity, which is essential in scenarios of low availability from the generating complex in the South region.

The concession is wholly-owned, where 100% of its pre-operating result is consolidated by TAESA.

ATE began operating in October 2005, and currently integrates the electric power transmission system that interconnects the South and Southeast regions, with approximately 370 km of 525kV transmission lines crossing the States of Paraná and São Paulo and 3 substations (all accessed by TAESA). This concession has synergy with ETEO. The concession term ends on February 18, 2034.

The contractual purpose of this concession aims to supply of electric energy the regions South and Southeast through the Londrina – Araraquara Interconnection.

It is TAESA’s wholly owned concession (making up the Holding Company) that has the highest voltage level in operation. Its fiscal regimen is Lucro Real (Real Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).

ATE II began operating in December 2006, and currently integrates the electric power transmission system that interconnects the North and Northeast regions, with 4 substations (1 owned and 3 accessed) located in the States of Tocantins, Piauí, and Bahia. The transmission lines cover approximately 942 km, with 500kV voltage, crossing the States of Tocantins, Maranhão, Piauí, and Bahia. This concession has synergy with Novatrans and ATE III. The concession term ends on March 15, 2035.

The contractual purpose of this concession aims to supply of electric energy the regions South and Southeast through the Colinas – Sobradinho Interconnection.

This concession also stands out for having in its facilities, 3 Fixed-Series Capacitor Banks and 11 Shunt Inductive Compensation.

It is TAESA’s wholly owned concession (making up the Holding Company) and its fiscal regimen is Lucro Real (Real Profit) and has a fiscal benefit SUDENE/SUDAM on 100% of its area. The related PIS and COFINS are 1.65% and 7.60% (RAP is already grossed up of PIS/ COFINS).

ATE III began operating in April 2008, and currently integrates the electric power transmission system, with 4 substations (1 owned and 3 accessed) and approximately 454 km of 230kV and 500kV transmission lines crossing the States of Tocantins and Pará. This concession has synergy with Novatrans and ATE II. The concession term ends on April 27, 2036.

This concession also stands out for having in its facilities one Fixed-Series Capacitor Banks and 4 Shunt Inductive Compensation.

It was incorporated by the holding Company . Its fiscal regimen is Lucro Real (Real Profit). It has a fiscal benefit SUDAM in 100% of its area. The related PIS and COFINS are 1.65% and 7.60% (RAP must be grossed up of PIS/ COFINS).

Brasnorte began operating in September 2009. The operation is in the State of Mato Grosso, with approximately 402 km of 230kV transmission lines and 4 substations (2 owned and 2 accessed). The concession term ends in March 2038.

The purpose of this concession is the construction, implementation, operation and maintenance of the electric power transmission public service of the basic grid of the Interconnected Electric System for the 230kV transmission lines LT Jubá/Jauru (129 km) and LT Brasnorte/Nova Mutum (273 km) and 230/138kV substations SE Jubá, of 300 MVA, and SE Brasnorte, of 100 MVA.

It is TAESA’s wholly-owned concession (100% consolidated by TAESA) and its fiscal regimen is Lucro Real (Real Profit). It has a fiscal benefit SUDAM in 100% of its area. The related PIS and COFINS are 1.65% and 7.60% (RAP must be grossed up of PIS/ COFINS).

EATE began operating in March 2003. The operation is in the States of Pará and Maranhão with approximately 927 km of 500kV transmission lines and 5 substations (1 owned and 4 accessed by TAESA). The concession term ends in June 2031.

The purpose of this concession is to (i) meet the growing demand for electric power in the North and Northeast regions of the country, (ii) interconnect the substations of Tucuruí, Marabá, Açailândia, Imperatriz, and Presidente Dutra, becoming the third circuit of North-Northeast interconnection, and (iii) reinforce the connection among the South-Southeast, Mid-Western and North-Northeast electrical systems, ensuring greater operational reliability for the National Interconnected System (SIN).

TAESA holds 49,98% stake on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Real (Real Profit). It has a fiscal benefit SUDAM in 100% of its area. The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).

Controlling shareholders: TAESA (49.98%) e Alupar (50.02%).

EBTE began operating in June 2011. The operation is in the State of Mato Grosso with approximately 782 km of 230kV transmission lines and 7 substations (2 owned and 5 accessed by TAESA). The concession term ends in October 2038.

The purpose of this concession is to meet the growing demand for electric power in the Mid-Western region of the country, allowing the electric power to flow from the various generation projects that will be implemented in the State.

TAESA holds 74,49% stake on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Real (Real Profit). It has a fiscal benefit SUDAM in 100% of its area. The related PIS and COFINS are 1.65% and 7.60% (RAP must be grossed up of PIS/ COFINS).

Controlling shareholders: TAESA (49,0%) e EATE (51,0%) – TAESA holds directly stake of 49,98%

ECTE began operating in March 2002. The operation is in the State of Santa Catarina with approximately 253 km of 525kV transmission lines and 2 substations (all accessed by TAESA). The concession term ends in November 2030.

The purpose of this concession is to ensure supply to the East and Coast region of the State of Santa Catarina, in order to meet the demand for electric power in the South-Southeast region and to enable greater operational reliability for the National Interconnected System (SIN).

TAESA holds 19,09% stake on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Real (Real Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).

Controlling shareholders: TAESA (19.09%), Alupar (50.02%), and Celesc (30.89%).

EDTE began operating in January 20, 2020. The asset is located in the State of Bahia with approximately 165 km of 230kV transmission lines and 3 substations (all owned). The concession term ends in December 2046.

It must start its operations by December 2019, aiming at expanding the transmission system of the south region of the State of Bahia in order to provide adequate electric service for the consumers of this region.

TAESA holds 49.99% stake on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Real (Real Profit). The related PIS and COFINS are 1.65% and 7.60% (RAP must be grossed up of PIS/ COFINS).

Controlling shareholders: TAESA (24.95%), Apollo (24.95%) e ENTE (50.10%) – TAESA holds directly stake of 49.99%

ENTE began operating in February 2005. The operation is in the States of Pará and Maranhão with approximately 459 km of 500kV transmission lines and 3 substations (all accessed). The concession term ends in December 2032.

The purpose of this concession is to (i) meet the growing demand for electric power in the North and Northeast regions of the country, (ii) interconnect the substations of Tucuruí, Marabá, and Açailândia, becoming the fourth circuit of the North-Northeast interconnection, (iii) enable the transmission of the additional energy generated by the expansion of the Tucuruí Hydroelectric Power Plant, and (iv) strengthen the connection between the South-Southeast, Mid-Western and North-Northeast electrical systems.

TAESA holds 49.99% stake on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Real (Real Profit). It has a fiscal benefit SUDAM in 100% of its area. The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).

Controlling shareholders: TAESA (49.99%) and Alupar (50.01%).

ERTE began operating in September 2004. The operation is in the State of Pará with approximately 155 km of 230kV transmission lines and 3 substations (1 owned and 2 accessed by TAESA). The concession term ends in December 2032.

The purpose of this concession is to meet the growing demand for electric power in the metropolitan region of Belém and the Northeast region of the State of Pará, and to ensure greater operational reliability in the region.

TAESA holds 49.99% stake on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Presumido (Presumed Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).

Controlling shareholders: TAESA (21,95%), ENTE (38.01%) – TAESA holds directly stake of 49.99%, EATE (18.08%) – TAESA holds directly stake of 49.98% e Alupar (21.96%).

ESDE began operating in February 2012. The operation is in the State of Minas Gerais with an owned substation that operates with 345kV voltage. The concession term ends in November 2039.

The purpose of this concession is to meet the growth of energy load in the southeast region of the State of Minas Gerais and to provide greater operational reliability for the National Interconnected System (SIN).

TAESA holds 49,98% stake on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Presumido (Presumed Profit). The related PIS and COFINS are 1.65% and 7.60% (RAP must be grossed up of PIS/ COFINS).

Controlling shareholders: ETEP (TAESA holds directly stake of 49.98%).

ESTE is a project under construction, located in the States of Minas Gerais and Espírito Santo with approximately 237 km of 500kV transmission lines and 2 substations (all accessed). ESTE must start operations by February 2022. The concession term ends in February 2047.

The purpose of this concession is aiming at supplying power to the central region of the State of Espírito Santo.

TAESA holds indirectly 49,98% stake on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Presumido (Presumed Profit). The related PIS and COFINS are 1.65% and 7.60% (RAP must be grossed up of PIS/ COFINS).

Controlling shareholders: EATE (TAESA holds directly stake of 49.98%).

ETAU began operating in July 2005. The operation is in the States of Santa Catarina (SC) and Rio Grande do Sul (RS) with approximately 188 km of 230kV transmission lines and 4 substations (2 owned and 2 accessed by TAESA). The concession term ends in December 2032.

The purpose of the concession is the construction, implementation, operation and maintenance of the electric power transmission public service named Campos Novos/Santa Marta (230kV), as well as the substations of Lagoa Vermelha 2 (RS) and Barra Grande (SC), and the line inputs and facilities linked to them located in the substations of Santa Marta (RS) and Campos Novos (SC).

This concession is controlled in partnership by TAESA, DME Energética S.A., and Companhia Estadual de Geração e Transmissão de Emergia Elétrica S.A. (“CEEE-GT”). And its results are accounted through equity method in TAESA. Its fiscal regimen is Lucro Real (Real Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS / COFINS).

Controlling shareholders: TAESA (75.6%), DME (14.38%) and CEEE-GT (10.0%).

ETEO began operating in October 2001, and currently integrates the State of São Paulo’s electric power transmission system, with 3 substations (all accessed by TAESA) and 505 km of 440kV transmission lines only in that state. This concession has synergy with ATE. The concession term ends on May 12, 2030.

The purpose of this concession is aiming at supplying power to the region of the State of São Paulo, through the transmission line that will connect the substation Taquaruçu to substation Assis and substation Assis to substation Sumaré.

It is TAESA’s wholly owned concession (making up the Holding Company) with fiscal regimen is Lucro Real (Real Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).

ETEP began operating in August 2002. The operation is in the State of Pará with approximately 328 km of 500kV transmission lines and 2 substations (all accessed by TAESA). The concession term ends in June 2031.

The purpose of this concession is aiming at supplying power to the Northeast region of the State of Pará, through the Tucuruí transmission line from Torre nº 9 da Travessia do Rio Tocantins of the transmission line system and end in the substation of Vila do Conde. This project resulted from the partnership between private investor and the public sector under the auction modality promoted by ANEEL in 2000.

TAESA holds 49.98% stake on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Real (Real Profit). It has a fiscal benefit SUDAM in 100% of its area. The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).

Controlling shareholders: TAESA (49.98%) and Alupar (50.02%).

ETSE began operating in March 2015. The operation is in the State of Santa Catarina with 2 owned substations that operate with 525kV voltage. The concession term ends in May 2042.

The purpose of this concession is to integrate electric power generation plants to the National Interconnected System (SIN), as well as to enable access to CELESC’s distribution system, and to meet the expansion of electric power supply to the region of Vale do Itajaí.

TAESA holds indirectly 19,09% stake on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Presumido (Presumed Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP must be grossed up of PIS/ COFINS).

Controlling shareholders: ECTE (TAESA holds directly stake of 19.09%).

GTESA began operating in August 2003, and currently integrates the electric power transmission system of the States of Pernambuco and Paraíba, with approximately 52 km of 230kV transmission lines and 3 substations (1 owned and 2 accessed by TAESA) crossing those two States. The concession term ends on January 20, 2032.

The contractual purpose of this concession aims to supply of electric energy to the region of the State of Pernambuco and Paraíba, through the transmission line that will connect the substation of Goianinha (Pernambuco) to substation of Mussuré (Paraíba).

It is TAESA’s wholly owned concession (making up the Holding Company) and its fiscal regimen is Lucro Real (Real Profit). It has a fiscal benefit SUDENE in 100% of its area. The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).

Ivaí is a project located in the State of Paraná, with approximately 593 km of 230kV and 525kV transmission lines and 5 substations (1 owned and 4 accessed by TAESA). The concession term ends in August 2047.

The purpose of this concession is aiming at being a reinforcement to serve the State of Mato Grosso do Sul and to the region of the municipality of Guaíra (Paraná), as well as increasing the reliability of the energy flow from the UHE Itaipu.

This concession is controlled in partnership by TAESA and ISA Cteep and its results will be accounted through equity method in TAESA. Its fiscal regimen is Lucro Real (Real Profit). The related PIS and COFINS are 1.65% and 7.60% (RAP must be grossed up of PIS / COFINS).

Janaúba began operating in September 1, 2021 and integrates the electric power transmission system of the States of Bahia and Minas Gerais, with 3 substations (all accessed by TAESA) and approximately 545 km of 500kV transmission lines crossing those two States. The concession term ends on February 10, 2047.

The contractual purpose of this concession aims to supply of electric energy the State of Minas Gerais and Bahia, through the transmission line that will connect the substation Pirapora 2 to the substation Janaúba 3 and the substation Bom Jesus da Lapa II to the substation Janaúba 3.

It is TAESA’s wholly owned concession wherein 100% of its pre-operational results is consolidated by TAESA. Its fiscal regimen is Lucro Real (Real Profit). It has a fiscal benefit SUDENE in 100% of its area. The related PIS and COFINS are 1.65% and 7.60% (RAP must be grossed up of PIS / COFINS).

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Donec placerat, felis sed accumsan vestibulum, lorem odio euismod tellus, a vestibulum libero mi nec ex. Duis et nunc tincidunt, sodales purus eget, commodo dui. Vivamus aliquet consectetur sem, quis sodales risus pharetra ac. Proin eget congue tellus. Nulla vehicula nulla est, quis rutrum sapien pellentesque vitae. Aenean pharetra id nulla ac scelerisque. Sed rutrum, est nec vehicula mollis, felis ligula pellentesque turpis, nec consequat lectus enim quis neque. Phasellus cursus sapien tellus, id tincidunt dolor luctus sed.

Lagoa Nova began operating in March 2019. The asset is in the State of Rio Grande do Norte, with approximately 28 km of 230kV and 69kV transmission lines and 2 substations (1 owned and 1 accessed by TAESA). The concession term ends on August 11, 2047.

The double circuit of 230 kV transmission lines that connects the SE Lagoa Nova and the SE Currais Novos were acquired on March 13, 2020, when the operation of the facilities was transferred in real time to TAESA, after the adjustments and tests required for operation continuity and availability. There are connections with the COSERN distributor serving local demand and improving the efficiency of the SIN in the State of Rio Grande do Norte.

It is TAESA’s wholly-owned concession (100% consolidated by TAESA) and its fiscal regime is Lucro Presumido (Presumed Profit). The related PIS and COFINS are 3.65% (RAP must be grossed up of PIS / COFINS).

Lumitrans began operating in October 2007. The operation is in the States of Santa Catarina and Rio Grande do Sul with approximately 40 km of 525kV transmission lines and 2 substations (all accessed by TAESA). The concession term ends in February 2034.

The purpose of this concession is to reinforce the supply of electric energy to the South region, to interconnect the substations of Machadinho and Campos Novos, and to provide greater operational reliability for the National Interconnected System (SIN).

TAESA holds indirectly 39.99% stake on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Presumido (Presumed Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).

Controlling shareholders: EATE (80.0%) (TAESA holds directly stake of 49.98%), Alupar (15.0%), e Auto Invest (5.0%).

Mariana began operating in May 25, 2020 and integrates the electric power transmission system of the State of Minas Gerais, with approximately 82 km of 500kV transmission lines and 2 substations (all accessed by TAESA). It must start its operations in April 2020. The concession term ends on May 2, 2044.

The contractual purpose of this concession aims to supply of electric energy the State of Minas Gerais, through the transmission line connecting the substation Itabirito 2 to the substation Vespasiano 2.

It is its own concession (100% consolidated by TAESA) and its tax regime is Lucro Presumido (Presumed Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP must be grossed up of PIS / COFINS).

Miracema began operating in December 17, 2019 and integrates the electric power transmission system of the State of Tocantins, with approximately 90 km of 230kV and 500kV transmission lines and 3 substations (2 owned and 1 accessed by TAESA). The concession term ends on June 27, 2046.

The first transmission line of the project (LT) Miracema – Lajeado (circuit 2), 500kV of voltage and 30 km of extension, was energized on September 30, 2019. The last energizations of the project, which comprehends the new transmission line (LT) 230kV Palmas – Lajeado (circuit 2) of approximately 60 km of extension, the new Palmas substation where the transmission lines of the local distributor were connected to, and the adaptation of the LT 500kV Miracema – Lajeado (circuit 1) to Lajeado substation were concluded on November 29, 2019.

The contractual purpose of this concession aims to supply of electric energy the State of Tocantins, through the transmission lines connecting the substation Miracema to the substation Lajeado and the substation Lajeado to the substation Palmas.

It was incorporated into the holding Company on April 2024. Its tax fiscal regimen is Lucro Presumido (Presumed Profit) and it has a fiscal benefit SUDAM on 100% of its area. The related PIS and COFINS are 0.65% and 7.6% (RAP must be grossed up of PIS / COFINS).

Munirah began operating in October 2005, and currently integrates the electric power transmission system of the State of Bahia, with approximately 106 km of 500kV transmission lines and 2 substations (1 owned and 1 accessed by TAESA). This concession has synergy with TSN. The concession contract ends on February 18, 2034.

The contractual purpose of this concession aims to supply of electric energy the State of Bahia, through the transmission lines that will connect the substation Camaçari II to the substation Sapeaçu.

It is TAESA’s wholly owned concession (making up the Holding Company) and its fiscal regimen is Lucro Real (Real Profit). It has a fiscal benefit SUDENE in 84% of its area. The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).

Novatrans began operating in June 2003, and currently integrates the electric power transmission system that interconnects the North and Southeast regions, with 6 substations (all accessed) and approximately 1,278 km of 500kV transmission lines crossing through the States of Maranhão, Tocantins, and Goiás. It is the concession with the longest extension of TAESA’s transmission lines, having synergy with TSN, ATE II, and ATE III. The concession term ends on December 20, 2030.

The contractual purpose of this concession aims to supply of electric energy the North and Southeast regions, through the transmission lines that will connect the substation Imperatriz to the substation Samambaia, crossing the substations of Colinas, Miracema, Gurupi, and Serra da Mesa.

This concession also stands out by having in its facilities 8 fixed-series capacitor banks and 10 shunt inductive compensation. On October 21, 2019, the reinforcement of the concession related to the authoritative resolution REA 6306/17 and, respectively, on October 28 and November 18, 2019, the reinforcement of the concession related to the authoritative resolution REA 6369/17 was concluded, fulfilling the deadline required by ANEEL and adding RAP of R$ 38.1 million for the 2019-2020 cycle, starting from the energization date of each installation (pro-rata). The project consists of the rehabilitation of four (4) 500kV Series Capacitor Banks on the Miracema-Gurupi C2 and Serra da Mesa-Gurupi C2 transmission lines (LT), with the objective of allowing an increase in the energy transfer capacity between the North, Northeast and Southeast regions through the North-South Interconnection, previously limited by the nominal current of the series capacitor banks.

It is TAESA’s wholly owned concession (making up the Holding Company) and its fiscal regimen is Lucro Real (Real Profit) and has a fiscal benefit SUDAM on 76% of its area. The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).

NTE began operating in January 2004, and currently integrates the electric power transmission system of the States of Alagoas, Pernambuco, and Paraíba, with 4 substations (all accessed by TAESA) and approximately 383 km of 230kV and 500kV transmission lines crossing those 3 States. The concession term ends on January 21, 2032.

The contractual purpose of this concession aims to supply of electric energy the States of Alagoas, Pernambuco e Paraíba, through the transmission lines of 500kV that will connect the substation Xingó (Alagoas) to the substation Angelim (Pernambuco), and the transmission lines of 230kV that will connect the substation Angelim to the substation Campina Grande (Paraíba).

It is TAESA’s wholly owned concession (making up the Holding Company) and its fiscal regimen is Lucro Real (Real Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).

Paraguaçú is a project lot 3 of the ANEEL transmission auction nº013/2015 (part 2), held in October 2016. It is located in the States of Minas Gerais and Bahia, with approximately 338 km of 500kV transmission lines and 2 substations (all accessed by TAESA).

The contractual purpose of this concession aims to supply of electric energy the States of Minas Gerais and Bahia, through the transmission line that will connect the substation Poções III to the substation Padre Paraíso 2.

This concession is controlled in partnership by TAESA and ISA Cteep and its results will be accounted through equity method in TAESA. Its fiscal regimen is Lucro Real (Real Profit) and it has a fiscal benefit SUDENE in 100% of its area. The related PIS and COFINS are 1.65% and 7.60% (RAP must be grossed up of PIS / COFINS).

PATESA began operating in September 2004, and currently integrates the electric power transmission system of the State of Rio Grande do Norte, with approximately 146 km of 230kV transmission lines and 4 substations (all accessed by TAESA) only in that State. The concession term ends on December 11, 2032.

The contractual purpose of this concession aims to supply of electric energy the States of Rio Grande do Norte, through the transmission lines that will connect the substation Paraíso to the substation Açú.

It is TAESA’s wholly owned concession (making up the Holding Company) and its fiscal regimen is Lucro Real (Real Profit). It has a fiscal benefit SUDENE in 100% of its area. The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).

Pitiguari,egan operating in Juno 2025 and refers to lot 10 of the Transmission Auction No. 01/2022 of July 2021. It is located in the State of Santa Catarina with an extension of 93 km of transmission lines of 230 KV and 3 substations (all accessed by TAESA). The term stipulated by ANEEL for energizing Pitiguari in mach 2027. While the concession term is expected to end in 2052.

Sant’Ana is in project stage, located in the State of Rio Grande do Sul, with approximately 558 km of 230kV transmission lines e 6 substations (3 owned and 3 accessed by TAESA). It must start its operations by March 2023.The concession term ends in March 2049. Those transmission lines will allow the connection of new wind farms in the region.

The contractual purpose of this concession aims to supply of electric energy the States of Rio Grande do Sul, through the transmission lines that will connect the substations Livramento 3, Maçambará, Santo Ângelo, Maçambará 3, Santo Ângelo C1 e Santo Ângelo C2.

It was incorporated by the holding Company. Its pre-operational results is consolidated by TAESA. Its fiscal regimen is Lucro Presumido (Presumed Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP must be grossed up of PIS / COFINS).

São Gotardo began operating in March 2014, and currently integrates the electric power transmission system of the State of Minas Gerais, with 1 accessed substation of 345kV by TAESA. TAESA does not perform the operation and maintenance of this system. The concession term ends on August 27, 2042.

The contractual purpose of this concession aims to connect units transformer, line input and busbar interconnection.

This concession also stands out for having in its facilities a phase shifting transformer.

It is TAESA’s wholly-owned concession (100% consolidated by TAESA) and its fiscal regimen is Lucro Presumido (Presumed Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP must be grossed up of PIS / COFINS).

São João began operating in August 2016. The asset is in the State of Piauí, with approximately 413 km of 500kV transmission lines and 2 substations (1 owned and 1 accessed by TAESA). The concession term ends on August 1, 2043.

The contractual purpose of this concession is to strengthen the transmission system in the North – Northeast region to transport part of the energy generated at the UHE Belo Monte, increasing the transmission capacity of the Northeast under normal conditions or in contingencies, increasing the reliability of the SIN.

It is TAESA’s wholly-owned concession (100% consolidated by TAESA) and its fiscal regime is Lucro Presumido (Presumed Profit). The related PIS and COFINS are 3.65% (RAP must be grossed up of PIS / COFINS).

São Pedro began operating in May 2017. The asset is in the States of Bahia and Piauí, with approximately 494 km of 500kV, 230kV, 69kV and 13,8kV transmission lines and 6 substations (2 owned and 4 accessed by TAESA). The concession term ends on October 9, 2043.

The contractual purpose of this concession is to assist the load increase of Cepisa – PI and Coelba – BA distributors, reinforcing the control capacity of the system through the installation of a Static Variable Compensator at SE Eliseu Martins. ANEEL also published in 2018 and 2019 Resolutions that authorize São Pedro to implement reinforcements that will expand the RAP of the concession, according to REA 7540/18 at SE Rio Grande II, with commercial operation scheduled for June 2020 and REA 8091/19 at SE Barreiras II to August 2021, both in the State of Bahia.

It is TAESA’s wholly-owned concession (100% consolidated by TAESA) and its fiscal regime Lucro Presumido (Presumed Profit). The related PIS and COFINS are 3.65% (RAP must be grossed up of PIS / COFINS).

STC began operating in November 2007. The operation is in the State of Santa Catarina with approximately 230 km of 230kV transmission lines and 4 substations (2 owned and 2 accessed by TAESA). The concession term ends in April 2036.

The purpose of this concession is to deploy the substations Lajes and Rio do Sul by interconnecting them to the substation Barra Grande (Anita Garibaldi), to reinforce the supply of electric power in the region, and to provide greater operational reliability for the National Interconnected System (SIN).

TAESA holds indirectly 39.99% stake on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Presumido (Presumed Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP must be grossed up of PIS/ COFINS).

Controlling shareholders: EATE (61.55%) – TAESA holds directly stake of 49.98%, Alupar (20.0%) e ENTE (18.45%) – TAESA holds directly stake of 49.99%.

STE began operating in June 2004, and currently integrates the power system transmission of the State of Rio Grande do Sul, with approximately 389 km of 230kV transmission lines and 4 accessed substations by TAESA only in that State. The concession term ends on December 19, 2032.

The contractual purpose of the concession aims to supply of electric energy the States of Rio Grande do Sul, through the transmission lines that will connect the substations Uruguaiana, Santa Rosa, Maçambará, e Santo Ângelo.

It is TAESA’s wholly owned concession (making up the Holding Company) and its fiscal regimen is Lucro Real (Real Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).

Transirapé began operating in May 2007. The operation is in the State of Minas Gerais, with approximately 61 km of 230kV transmission lines and 2 substations (1 owned and 1 accessed by TAESA). The concession term ends in March 2035.

The contractual purpose of the concession aims to supply of electric energy the States of Minas Gerais, through the transmission lines of the basic grid of the Interconnected Electric System – LT Irapé – Araçuaí.

TAESA holds total stake of 54.0% on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Presumido (Presumed Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP must be grossed up of PIS/ COFINS).

Controlling shareholders: Transminas (41.0%), TAESA (49.0%), e EATE (10.0%) – TAESA holds directly stake of 49.98%.

Transleste began operating in December 2005. The operation is in the State of Minas Gerais, with approximately 139 km of 345kV transmission lines and 2 substations (1 owned and 1 accessed by TAESA). The concession term ends in February 2034.

The contractual purpose of the concession aims to supply of electric energy the States of Minas Gerais, through the transmission lines of the basic grid of the Interconnected Electric System LT Montes Claros – Irapé.

TAESA holds total stake of 54.0% on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Presumido (Presumed Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP must be grossed up of PIS/ COFINS).

Controlling shareholders: Transminas (41.0%), TAESA (49.0%), e EATE (10.0%) – TAESA holds directly stake of 49.98%.

Transudeste began operating on February 2007. The operation is in the State of Minas Gerais, with approximately 140 km of 345kV transmission lines and 2 substations (both accessed). The concession term ends in March 2035.

The contractual purpose of this concession aims to supply of electric energy the States of Minas Gerais, through the transmission lines of the basic grid of the Interconnected Electric System LT Itutinga – Juiz de Fora.

TAESA holds total stake of 54.0% on the concession and its results are accounted through equity method in TAESA (classified as affiliate). Its fiscal regimen is Lucro Presumido (Presumed Profit). The related PIS and COFINS are 0.65% and 3.0% (RAP must be grossed up of PIS/ COFINS).

Controlling shareholders: Transminas (41.0%), TAESA (49.0%), e EATE (10.0%) – TAESA holds directly stake of 49.98%.

TSN began operating in March 2003, and currently integrates the electric power transmission system that interconnects the Southeast and Northeast regions, with approximately 1,139 km of 230kV and 500kV transmission lines crossing the States of Bahia and Goiás, and 8 substations (4 owned and 4 accessed by TAESA). The concession term ends on December 20, 2030.

The contractual purpose of this concession aims to supply of electric energy the States of Bahia and Goiás until its coast, through the transmission line that will connect the substations Correntina, Bom Jesus da Lapa II, Ibicoara, Governador Mangabeira II, Serra da Mesa, Rio das Éguas, Governador Mangabeira, and Bom Jesus da Lapa. It is the concession with the largest amount of owned substations and has synergy with Novatrans and Munirah.

It also stands out for having in its facilities 2 Static Compensators and 11 shunt inductive compensation.

It is TAESA’s wholly owned concession (making up the Holding Company) and its fiscal regimen is Lucro Real (Real Profit) and has a fiscal benefit SUDENE on 76% of its area. The related PIS and COFINS are 0.65% and 3.0% (RAP is already grossed up of PIS/ COFINS).