In 3Q25, the Company’s Gross Debt totaled R$ 10,459.6 million, 0.5% higher than the previous quarter. The Company’s cash position totaled R$ 1,113.6 million, an increase of 23.4% in the quarter and resulting in a net debt of R$ 9,346.0 million, 1.7% lower than in 2Q25.

The 23.4% increase in Cash and Cash Equivalents in the quarter is mainly explained by TAESA’s 18th debenture issuance in the amount of R$ 800 million, cash generation, and dividend receipts from its investee companies. These effects were partially offset by payments totaling approximately (i) R$ 1.0 billion in interest and amortization related to

TAESA’s 5th, 7th, 11th, 14th, 15th, and 16th debenture issuances and Citibank Swap, (ii) R$ 516.7 million in capital expenditures in the quarter, and (iii) R$ 188.3 million in dividends paid in August 2025.

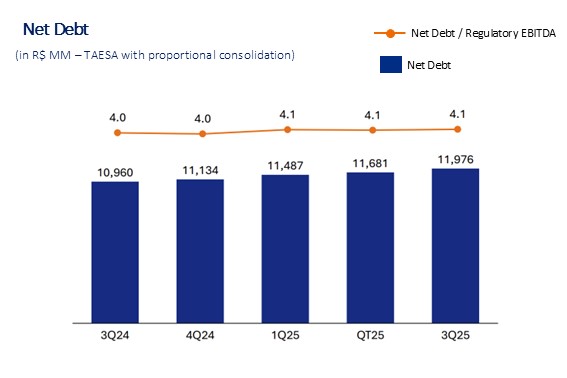

Consolidating jointly controlled and affiliated companies proportionally, total gross debt would be R$ 13,328.6 million and cash would be R$ 1,352.4 million, considering the following amounts: (i) TBE debts in the amount of R$ 1,331.2 million and cash/investments of R$ 98.1 million; (ii) ETAU cash/investments of R$ 7.6 million; and (iii) AIE (Aimorés, Paraguaçu, and Ivaí) debts of R$ 1,537.8 million and cash/investments of R$ 133.2 million.

Considering the proportional net debt of joint ventures and associates, the net debt to EBITDA ratio stood at 4.1x in 3Q25, in line with the figure recorded in 2Q25 (4.1x).