Number of members

| Total | Appointed by CEMIG | Appointed by ISA Brasil | Independent | |

| Board of Directors¹ | 13 | 5 | 4 | 4 |

| Fiscal Council² | 5 | 2 | 1 | 2 |

| Strategy, Governance and Human Resources Committee | 6 | 2 | 3 | 1 |

| Financial Commitee | 6 | 3 | 2 | 1 |

| Auditing Committee | 6 | 4 | 2 | 0 |

| Operations and Business Committee | 6 | 3 | 2 | 1 |

¹ It does not have alternate board members

² 5 (five) sitting members and 5 (five) alternate members

Pursuant to TAESA’s Bylaws terms, the Board of Directors shall be comprised of 13 (thirteen) sitting members (full), Brazil residents or residents of other countries, elected by the General Meeting, with a unified term of office of 1 (one) year, with reelection permitted. Pursuant to the Agreement for the Adoption of Differentiated Corporate Governance Practices – Level 2, (i) The Chairman of the Board of Directors shall be chosen from among the elected members, and there shall be no accumulation of the positions of Chairman of the Board of Directors and Chief Executive Officer of the Company, (ii) the Company’s Board of Directors shall have at least 20% of independent board members, who must be identified as such in the minutes of the General Meeting that elect them, and (iii) the decisions of the Board of Directors shall be made by affirmative vote of the absolute majority of the present members, except for decisions relating to matters set forth in the Company’s Bylaws, which requires at least 9 (nine) Board members’ approval for its respective implementation.

TAESA’s Board of Directors is responsible for the general guidance of its business. Among other duties, it is responsible for electing and removing the members of its Executive Board, in addition to overseeing the performance of their duties. It is also incumbent upon the Board of Directors to decide on the participation in public bids promoted by ANEEL or by any representative of the Concession Grantor with the authority to do so.

Click here to access the Board of Directors Internal Regulations (Information available in Portuguese only).

Currently, TAESA’s Board of Directors is composed of the following:

| Name | Position | Elected on | End of Term at | |

|---|---|---|---|---|

| Reynaldo Passanezi Filho | Chairman | 04/29/2025 | 2026 Ordinary General Meeting | |

|

Mr. Reynaldo Passanezi Filho holds an Economics degree from the School of Economics, Administration, Accounting and Actuarial Science of the University of São Paulo (FEA-USP) and a bachelor’s degree in law from Pontifical Catholic University (PUC-SP) with a master’s degree in economics from the Institute of Economics of UNICAMP and a doctorate in economics from FEA-USP. Reynaldo has been Chief Executive Officer of Companhia Energética de Minas Gerais (CEMIG) since January 2020; he was Chief Financial and Investor Relations Officer from July 2012 to November 2013 and President from November 2013 to July 2019 at Companhia de Transmissão Elétrica Paulista (CTEEP). Reynaldo declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Paulo Gustavo Ganime Alves Teixeira | Sitting Member | 04/29/2025 | 2026 Ordinary General Meeting | |

|

Mr. Paulo Gustavo Ganime Alves Teixeira is a production engineer who graduated in 2005 from the Federal Center for Technological Education – CEFET/RJ, studied Economics (incomplete) from 2001 to 2008 at the State University of Rio de Janeiro – UERJ, and also has a postgraduate MBA in Business Management from the Pontifical Catholic University of Rio de Janeiro – PUC/RJ in 2009. He was certified PMP – Project Management Professional – PMI in 2015 and completed the Board of Directors course at the Brazilian Institute of Corporate Governance – IBGC in 2024. He is currently a consultant and board member. Over the last 5 (five) years he has been: (i) a member of the Novo 30 political party (April/2017 – January/2023); and (ii) an elected Federal Deputy (January/2019 – December /2023). In addition to these, he also served at Club de Regatas Vasco da Gama as: Chief Finance Officer (February/2018 – May/2018); Vice President of Strategic Management (May/2018 – August/2018); and Vice President of Finance (February/2023 – January/2024). Paulo declares that over the last 5 years he has not been subject to the effects of any criminal conviction, any conviction or penalty in administrative proceedings before the CVM and/or any final and unappealable conviction, in the judicial or administrative sphere, which would have the effect of suspending or disqualifying him from practicing any professional or commercial activity.

|

||||

| Fernando Bunker Gentil | Sitting Member | 04/29/2025 | 2026 Ordinary General Meeting | |

|

Mr. Fernando Bunker Gentil holds a Bachelor’s degree in Business Administration and a Master’s degree in Business Administration from the University of Southern California. Fernando has been a Partner and Executive Director of G5 Evercore Private Equity since 2012. Fernando declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Carolina Sánchez Restrepo | Sitting Member | 04/29/2025 | 2026 Ordinary General Meeting | |

|

Ms. Carolina Sánchez Restrepo holds a degree in Electrical Engineering from the Universidad Pontificia Bolivariana, with a specialization in High Voltage Transmission and Project Management, both from the Universidad Pontificia Bolivariana. Ms. Carolina is: (i) Director of Corporate Engineering of Interconexión Eléctrica S.A. E.S.P. (ISA) since May 2022; and (ii) member of the Board of Directors of CEYA (Consortium Elétrico Yapai) since April 2025. She was CEO of Transmission Solutions in Colombia and Peru at Siemens Energy from April 2017 to October 2020. Ms. Restrepo declares that (i) in the last 5 years she has not been the subject of (a) any criminal complaint; any notification in an administrative proceeding or deliberations from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and binding instruction, in the judicial or administrative sphere, that has suspended or disqualified him from practicing a professional or commercial activity of any kind; and (ii) is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021. |

||||

| José Reinaldo Magalhães | Sitting Member | 04/29/2025 | 2026 Ordinary General Meeting | |

|

Mr. José Reinaldo Magalhães holds an Economics degree from the Federal University of Minas Gerais (UFMG), an MBA in Finance from the Brazilian Institute of Capital Markets (IBMEC) and in Corporate Finance and Corporate Law from Fundação Getulio Vargas (FGV) and is certified as a Board Member and Fiscal Advisor by the Brazilian Institute of Corporate Governance (“IBGC”). José Reinaldo is a member of the Board of Directors of Companhia Energética de Minas Gerais (CEMIG), Companhia de Gás de Minas Gerais (GASMIG) and was a member of the team responsible for investment and divestment decisions for the BR-Investimentos and Bozano Investimentos Funds, Asset Managers and FIP Managers in the Private Equity segment between 2009 and 2015. José Reinaldo declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Reinaldo Le Grazie | Sitting Member | 04/29/2025 | 2026 Ordinary General Meeting | |

|

Mr. Reinaldo Le Grazie holds a degree in Public Administration from Fundação Getulio Vargas with an executive extension from INSEAD Business School. – Reinaldo Le Grazie has been a partner and manager of Panamby Capital since 2019. Reinaldo declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Celso Maia de Barros | Sitting Member | 04/29/2025 | 2026 Ordinary General Meeting | |

|

Mr. Celso Maia de Barros holds a degree in Business Administration from the Universidad Autónoma de Centroamérica (Fidelitas), in San José, Costa Rica, and a master’s degree from Tulane University, A.B. Freeman School of Business, in New Orleans, USA. Mr. Celso is: (i) a Partner at the consulting firm Cambridge Family Enterprise Group since June 2025; (ii) a member of the Board of Directors of DELP Engenharia Mecânica since 2021; (iii) a member of the Board of Directors of Trevisa Investimentos S.A. since 2017; and (iv) an alternate member of the Fiscal Council of Hospital Sírio-Libanês since 2022. He was a Managing Partner of Urca Capital Partners from 2015 to June 2025.

|

||||

| Hermes Jorge Chipp | Sitting Member | 04/29/2025 | 2026 Ordinary General Meeting | |

|

Mr. Hermes Jorge Chipp holds a degree in Electrical Engineering from the Federal University of Rio de Janeiro (UFRJ). Hermes is President of Chipp Consultoria de Engenharia Ltda. and acts as a consultant in the institutional area in the electricity market; he was a member of the Board of Directors of Santo Antonio Energia from 2017 to 2021 and of Echoenergia (Actis Group) from 2017 to 2022. Hermes declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Mario Engler Pinto Júnior | Sitting Member | 04/29/2025 | 2026 Ordinary General Meeting | |

|

Mr. Mario Engler holds a bachelor’s degree in Law and a PhD in Commercial Law from the University of São Paulo. – Mario Engler has been a professor at the Law School of Fundação Getulio Vargas of São Paulo (FGV SP) since 2009 and Coordinator of the Professional Master’s Degree since 2013; a member of the Arbitration Chamber of the B3 S.A. Market. – Brasil, Bolsa, Balcão. since 2002 and of the Brazil-Canada Chamber of Commerce (CCBC) since 2022; Founding Partner of Engler Advogados; was Chairman of the Board of Directors of Companhia Paulista de Securitização (CPSEC) from 2020 to 2022; of Companhia Riograndense de Saneamento (CORSAN) from 2019 to 2023; of Companhia de Saneamento Básico do Estado de São Paulo (SABESP) from 2018 to 2023 and of Empresa Metropolitana de Águas e Energia S. A. (EMAE) from 2017 to 2019; CEO of Companhia Paulista de Parcerias (CPP) from 2016 to 2019; member of the São Paulo State Government’s Privatization Council from 2016 to 2019 and guest of the Management Council of the Public-Private Partnership Program in the State of São Paulo from 2016 to 2019. Mario declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Denise Lanfredi Tosetti Hills Lopes | Sitting Member | 04/29/2025 | 2026 Ordinary General Meeting | |

|

Denise Lanfredi Tosetti Hills Lopes has a degree in Business Administration from the University of Ribeirão Preto and a post-graduate degree in Economics from FIPE USP; she is certified as a Board Member by the Brazilian Institute of Corporate Governance (IBGC) and has completed the Strategic Risk Management program at Wharton; the Sustainability Leadership from Cambridge University; Integrated Sustainability Management; Strategic People Management and Business Planning and Strategy by Fundação Dom Cabral (FDC) and Credit Risk Management by Fundação Instituto de Pesquisas Econômicas of the University of São Paulo (FIPE USP). Denise has been a Board Member and leader of the Climate Change and Biodiversity front of the ANBIMA Sustainability Network since 2023; Specialist Board Member of the Talanoa Institute; member of the Advisory Board of the Rede Mulher Empreendedora; member of the Advisory Committee of the IBGC Chapter Zero Brasil; Board Member of the UN Global Compact Brazil Network – Net Zero Movement; Guest Professor and Board Member of the ESG Innovation Reference Center – CRI ESG at FDC since 2023; Guest Professor at FIPE USP; Independent Advisor to the Sustainability Committee of Zurich Seguros since 2023; Independent Advisor to the Sustainability Committee of Banco BS2; Independent Advisor to the Brazilian Business Council for Sustainable Development since 2023 and was Global Sustainability Director of Natura&Co Latam from 2019 to 2023. Denise declares that over the last 5 years he has not been subject to the effects of any criminal conviction, any conviction or penalty in administrative proceedings before the CVM and/or any final and unappealable conviction, in the judicial or administrative sphere, which would have the effect of suspending or disqualifying him from practicing any professional or commercial activity. She is considered an independent member based on the independence criteria defined by the Level 2 Regulations of B3 S.A. – Brasil, Bolsa, Balcão.

|

||||

| Francisco Martins Codorniz Filho | Sitting Member | 04/29/2025 | 2026 Ordinary General Meeting | |

|

Mr. Francisco Martins Cordoniz Filho holds a degree in Law from the Pontifical Catholic University of Rio Grande do Sul (PUC-RS) with a Master’s degree in Economic Analysis of Law from the University of Salamanca, having completed the Corporate Venture Capital Programs from Ruta N Flink and the Leadership in Action Program from Prestígio Formación Ejecutiva. Mr. Francisco has been Director of Corporate Governance and Legal Affairs since 2023 and was a Legal Specialist from 2019 to 2023 at Interconexión Eléctrica S.A. E.S.P. Mr. Cordoniz declares that (i) in the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final conviction, in the judicial or administrative sphere, that has suspended or disqualified him/her from practicing any professional or commercial activity; and (ii) is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Francisco Martins Codorniz Filho | Sitting Member | 04/29/2025 | 2026 Ordinary General Meeting | |

|

Mr. Francisco Martins Cordoniz Filho holds a degree in Law from the Pontifical Catholic University of Rio Grande do Sul (PUC-RS) with a Master’s degree in Economic Analysis of Law from the University of Salamanca, having completed the Corporate Venture Capital Programs from Ruta N Flink and the Leadership in Action Program from Prestígio Formación Ejecutiva. Mr. Francisco has been Director of Corporate Governance and Legal Affairs since 2023 and was a Legal Specialist from 2019 to 2023 at Interconexión Eléctrica S.A. E.S.P. Mr. Cordoniz declares that (i) in the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final conviction, in the judicial or administrative sphere, that has suspended or disqualified him/her from practicing any professional or commercial activity; and (ii) is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Marco da Camino Ancona Lopez Soligo | Sitting Member | 07/30/2025 | 2026 Ordinary General Meeting | |

|

Mr. Marco da Camino Ancona Lopez Soligo holds an Economics degree from FEA/USP, an MBA in Business Administration from the Université Catholique de Louvain in Belgium, and a specialization in Corporate Law from FGV/GVlaw. Mr. Soligo has served as Equity Investments Officer at Companhia Energética de Minas Gerais (CEMIG) since May 2025. He previously held the following positions: (i) CEO of the CEEE Group companies, including CEEE Distribuição, CEEE Transmissão, CEEE Geração, and CEEE Holding; (ii) at CPFL Energia S.A., he served as Director of Risk Management and Internal Controls, Secretary to the Board of Directors and its Committees, and Corporate Governance Manager.

|

||||

| Antonio Roquim Neto | Sitting Member | 12/15/2025 | 2026 Ordinary General Meeting | |

|

Mr. Antonio Roquim Neto holds a degree in Business Administration from Universidade do Distrito Federal (UNIDF). Mr. Antonio currently serves as: (i) General Manager of Power International Holding for Africa and the Americas, and (ii) Director at UCC Holding, since 2024 He previously served as General Manager and member of the Board of Directors of Nasser Bin Khaled Holding and Nasser Bin Khaled International from 2016 to 2024. Mr. Roquim declares that (i) over the past five years he has not been subject to (a) any criminal conviction, any administrative proceeding or penalties imposed by the CVM, the Central Bank of Brazil, or the Superintendence of Private Insurance (SUSEP); or (b) any final judicial or administrative conviction that has suspended or disqualified him from engaging in any professional or commercial activity; and (ii) he is not considered a politically exposed person, pursuant to CVM Resolution No. 50 of August 31, 2021.

|

||||

TAESA’s Bylaws sets that the Executive Board should be comprised of 6 (six) officers: 1 (one) Chief Executive Officer, 1 (one) Chief Financial and Investor Relations Officer, 1 (one) Chief Technical Officer, 1 (one) Chief Legal and Regulatory Officer, 1 (one) Business and Holdings Management Officer, and 1 (one) Implementation Officer, all elected by the Board of Directors for an unified 2-year (two) mandate, dismissible at any time, being allowed the accumulation of positions and a total or partial reelection of its members. Up to 1/3 (one-third) of the Board of Directors members may be elected for the position of an executive officer.

The executive officers are responsible for the day-to-day management of the business and for implementing the guidelines and policies adopted by the board of directors.

The Board of Executive Officers is currently composed of:

| Name | Position | Elected on | End of Term at | |

|---|---|---|---|---|

| Rinaldo Pecchio Jr | CEO | 04/29/2025 | 1st BoD Meeting after the 2026 Ordinary General Meeting | |

|

Mr. Rinaldo Pecchio Júnior holds an Economics degree from the State University of Campinas (Unicamp), a degree in Accounting from the Pontifical Catholic University of Campinas (PUCcamp) and an MBA in Finance from the Brazilian Institute of Capital Markets (IBMEC). – Rinaldo has had career of over 30 years, mostly in the electricity industry; he is the company’s CEO, Chief Finance and Investor Relations Officer; an effective member of Vibra Energia’s Audit Committee and was CFO, Chief Investor Relations and IT Officer at Centro de Tecnologia Canavieira S. A. (CTC) from 2019 to 2022; CFO, Chief Investor Relations, Logistics and Supplies of ISA CTEEP from 2013 to 2019; Chairman of the Board of Directors of IE Madeira and IE Garanhuns of Grupo ISA CTEEP / Eletrobras. – Rinaldo declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Catia Pereira | CFO and Investor Relations Officer | 04/29/2025 | 1st BoD Meeting after the 2026 Ordinary General Meeting | |

|

Ms. Catia Pereira has a degree in Economics from Universidade Federal Fluminense and an MBA in Finance from IBMEC, Controllership and Finance from Universidade Federal Fluminense and Economic Engineering from Universidade do Estado do Rio de Janeiro. She has a career spanning more than 30 years, with extensive experience in risk management, treasury, capital markets, strategic planning, restructuring, innovation and digital transformation, in addition to expertise in infrastructure projects financing, corporate finance and shared services management. She has worked for companies such as Sabesp, Embratel, Ball Corporation and Rexam.

|

||||

| Mauricio Dall'Agnese | Chief New Business Officer | 05/23/2025 | 1st BoD Meeting after the 2026 Ordinary General Meeting | |

|

Mr. Maurício Dall’Agnese holds a degree in Economics from the University of São Paulo (USP). Mr. Maurício has been Deputy Director of Strategy, Environment and Innovation at Companhia Energética de Minas Gerais (CEMIG) since April 2019 and Director at CemigPar since December 2020; he was Director and Manager of Commercialization and Regulatory Affairs at Vale Energia S.A and Vale S.A from October 2019 to March 2020 and Manager of New Business and M&A at Companhia de Transmissão Elétrica Paulista (CTEEP) from November 2015 to October 2019. Mr. Dall’Agnese declares that (i) in the last 5 years he has not been the victim of (a) any criminal offense; any notification in an administrative proceeding or deliberations of the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final ruling, in the judicial or administrative sphere, that has suspended or disqualified him from practicing any professional or commercial activity; and (ii) is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021

|

||||

| Luis Alessandro Alves | Chief Technical Officer | 04/29/2025 | 1st BoD Meeting after the 2026 Ordinary General Meeting | |

|

Mr. Luis Alessandro Alves has a degree in Electrical Engineering from São Paulo State University Julio de Mesquita Filho, a post-graduate degree in Energy Systems Planning from the State University of Campinas (UNICAMP) and an MBA in Business Management with an emphasis on Management from Fundação Getulio Vargas (FGV). Luis has been working for over 20 years in the electricity industry in the transmission and distribution segments; he is the Company’s Chief implementation Officer; he was Neoenergia’s Transmission and Projects Director from 2019 to 2021 and Superintendent of Transmission Projects from 2017 to 2021. Luis Alessandro declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Jell Lima de Andrade | Chief Implementation Officer | 04/29/2025 | 1st BoD Meeting after the 2026 Ordinary General Meeting | |

|

Mr. Jell Lima de Andrade has a degree in Mechanical Engineering from USP, with an MBA in Administration from FGV and an MBA in Hydraulic and Fluid Energy Technology from the École Nationale Supérieure d’Hydraulique et Mécanique de Grenoble – France. He has more than 22 years of professional experience as operations director, engineering and projects, working in large companies such as Alstom, GE, Sterlite, among others. In addition to extensive experience in general business management, development of high-performance teams, participation in financial fundraising processes, experience in turnaround processes, restructuring and mergers.

|

||||

In accordance with the Brazilian Corporations Act, the Fiscal Council is a corporate body independent of TAESA’s administration and its independent auditors. TAESA’s Bylaws provide for a permanent Fiscal Council. It must be composed of no less than 3 (three) and no more than 5 (five) sitting members, with the same number of alternate members.

The main responsibilities of the Fiscal Council are to oversee the activities of the administration, review the publicly-held company’s financial statements and report their findings to shareholders.

Bylaws of the Company’s Fiscal Council

The Fiscal Council is currently composed of:

| Name | Position | Elected on | End of Term at | |

|---|---|---|---|---|

| Felipe José Fonseca Attiê | Sitting Member | 04/29/2024 | 2025 Ordinary General Meeting | |

|

Mr. FFelipe José Fonseca Attiê has an Economics and a Business Administration degree from the Federal University of Uberlândia with a specialization in Regional and Urban Economics and in Advertising and Publicity and completed a course in New Technologies Applied to Public Administration at Georgetown University Washington DC. Felipe is President of the Ezequiel Dias Foundation (FUNED); he was the owner of Rooster Empreendimentos Imobiliários – Gallo Empreendimentos e Participações from 2008 to 2020; he served a term as State Representative in the Minas Gerais Legislative Assembly from 2015 to 2020 and was Undersecretary for Science, Technology and Innovation of the Minas Gerais Government from 2021 to 2022. Felipe declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Manuel Domingues de Jesus e Pinho | Sitting Member | 04/29/2024 | 2025 Ordinary General Meeting | |

|

Mr. Manuel Domingues de Jesus e Pinho graduated in Accounting Sciences from the Faculdade de Ciências Contábeis e Administrativas Moraes Junior. – Manuel is the founder and CEO of Domingues e Pinho Contadores; founder and member of the Brazil Group of Accounting Companies (GBRASIL) since 1996; Chairman of the Advisory Board of the Portuguese Chamber of Commerce and Industry of Rio de Janeiro since 2022; member of the Advisory Board of the Union of Accounting, Advisory, Expertise, Information and Research Services Companies of the State of Rio de Janeiro (SESCON-RJ); alternate member of the Regional Accounting Council of the State of Rio de Janeiro since 2014; was a member of the Audit Committee of the Companhia de Transmissão de Energia Elétrica Paulista – CTEEP from 2006 to 2023; of the Associação de Amigos do Jardim Botânico (AAJB) from 2018 to 2020 and Chairman of the Audit Committee of Fundação Orquestra Sinfônica Brasileira – (FOSB) from 2019 to 2022. Manuel declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Marcello Joaquim Pacheco | Sitting Member | 04/29/2024 | 2025 Ordinary General Meeting | |

|

Mr.Marcelo Joaquim Pacheco holds a bachelor’s degree in Law from São Francisco University, a Lato Sensu postgraduate degree in Corporate Law and Compliance from Centro Universitário Unidombosco (UniDBSCO) and Escola Paulista de Direito (EPD) and specializations in Corporate Finance, Investments and Sustainable Financing; in Controllership; in Financial Management: Evaluation of Business Performance and in Corporate Law from Fundação Getulio Vargas. Marcello has been Chairman of the Board of Directors of CEB Lajeado S.A. since 2021; a member of the Board of Directors of Rossi Residencial S.A. since 2018; of the Audit Committee of Têxtil Renauxview S.A. since 2018; Coordinator of CEB’s Audit Committee created by virtue of the articles of incorporation since 2019; a member of the Audit Committee created by virtue of the articles of incorporation of Banco do Estado de Sergipe S/A (BANESE) since 2021 and of the Internal Audit Committee of Guararapes S. A. since 2021. A. since 2021; member of the Board of Directors of Companhia Energética de Brasília (CEB) from 2015 to 2023; member of the Audit Committee of Guararapes S.A. from 2014 to 2021 and of Tarpon Investimentos S.A. from 2017 to 2019; member of the Audit Committee of Profarma Distribuidora de Produtos Farmacêuticos S.A. from 2017 to 2023 and member of the Audit Committee of Vulcabrás Azaleia S.A. from 2018 to 2021. Marcello declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Murici dos Santos | Sitting Member | 04/29/2024 | 2025 Ordinary General Meeting | |

|

Mr. Murici dos Santos holds a bachelor’s degree in Law from the University of Guarulhos with a post-graduate degree in Corporate Law and Compliance from Fundação Getulio Vargas (FGV) and in Corporate Law and Compliance from Escola Paulista de Direito (EPD), currently in progress. Murici has been a full member of the Audit Committee of Rossi Residencial S.A. since 2018; of Creditaqui Financeira S.A. since 2023; of Guararapes Confecções S.A. since 2021 and Chairman of the Body this term; a full member of the Audit Committee of Pettenati S.A. Indústria Têxtil since 2019; an alternate member of the Audit Committee of Vulcabras Azaleia S.A. since 2018; of Valid Soluções S.A. since 2015; of Minupar Participações S.A. since 2022. since 2022; Chairman of the Audit Committee of International School Serviços de Ensino, Treinamento e Editoração Franqueadora S.A. from 2021 to 2022; member of the Audit Committee of Eucatex S. A Industria e Comércio from 2017 to 2021; of Distribuidora de Gás do Rio de Janeiro (CEG) from 2017 to 2022; alternate member of Metalgrafica Iguaçu S.A. from 2021 to 2022; of Rio Paranapanema S.A. from 2014 to 2020 and of Profarma Distribuidora de Produtos Farmacêuticos S.A. from 2017 to 2021. Murici declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Luciana dos Santos Uchôa | Alternate Member | 04/29/2024 | 2025 Ordinary General Meeting | |

|

Ms. Luciana dos Santos Uchôa holds a degree in Accounting Sciences from the Faculdade de Ciências Contábeis e Administrativas Moraes Júnior; she is the Managing Partner of Domingues e Pinho Contadores; Financial Director of the American Chamber of Commerce for Brazil/Rio de Janeiro since 2019; member of the Audit Committee of Transportadora Brasileira Gasoduto Bolívia-Brasil S.A (TBG) since 2012 and the Corcovado German School – Deutsche Schule since 2019. Luciana declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Mirian Paula Ferreira Rodrigues | Alternate Member | 04/29/2024 | 2025 Ordinary General Meeting | |

|

Ms. Miriam Paula Ferreira Rodrigues holds a degree in Business Administration from the Pontifical Catholic University of Minas Gerais (PUC-MG), a postgraduate degree in Strategic Marketing Management from the Institute of Continuing Education at PUC-MG, an MBA in Financial Management from the Getúlio Vargas Foundation (FGV) with training in Compliance from the Federation of Industries of the State of Minas Gerais (FIMEG), the Compliance Research and Teaching Center (CPEC) and the Institute of European and International Criminal Law of the University of Castilla de La Mancha (UCLM) in 2018, having completed the Human Resources Management Program from the Dom Cabral Foundation (FDC) in 2010, Applied Corporate Law from the Brazilian Institute of Capital Markets (IBMEC) in 2010 and Implementation of Best Corporate Governance Practices from the Brazilian Institute of Corporate Governance (IBGC). Ms. Miriam was: (i) Compliance Manager of Companhia Energética de Minas Gerais (CEMIG) from 2014 to 2021; (ii) member of the Audit, Compliance and Risk Committee of Norte Energia S.A. from 2019 to 2021; (iii) Fiscal Advisor of Fundação Forluminas e Seguridade Social (Forluz) from 2017 to 2020; (iv) Board Member of Hidrelétrica Cachoeirão S.A. from 2016 to 2019; and (v) Board Member of Empresa Paraense de Transmissão S.A. Ms. Rodrigues declares that (i) in the last 5 years she has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final conviction, in the judicial or administrative sphere, that has suspended or disqualified him/her from practicing any professional or commercial activity; and (ii) is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Luiz Felipe da Silva Veloso | Alternate Member | 04/29/2024 | 2025 Ordinary General Meeting | |

|

Mr. Luiz Felipe da Silva Veloso has an Economics degree from Pontifical Catholic University of Minas Gerais (PUC-MG), a postgraduate degree in Financial Administration from Fundação Dom Cabral and Strategic Management from the Minas Gerais Institute for Economic, Administrative and Accounting Research (UFMG) and in Finance and Corporate Business from INSEAD Business School. Over the last five years, Luiz Felipe has been working as a consultant analyst. Luiz Felipe declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Rosangela Torres | Alternate Member | 04/29/2024 | 2025 Ordinary General Meeting | |

|

Ms. Rosangela Torres has a degree in Psychology from the University of Guarulhos and a post-graduate degree in Psychopedagogy from the University of Mogi das Cruzes. Rosângela is a teacher at Colégio Objetivo Caieiras and has been a consultant and business advisor in the corporate and corporate governance lines of business, especially engaged in people, compliance and internal controls affairs. Rosangela declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

| Ana Patrícia Alves Costa Pacheco | Alternate Member | 04/29/2024 | 2025 Ordinary General Meeting | |

|

Ms. Ana Patrícia Alves Costa Pacheco has a degree in Chemistry from the University of São Paulo (USP), a Master’s degree in Green Chemistry and Sustainable Industrial Technology from the University of York, United Kingdom and a PhD in Chemistry from the University of Nottingham (UoN), United Kingdom and Université Claude Bernard Lyon 1 (UCBL), France and completed the Project Management Immersion course at DNC Group, Brazil. Ana Patrícia has been a Project Manager at Ericsson – ESS in São José dos Campos since March 2022; was a Project Management Consultant at DNC Group (self-employed) from September to December 2021; Researcher at the University of Nottingham (UoN) and Université Claude Bernarde Lyon 1 (UCBL) from September 2017 to September 2021. Ana Patrícia declares that (i) over the last 5 years he has not suffered (a) any criminal conviction; any conviction in an administrative proceeding or penalties from the CVM, the Central Bank of Brazil or the Superintendence of Private Insurance; or (b) any final and unappealable conviction, in the judicial or administrative sphere, that has suspended or disabled him from practicing any professional or commercial activity and (ii) he is not considered a politically exposed person, under the terms of CVM Resolution No. 50, of August 31, 2021.

|

||||

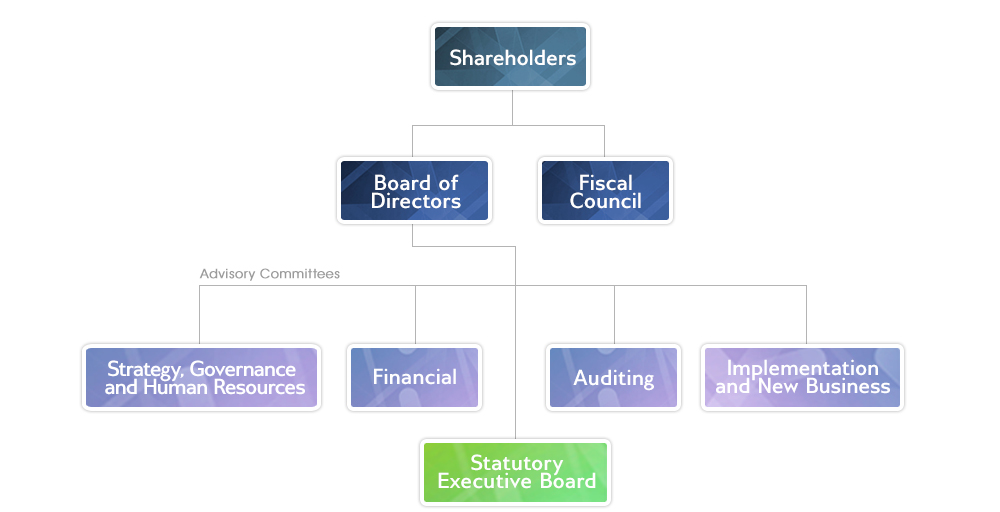

TAESA currently has four committees to advise the Board of Directors, with their members’ term of office coinciding with that of the members of the Board of Directors.

Competences of the Strategy, Governance and Human Resources Committee:

- To recommend the Company’s operational strategies, interacting with executives in preparing the Strategic Plan, providing support in defining strategic and budgetary guidelines, general and specific targets, indicators, prospects and metrics;

- To recommend guidelines for the execution of the Business Plan, formulation of strategy and for execution of the company’s yearly and multiyear plans;

- To track the progress of the strategy and the operational tactics of the Executive Board;

- To discuss specific annual targets and indicators;

- To monitor and analyze the Company’s operating performance and risks, and check the compliance with targets, proposing strategic initiatives, providing information and knowledge to the Board of Directors;

- To provide information for appraising the performance of the Executive Board;

- To propose to the Board of Directors the corporate governance practices and rules;

- To propose to the Board and the Shareholders’ Meeting the nominations and the remuneration policy, as well as to review and recommend the appraisal criteria for executives;

- To examine and opine on the remuneration policies and monitor the implementation of the remuneration policy in the Company;

- To recommend the investment policy to help in the preparation of Strategic Plans;

- To evaluate the annual expenditure and investments programs, and the financial adjustments proposed by the Executive Board, and track their implementation;

- Any of its members may monitor the management of superintendent officers and examine, at anytime, the Company’s books, documents and papers, request information about agreements executed or in the process of being executed and about any other actions deemed necessary;

- Formally analyze on a periodical basis the performance results of the Company and of the Executive Board;

- To recommend strategic alliances and development of new businesses;

- To recommend the policy on employees’ profit sharing;

- To recommend the guidelines for the market penetration strategy; and,

- To recommend management guidelines and policies.

Members:

| Name | Appointed by |

| Douglas Braga Ferraz de Oliveira Xavier - Coordenador | CEMIG |

| Mario Engler Pinto Júnior | CEMIG |

| Denise Lanfredi Tosetti Hills Lopes | Independent |

| Karen Nataly Medina Moreno | ISA |

| Francisco Martins Codorniz Filho | ISA |

| - |

Competences of the Financial Committee:

- To analyze and evaluate the financial needs: capital structure, financial policies, cash flow, debt policy, capital structure and the Company’s risk;

- To analyze the quarterly and annual reports and monitor the key financial indicators;

- To evaluate the Fiscal / Tax plan;

- To verify the investments: (i) financial and economic feasibility, (ii) implementation of annual investments plan (iii) return on investments and of risks;

- To interact with the Executive Board in order to understand the priority financing requirements;

- To analyze and evaluate dividend distribution proposals;

- To verify the compliance with financial policies;

- To analyze the compatibility between the shareholder remuneration level and the parameters set in the annual budget;

- To analyze the consistency of the Company’s capital structure; and,

- To review and recommend financing opportunities.

Members:

| Name | Appointed by |

| José Reinaldo Magalhães - Coordinator | CEMIG |

| Andrea Marques de Almeida | CEMIG |

| Paulo Gustavo Ganime Alves Teixeira | CEMIG |

| Jaime Enrique Falquez Ortiga | ISA |

| Celso Maia de Barros | ISA |

| - | - |

Competences of the Auditing Committee:

- To provide permanent assistance to the Board, monitoring the effectiveness of the processes for the preparation of financial reports and compliance with applicable tax laws, analyzing the reports and accompanying/supervising the external and internal auditors, always preserving their autonomy from the Company;

- To propose to the Board of Directors the names of external auditors and the person responsible for the Company’s internal audit;

- To evaluate and report the policies and the Company’s annual audit plan submitted by the person responsible, the internal audit team and their implementation;

- To monitor the results of the Company’s internal audit and identify, prioritize and propose actions to be followed up by the Executive Board

- To analyze and opine on the Company’s annual report and financial statements, and provide recommendations to the Board of Directors;

- To monitor and ensure that the Company develops reliable internal controls;

- To ensure the autonomy and objectiveness of internal audit;

- To ensure that independent auditors review and evaluate the Executive Board and internal audit practices;

- To analyze and opine on the action plans for correcting the processes and minimizing the risks identified; and

- To observe the fundamental principles and Accounting Norms in Brazil while reporting the Company’s accounts and related acts.

Members:

| Name | Appointed by |

| Hermes Jorge Chipp - Coordinator | CEMIG |

| Daniel Perrelli Lança | CEMIG |

| José Reinaldo Magalhães | CEMIG |

| Mario Engler Pinto Júnior | CEMIG |

| Carlos Ignacio Mesa | ISA |

| Jaime Enrique Falquez Ortiga | ISA |

Competences of the Operations and Business Committee:

- Analyze the market of the Company, subsidiaries and potential new subsidiaries or controlled companies;

- To recommend strategic alliances and development of new businesses and guidelines for the market penetration strategy;

- Analyze and comment on the macroeconomic scenario;

- Analyze and comment on the main assumptions considered, raised through sources deemed reliable and that allow technical verification/validation;

- Analyze and comment on the assumptions to be used in calculating the Company’s Weighted Average Cost of Capital (WACC) and the new investment, such as capital structure projected over the period, cost of equity (Capital Asset Pricing Model – CAPM), comparable companies used to calculate the Beta, financial leverage and Cost of Debt (Kd);

- Recommend the benchmark value interval for the Company and the new investment based on different methodologies, such as Share Value (Shareholders’ Equity Value), Discounted Cash Flow Model – Cash Flow of the Firm, Discounted Cash Flow Model – Free Cash Flow to Equity, Market Multiples and Multiples of Similar Transactions, presenting sensitivity scenarios;

- Analyze and comment on the Company’s profitability indexes and new investments, such as: Internal Rate of Return (IRR) based on the Free Cash Flow to Equity, Internal Rate of Return (IRR) based on the dividend flow to be received by the shareholder, considering the percentage of dividend distribution (taking into account the amounts that can actually be distributed as dividends), presenting sensitivity scenarios;

- Analyze and provide an opinion on the economic-financial projection for the period considered appropriate to the Company and/or new investment, of: (a) Statement of income for the years; Balance sheets; (c) Cash flow from operating, investment and financing activities; (d) Free Cash Flow to Firm; (e) Free Cash Flow to Equity; and (f) Working Capital and Debts related to the projects, among other analyzes and projections that they deem pertinent to the specific project;

- Analyze and comment on the valuation report of the investment in question, as well as the demonstration of the evaluation; and

- Assess the consistency of the legal analysis of the potential new investment or divestment, addressing mainly corporate, tax, labor and environmental aspects, as well as any other risks arising from the investment and respective strategies or measures that may mitigate them.

Members:

| Name | Appointed by |

| Celso Maia de Barros - Coordinator | Independent |

| José Reinaldo Magalhães | CEMIG |

| Douglas Braga Ferraz de Oliveira Xavier | CEMIG |

| Reinaldo Le Grazie | CEMIG |

| Carolina Sánchez Restrepo | ISA |

| - | - |