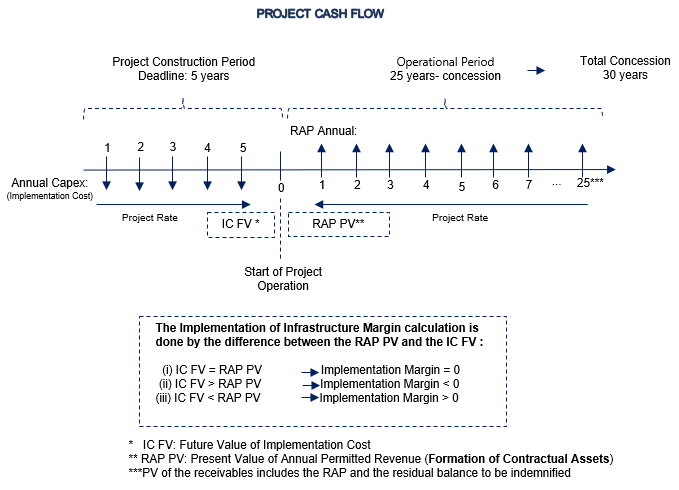

Following the entry into operation, the Contractual Asset is adjusted monthly by inflation (IGP-M or IPCA, according to each concession), calculated by the monetary restatement of future receipts brought to present value by the Project Rate. O&M revenues is a portion of the RAP intended to remunerate the operation and maintenance of the concession’s assets.

Impacts of the CPC-47 accounting change registered so far:

The adjustments generated by the adoption of CPC 47 as of January 1, 2018 were:

(i) For the initial (starting) balance of the Contractual Asset on January 1, 2018, the adjustment was entered into the special reserve account for the 2018 financial year (Shareholders’ Equity), in the amount of R$ 113,399,544.45, referring to previous years.

(ii) For Fiscal year 2018, the adjustment was entered into the Income Statements in the amount of R$ 116,924,085.17 and allocated to the special reserve account at the end of the year, net of the 5% that were retained as legal reserve.

(iii) For Fiscal year 2019, the adjustment was entered into the Income Statements in the amount of R$ 291,323,518.24 and allocated to the special reserve account at the end of the year, net of the 5% that were retained as legal reserve.

(iv) For the Fiscal Year 2020, the adjustment was entered in the Income Statements in the amount of R$ 631,469,547.58 (including the amount of R$ 124,947,792.20 related to the CIRCULAR LETTER / CVM / SNC / SEP / nº04 / 2020) that was allocated to the special reserve account at the end of the year. In addition, the amount of R$ 63,583,002.83 also related to the CIRCULAR LETTER / CVM / SNC / SEP / nº 04/2020 for previous years was recorded in the special reserve account, in the 2020 shareholders’ equity.

(v) For the Fiscal Year 2021, the adjustment was recorded in the Income Statement in the amount of R$ 408,098,711.76, which was allocated to the special reserve account at the end of the year.

(vi) For the Fiscal Year 2022, the adjustment was recorded in the Income Statement in the net amount of R$ 94,232,513.75 allocated to the special reserve account at the end of the year, consisting of a reserve of R$ 207,632,058.20 and a decrease of R$ 113,399,544.45 referring to the payment of interim dividends in December 2022.

(vii) For the 2023 Fiscal Year, the adjustment was recorded in the Income Statement in the net amount of R$ 232,903,901.03 which was allocated to the unrealized net income reserve account at the end of the year.

It is important to note that for the fiscal years of 2021, 2022, 2023 and 1Q24, the legal reserve (5%) was not constituted based on art. 193 paragraph 1 of the Brazilian Corporation Law, which indicates that the Company may stop constituting the legal reserve for the year when the balance of that reserve, plus the amount of capital reserves referred to in paragraph 1 of article 182, exceeds 30% of the share capital.

Based on the Board of Directors’ resolution at a meeting held on December 13, 2023, the Company transferred the amount of R$ 1,698,618,543.59 from the net income special reserve account to the unrealized net income reserve account, the realization of which will be made through payments of interim dividends, depending on the Company’s cash availability.

Due to the restatement of Taesa’s financial statements as of January 1, 2023, the amount of R$ 156,049,501.44 was offset from the unrealized profit reserve, which refers to accumulated adjustments until December 31, 2023. Therefore, the aforementioned adjustments total R$ 1,795,885,323.35, with R$ 1,775,472,943.18 recorded as Unrealized Profit Reserve and R$ 20,412,380.17 as Legal Reserve (5%).

On June 30, 2024, the adjustments generated by the adoption of CPC-47 in the net results amount to R$ 41,105,696.06, recorded in the Retained Earnings account. It is important to note that the effects related to the adoption of CPC 47 are excluded from the distributable net income and, during the year, are recorded in the Retained Earnings account, being allocated to the Unrealized Net Income Reserve and Legal Reserve accounts at the end of the fiscal year.